Dogecoin (DOGE) Slips Back Into the Red—Is Momentum Breaking Down?

NegativeCryptocurrency

- Dogecoin (DOGE) has experienced a decline, falling below the $0.1450 mark against the US Dollar, and is currently consolidating losses with resistance noted around $0.1420. The price has dropped below key support levels, including a break of a bullish trend line, indicating bearish momentum in the market.

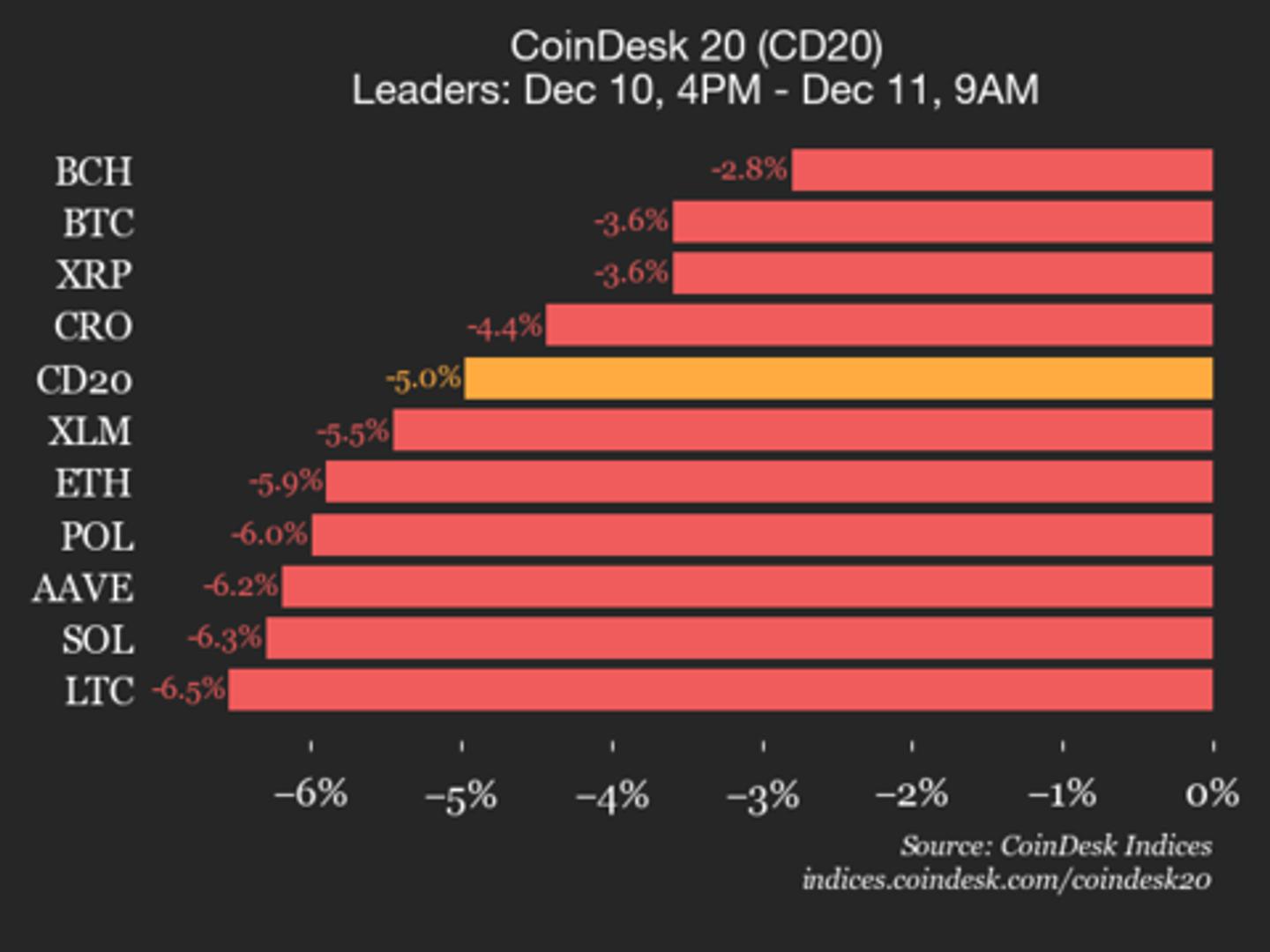

- This decline is significant as it reflects broader trends in the cryptocurrency market, where Dogecoin's performance is closely tied to movements in major cryptocurrencies like Bitcoin and Ethereum, which have also faced downward pressure.

- The current market conditions highlight a struggle for Dogecoin to regain upward momentum, with technical indicators suggesting potential recovery points. However, the overall sentiment remains cautious as the cryptocurrency navigates through a bearish phase, with fluctuating trading volumes and interest in Dogecoin ETFs declining.

— via World Pulse Now AI Editorial System