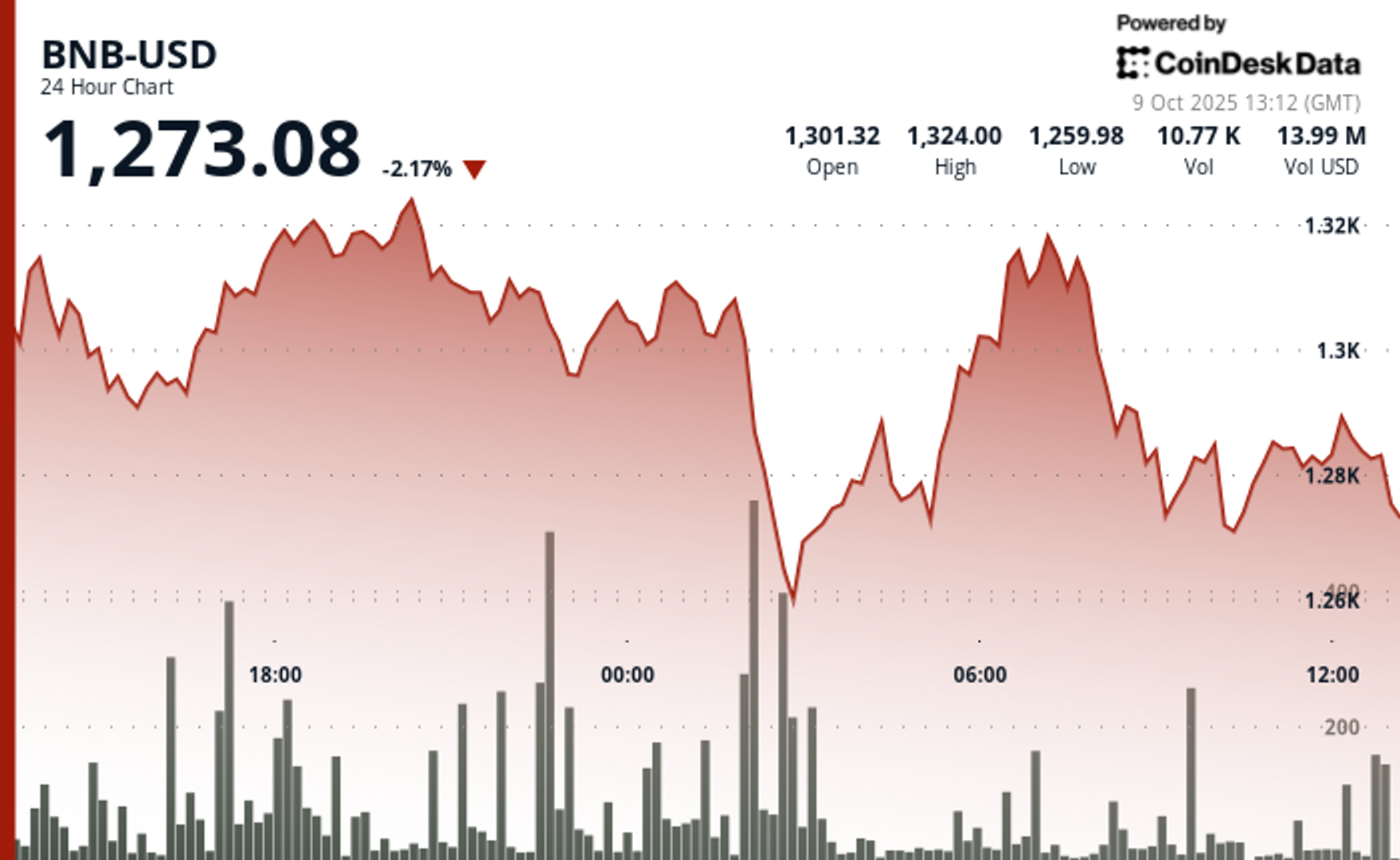

BNB Falls 2% as Memecoin Trades Unwind Despite 'Hard to Ignore' Rally

NegativeCryptocurrency

BNB has seen a 2% decline as trading in memecoins unwinds, despite a rally that many find hard to ignore. This downturn highlights the volatility in the cryptocurrency market, where speculative trading can lead to rapid shifts in value. Investors are closely watching these trends, as they can significantly impact market sentiment and investment strategies.

— Curated by the World Pulse Now AI Editorial System