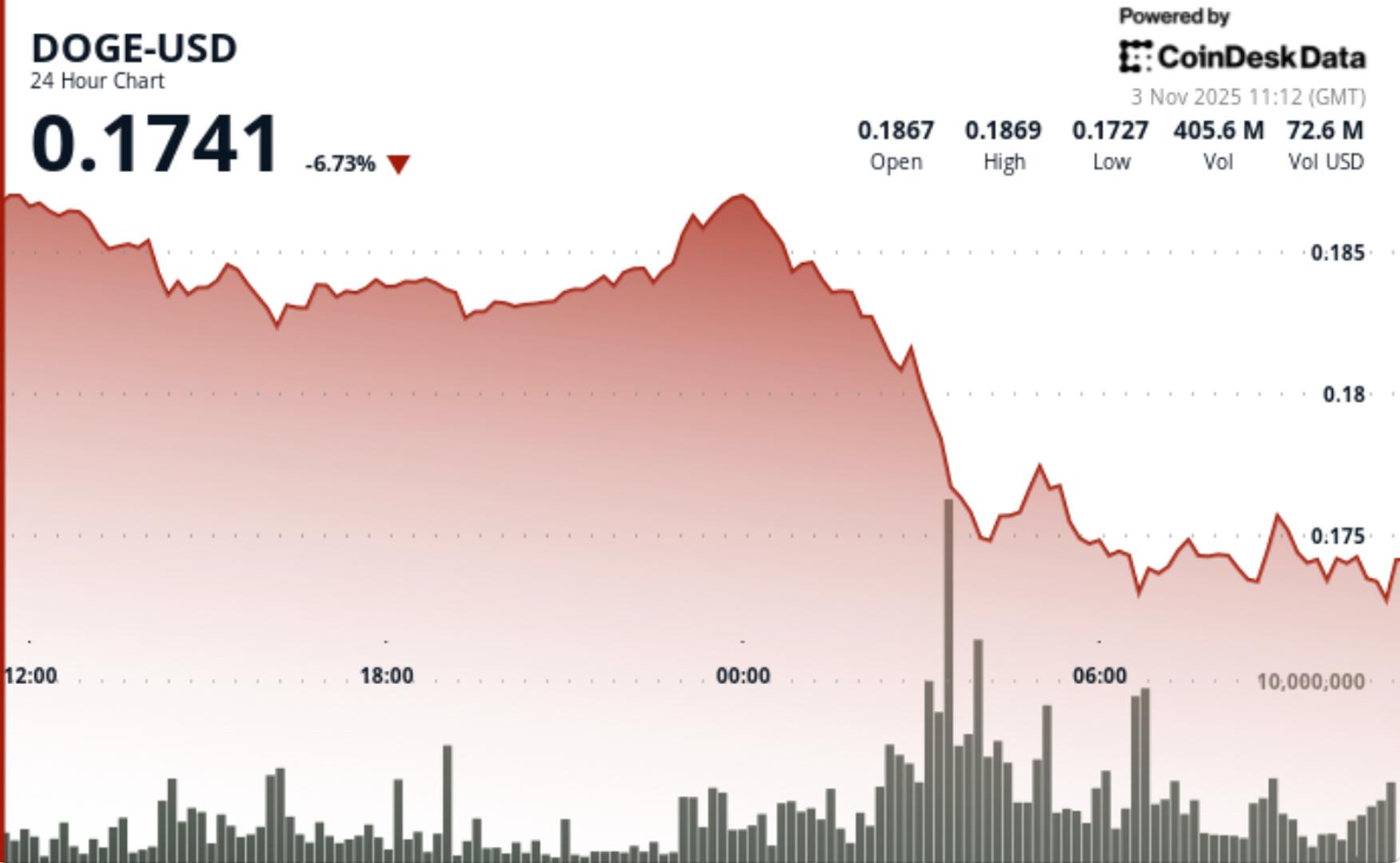

Dogecoin Breakdown Deepens, $0.18 Support Snaps as Whales Offload 440M Tokens

NegativeCryptocurrency

The recent downturn in Dogecoin has seen its support level at $0.18 break as large holders, known as whales, offload a staggering 440 million tokens. This significant sell-off raises concerns about the stability of Dogecoin and the broader cryptocurrency market, as it reflects a lack of confidence among major investors. The implications of this trend could lead to further price declines and increased volatility, making it a critical moment for both investors and enthusiasts to watch closely.

— Curated by the World Pulse Now AI Editorial System