Bitcoin Cash (BCH) Plunges 6.7% As Social Media Shows Overhype

NegativeCryptocurrency

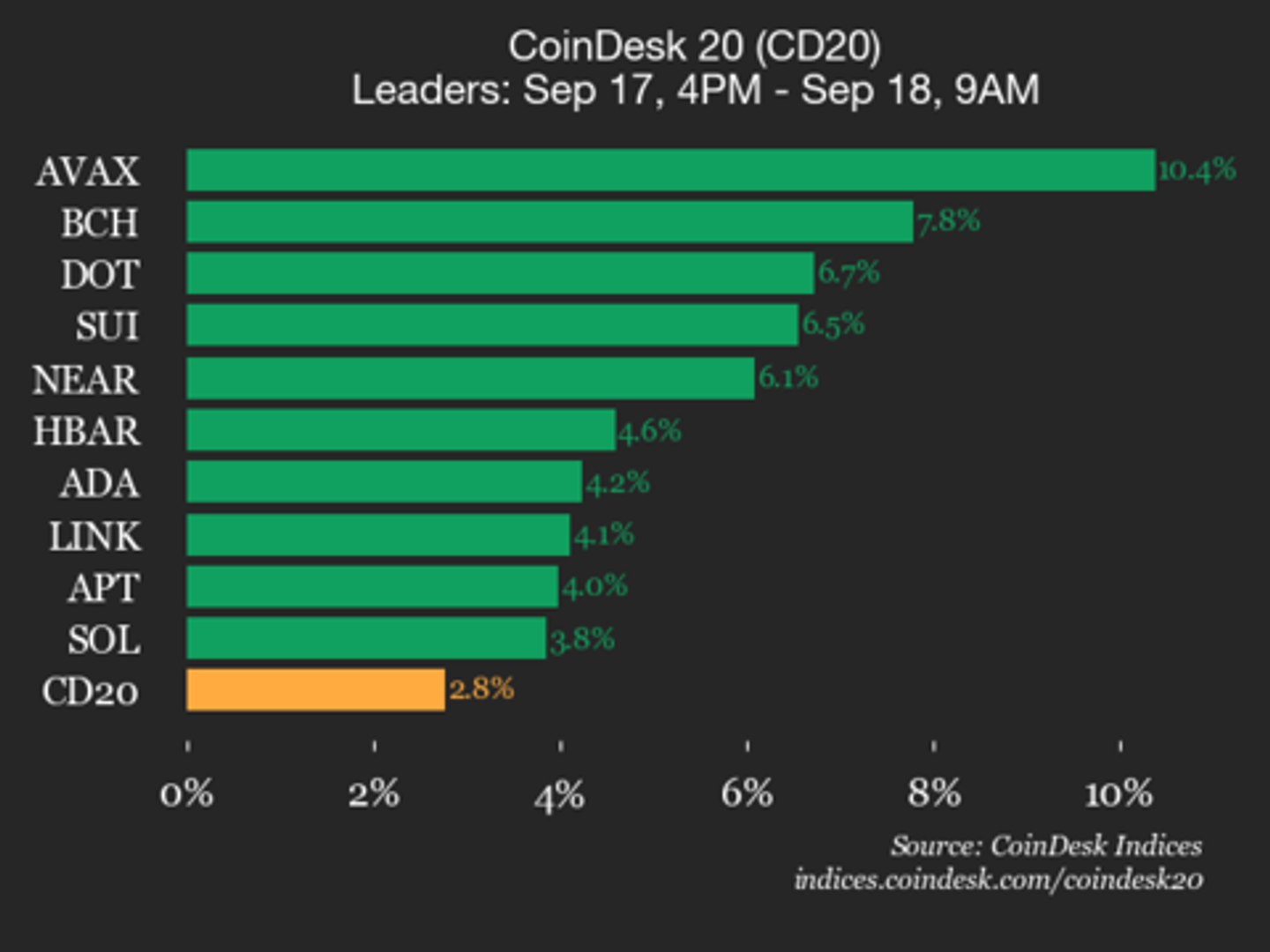

Bitcoin Cash (BCH) has seen a significant drop of 6.7%, which many attribute to an overhyped sentiment on social media. Recent data from analytics firm Santiment indicates that while there was a surge in positive comments about BCH, this may have led to an unsustainable rise, culminating in the coin's pullback from its 17-month high. This situation highlights the volatility of cryptocurrencies and the impact of social media on market trends, reminding investors to be cautious amidst the hype.

— Curated by the World Pulse Now AI Editorial System