Bitcoin Holds Firm At 121K With Mayer Multiple Indicator Forecasting $180k Potential

PositiveCryptocurrency

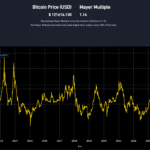

Bitcoin is currently trading at around $121,000, just below its all-time high of $126,080. Despite this slight dip, the Mayer Multiple indicator suggests that Bitcoin is not overheated, with a reading of 1.16 compared to a historical average of 2.4. This indicates potential for growth, with forecasts suggesting Bitcoin could reach $180,000. This matters because it reflects investor confidence and the resilience of Bitcoin in the market, hinting at a promising future for cryptocurrency enthusiasts.

— Curated by the World Pulse Now AI Editorial System