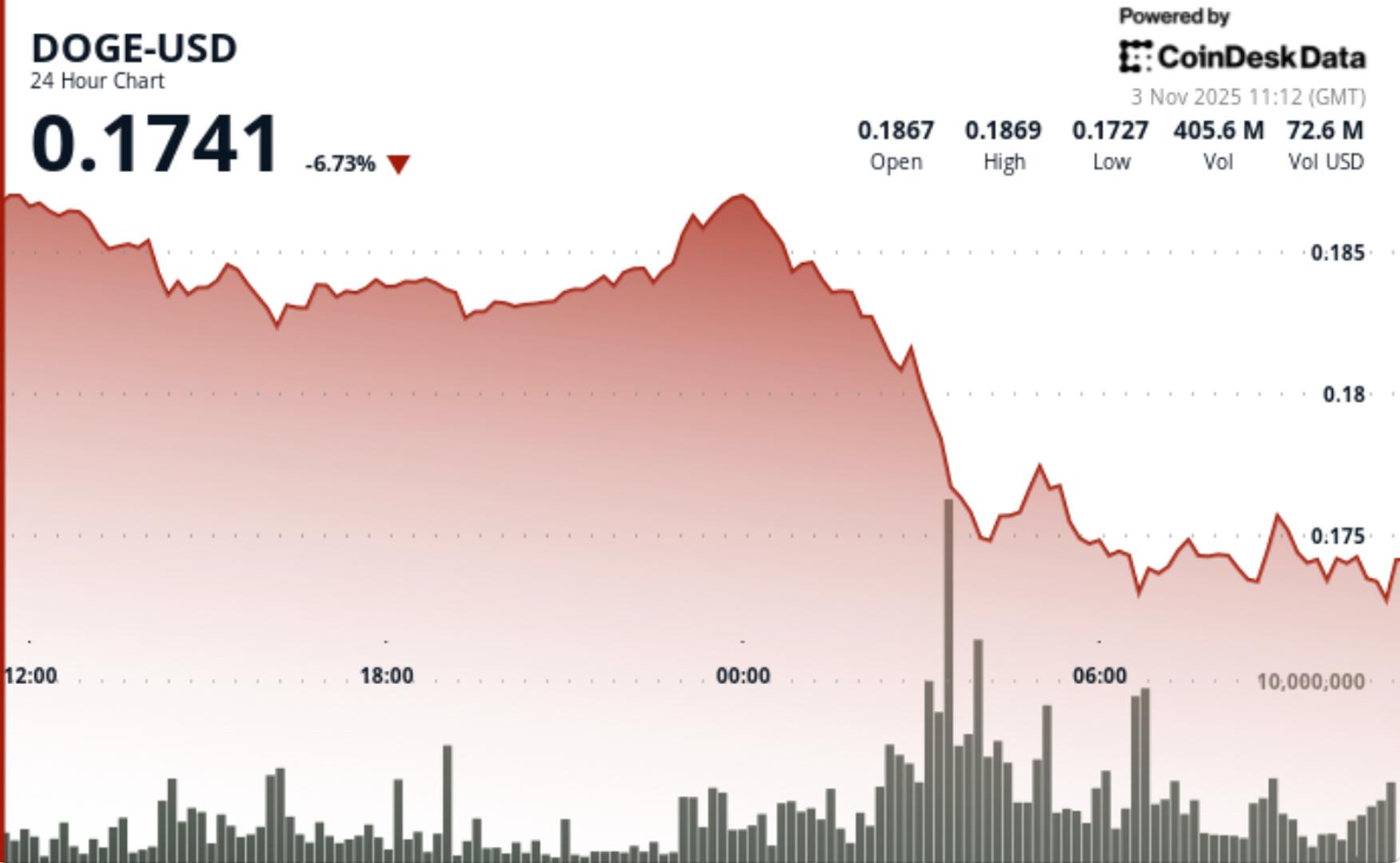

Dogecoin goes down as Fed keeps tight leash on rates

NegativeCryptocurrency

Dogecoin's price has taken a hit, dropping to around $0.16 as the cryptocurrency market faced a significant downturn on November 3. This decline is largely attributed to the Federal Reserve's decision to maintain tight control over interest rates, which has created uncertainty in the market. The impact of such monetary policies can ripple through the crypto space, affecting investor confidence and market stability.

— Curated by the World Pulse Now AI Editorial System