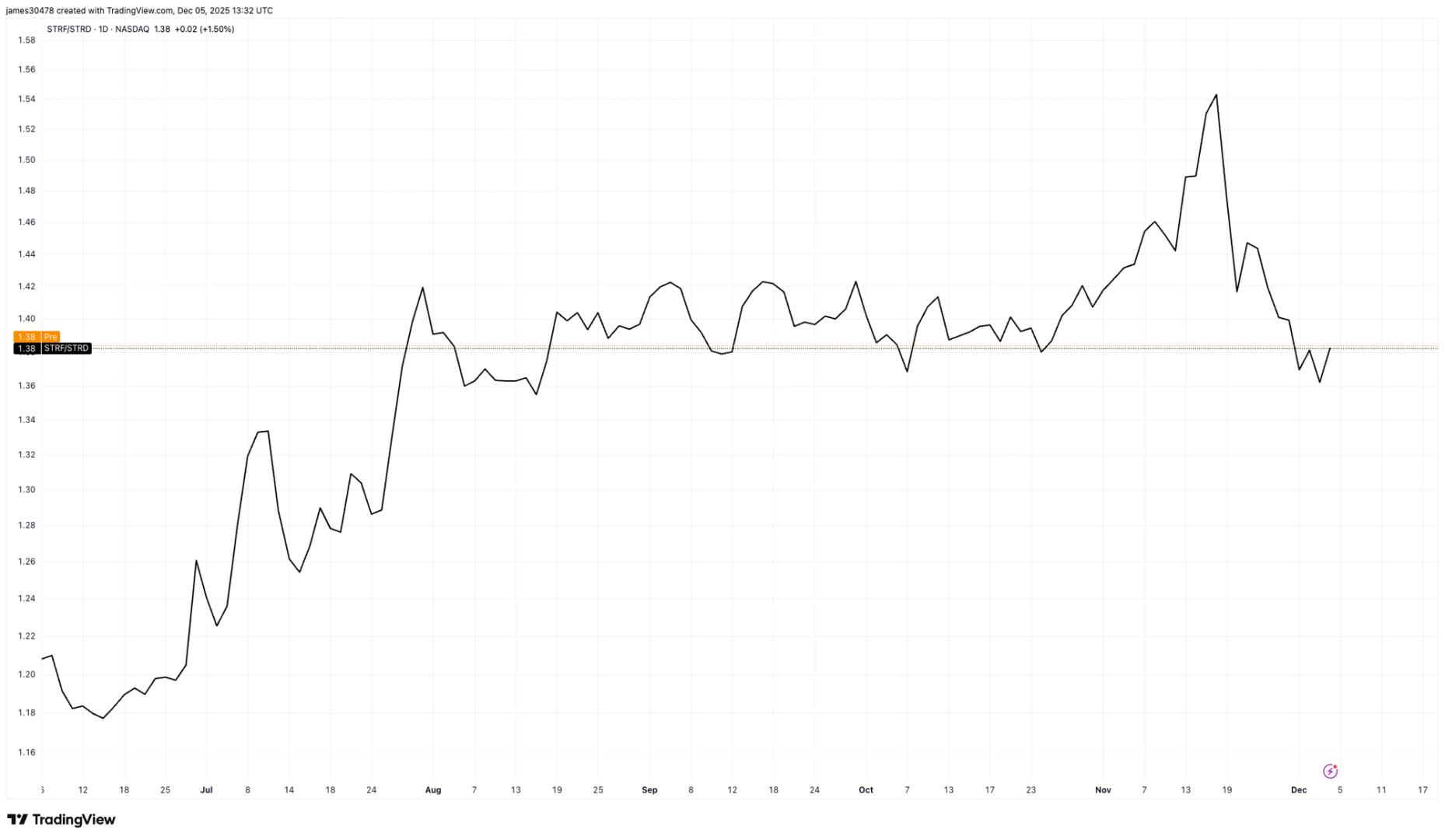

STRF Emerges as Strategy’s Standout Credit Instrument After Nine Months of Trading

NeutralCryptocurrency

- STRF has emerged as a standout credit instrument in the cryptocurrency market after nine months of trading, reflecting its growing significance amid the ongoing volatility affecting the sector. This development highlights STRF's resilience and potential as a reliable investment option for traders navigating a turbulent market landscape.

- The emergence of STRF as a key player is crucial for its parent company, Strategy, as it seeks to stabilize its financial position and regain investor confidence amidst fluctuating market conditions and recent trading challenges.

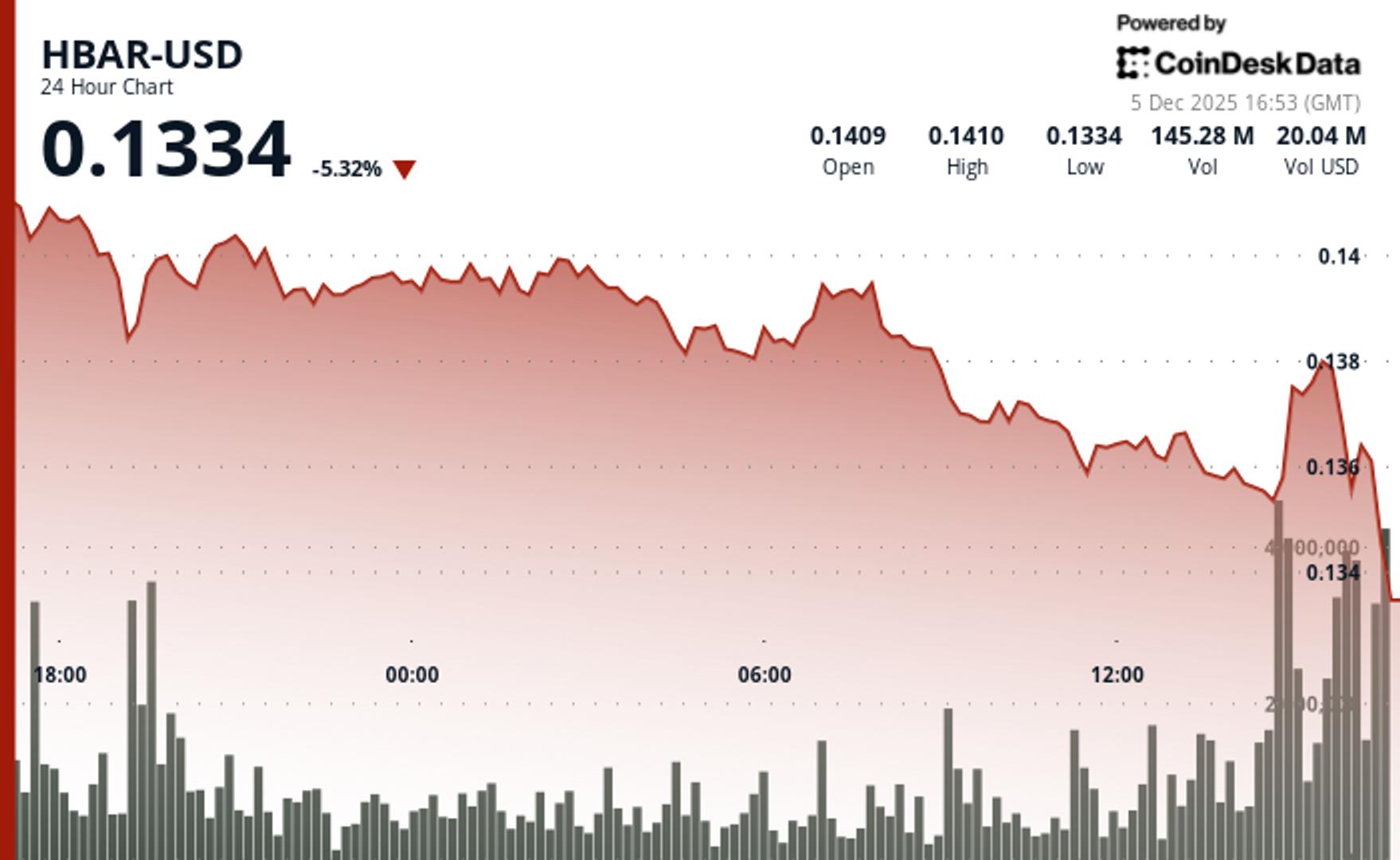

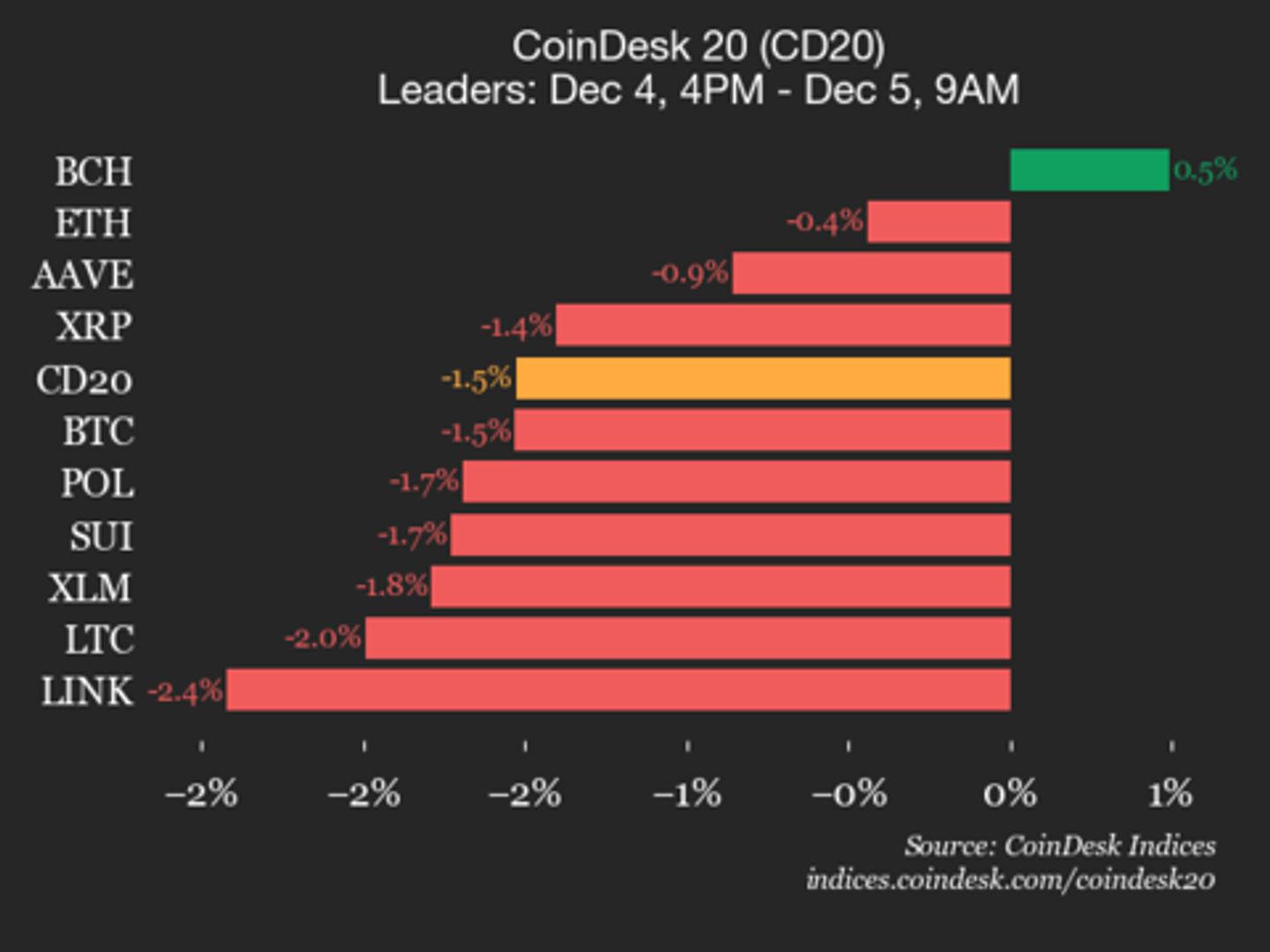

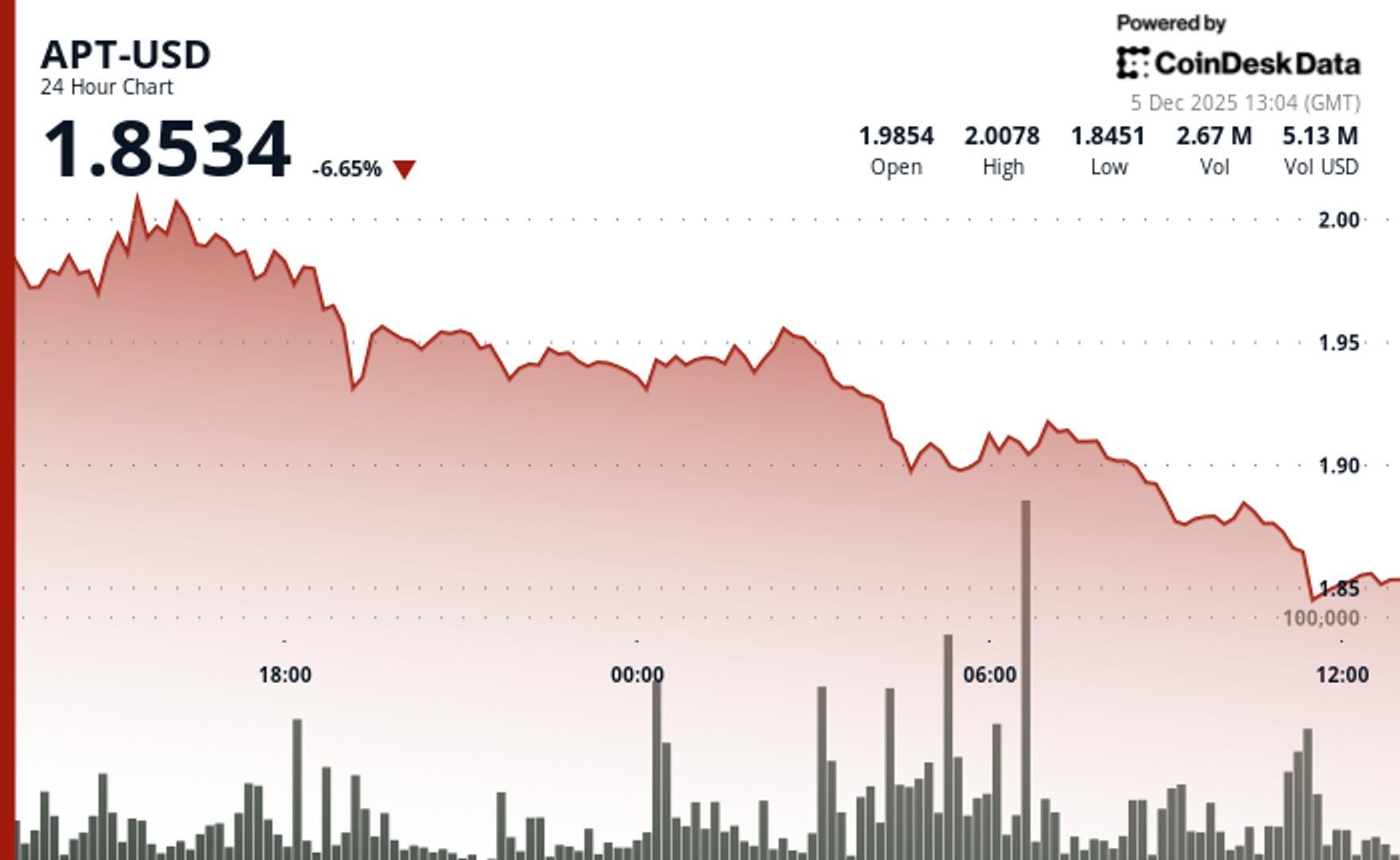

- The broader cryptocurrency market continues to experience significant volatility, with Bitcoin's price fluctuating around $86,000 and various assets facing challenges. This context underscores the importance of innovative financial instruments like STRF, which may provide stability and attract investors looking for alternatives in a shifting economic environment.

— via World Pulse Now AI Editorial System