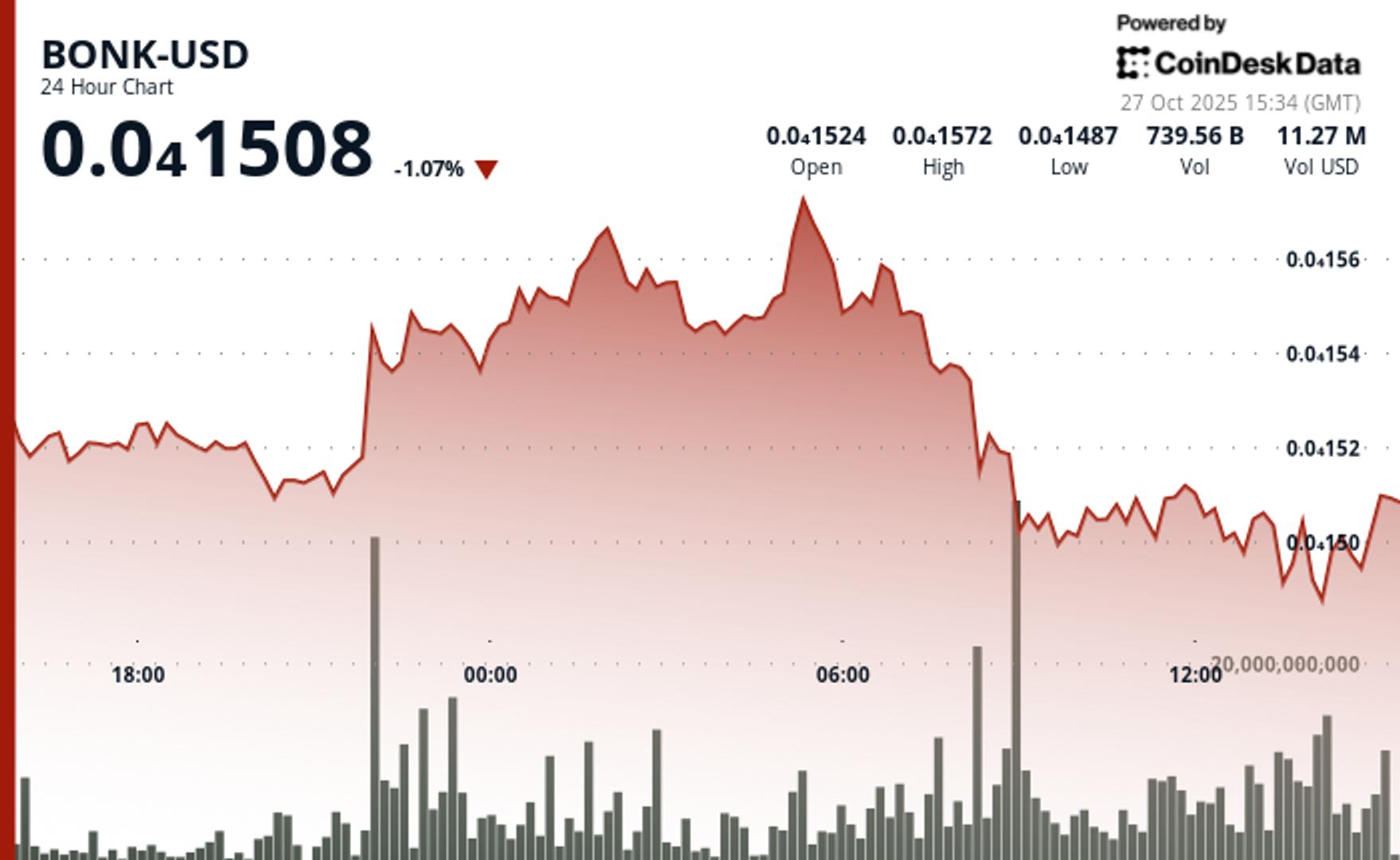

BONK Battles Back After Breaking Support; Traders Eye $0.000015 Rebound

PositiveCryptocurrency

After a recent dip, BONK is showing signs of recovery as traders anticipate a rebound to the $0.000015 mark. This turnaround is significant as it reflects the resilience of the cryptocurrency market and the confidence traders have in BONK's potential for growth. Keeping an eye on this trend could provide insights into broader market movements.

— Curated by the World Pulse Now AI Editorial System