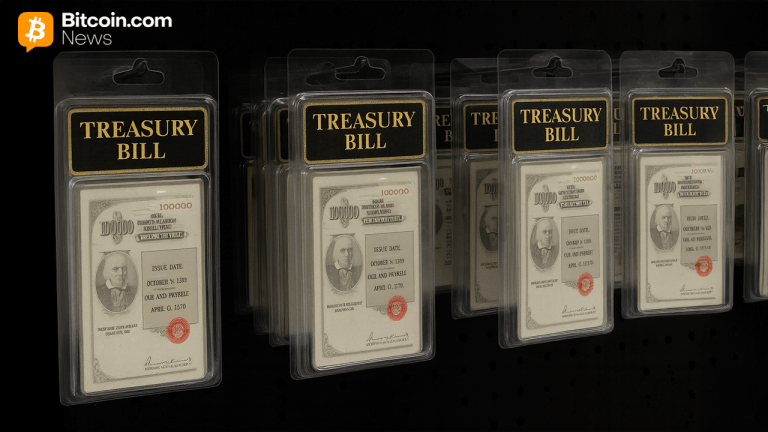

Tokenized US Bonds Advance 1.31% This Week as Blackrock’s BUIDL Pulls Inflows

PositiveCryptocurrency

This week, tokenized US bonds saw a notable increase of 1.31%, driven by significant inflows into Blackrock's BUIDL initiative. This development is important as it highlights the growing interest in tokenized assets and their potential to reshape traditional finance, making investments more accessible and efficient.

— Curated by the World Pulse Now AI Editorial System