Chainlink, Chainalysis partner to automate onchain compliance

PositiveCryptocurrency

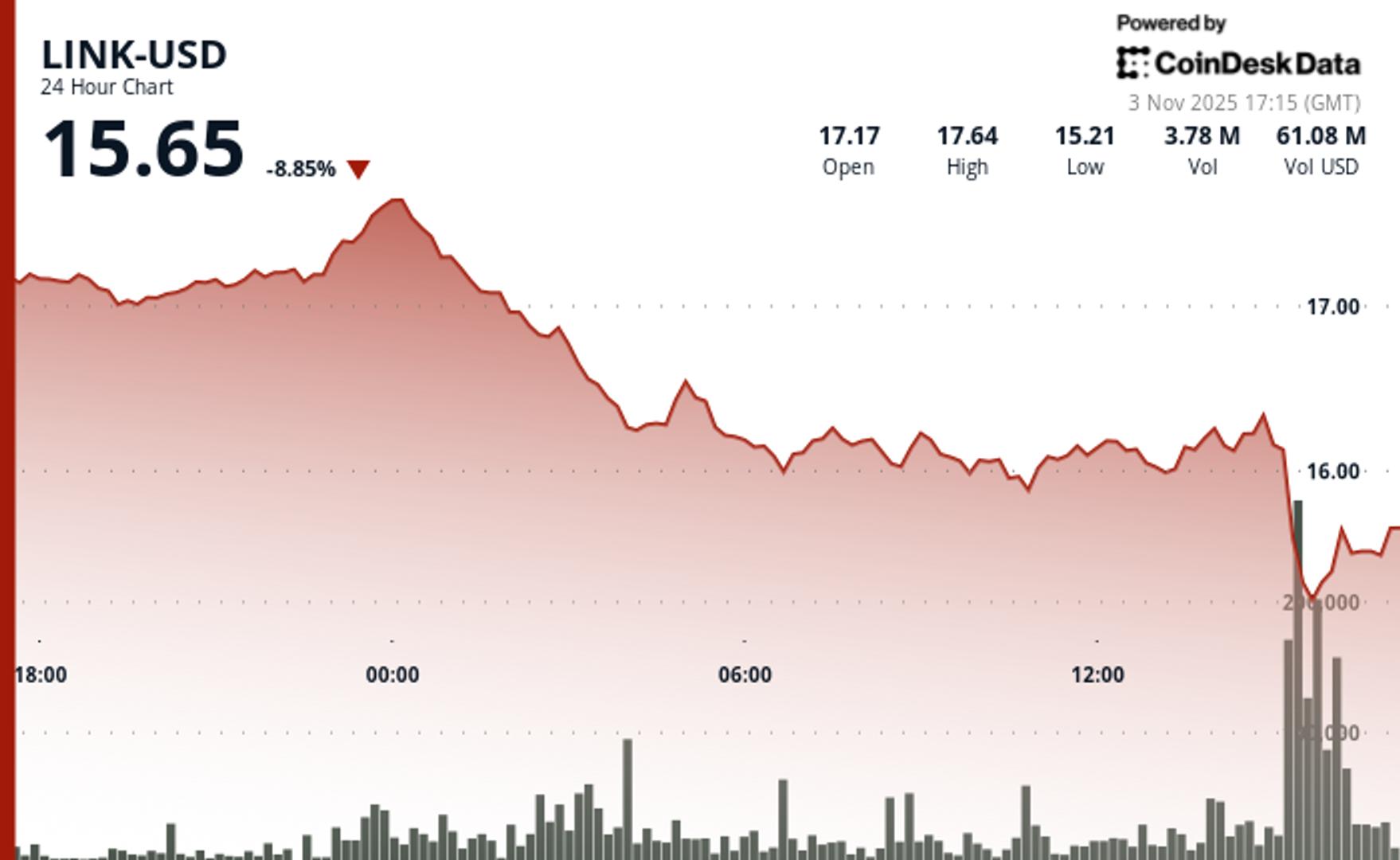

Chainlink has teamed up with Chainalysis to enhance on-chain compliance by integrating real-time risk data. This partnership allows institutions to enforce compliance policies as executable code across various blockchains, making it easier for them to navigate regulatory landscapes. This development is significant as it not only streamlines compliance processes but also promotes trust and security in blockchain transactions.

— Curated by the World Pulse Now AI Editorial System