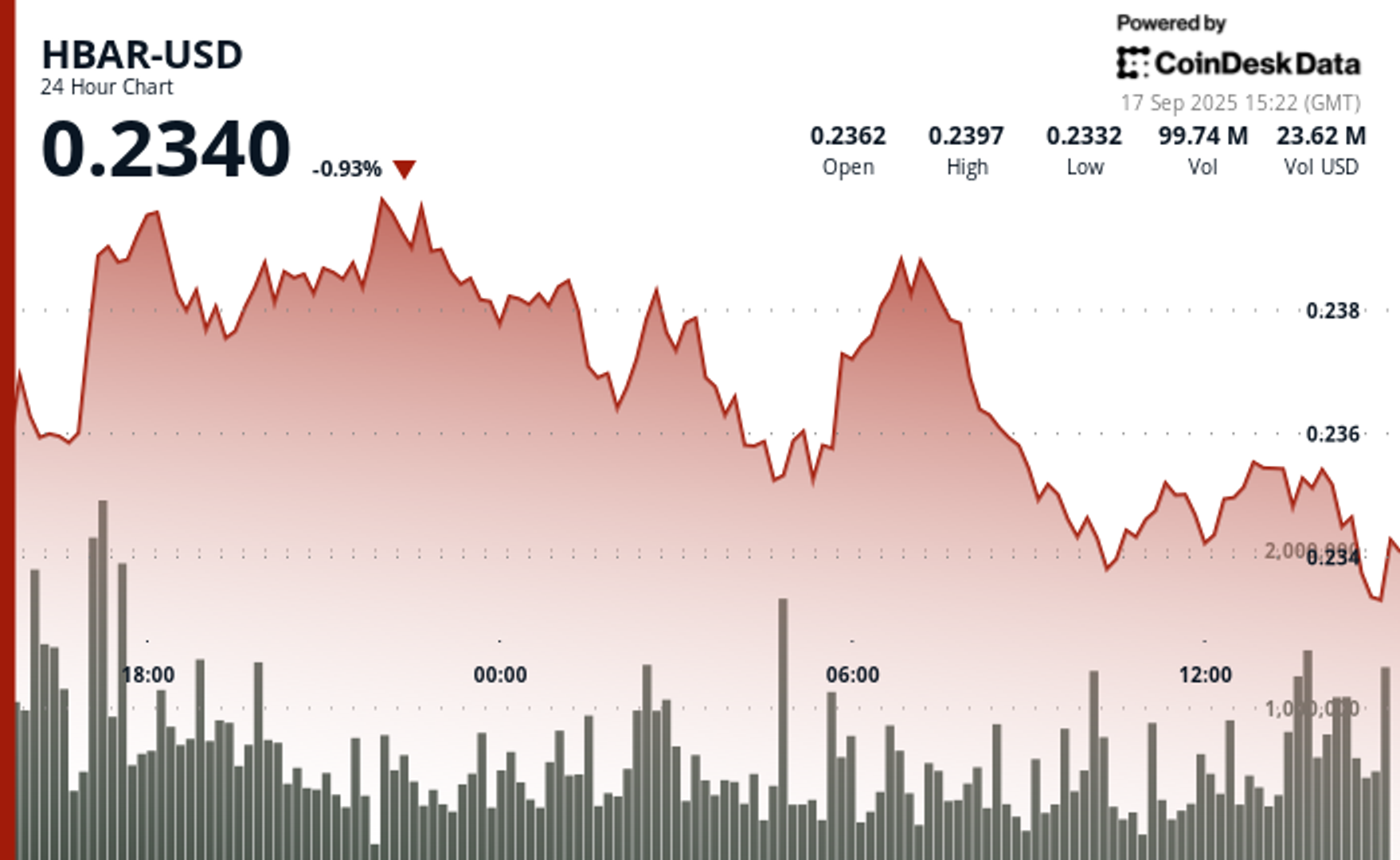

HBAR Retreats Amid Constrained Range Trading and Diminishing Volumes

NegativeCryptocurrency

HBAR has been experiencing a downturn as it retreats within a constrained trading range, coupled with diminishing trading volumes. This trend raises concerns among investors about the overall health of the cryptocurrency market, as lower volumes often indicate reduced interest and participation. Understanding these dynamics is crucial for investors looking to navigate the volatile landscape of digital assets.

— Curated by the World Pulse Now AI Editorial System