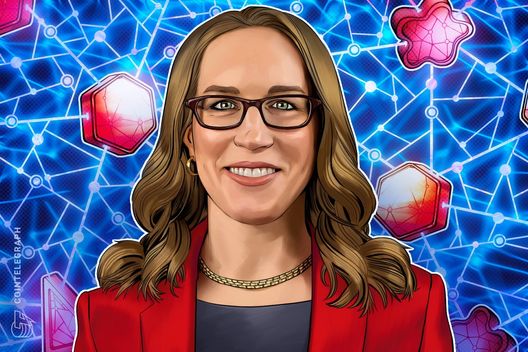

Hester Peirce discusses her future NFT plans after serving at the SEC

PositiveCryptocurrency

Hester Peirce, a commissioner at the SEC, recently shared her thoughts on her future plans regarding NFTs after her tenure at the agency. While she humorously mentioned the idea of becoming an NFT creator, she emphasized her commitment to ensuring that crypto policy is properly established first. This is significant as it highlights her ongoing dedication to shaping the regulatory landscape for cryptocurrencies, which could have a lasting impact on the industry.

— Curated by the World Pulse Now AI Editorial System