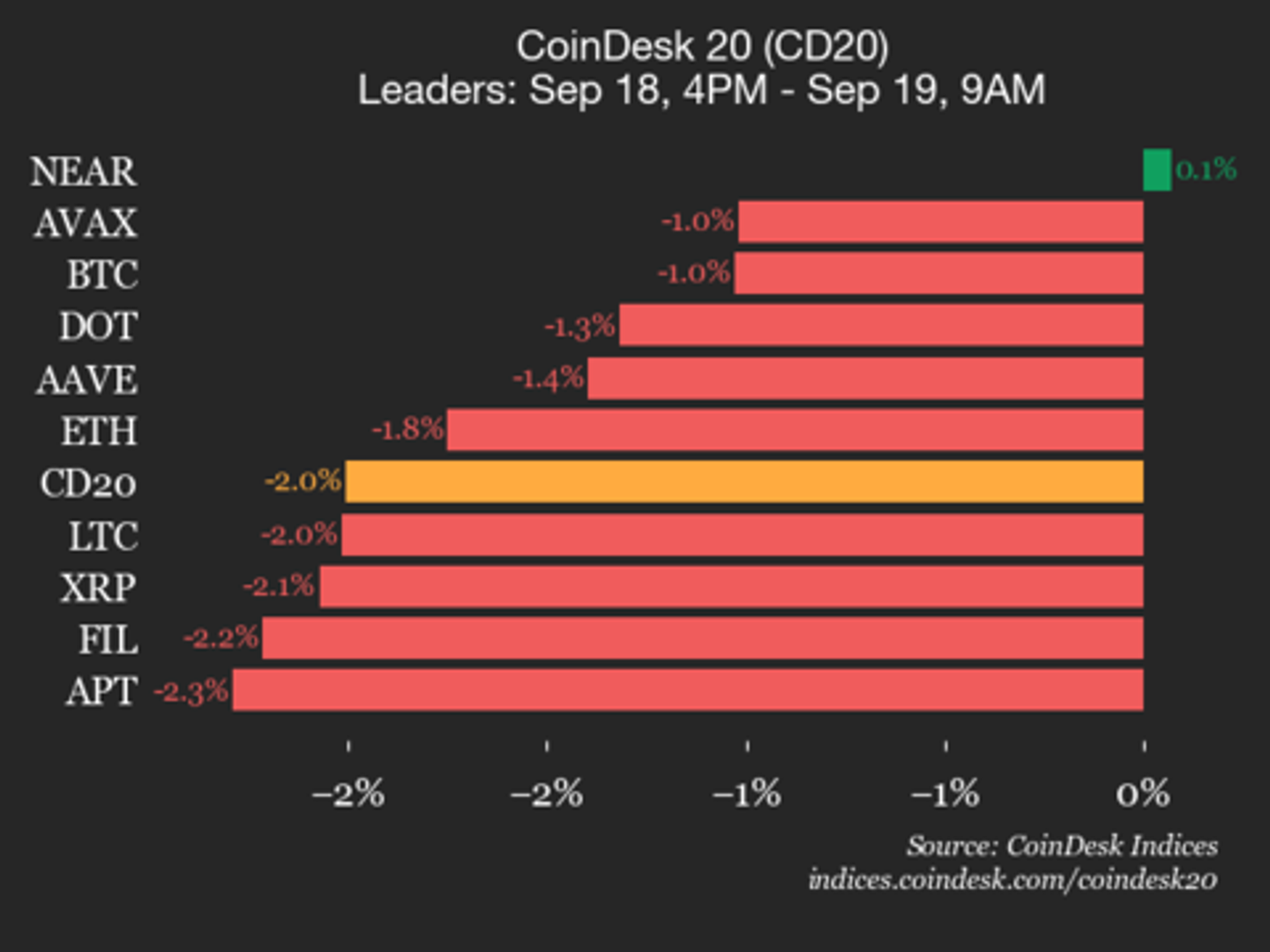

CoinDesk 20 Performance Update: Index Drops 2% as Nearly All Constituents Trade Lower

NegativeCryptocurrency

The CoinDesk 20 index has seen a decline of 2%, primarily driven by significant drops in key cryptocurrencies like Sui and Bitcoin Cash, which fell 5.6% and 4.7% respectively. This downturn is noteworthy as it reflects broader market trends and investor sentiment, highlighting the volatility that continues to characterize the cryptocurrency landscape.

— Curated by the World Pulse Now AI Editorial System