XTB Launches Free Uber Share Promotion Worth £70 for New Users

PositiveCryptocurrency

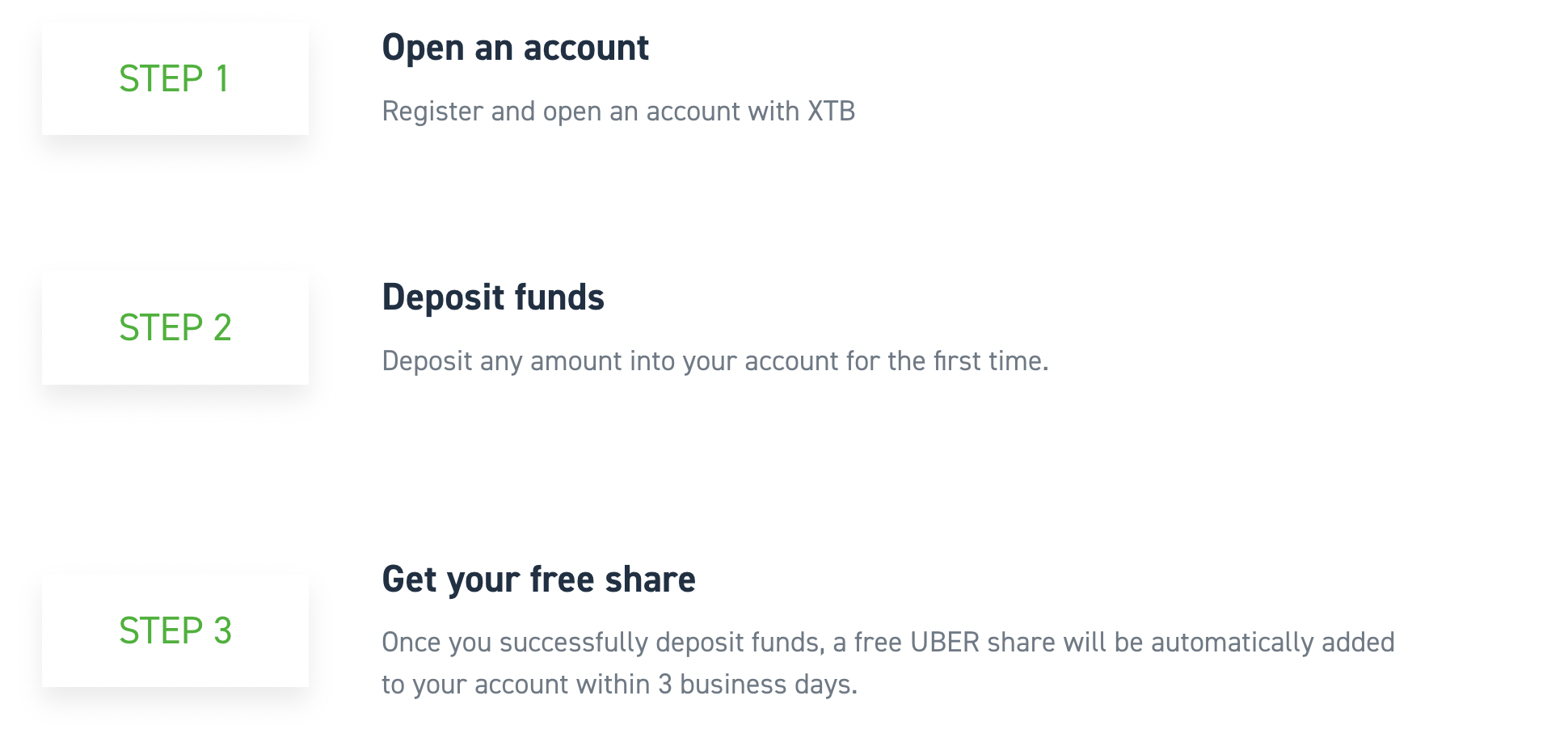

XTB is making waves in the investment world by launching a limited-time promotion that offers new UK traders a free share of Uber worth about £70. This initiative, running from September 29 to November 30, 2025, is designed to encourage more people to start investing by providing them with a tangible asset right from the get-go. It's a great opportunity for newcomers to dip their toes into trading with a little extra incentive.

— Curated by the World Pulse Now AI Editorial System