Chinese Investment Bank Eyes $600 Million Raise For BNB Treasury Company

PositiveCryptocurrency

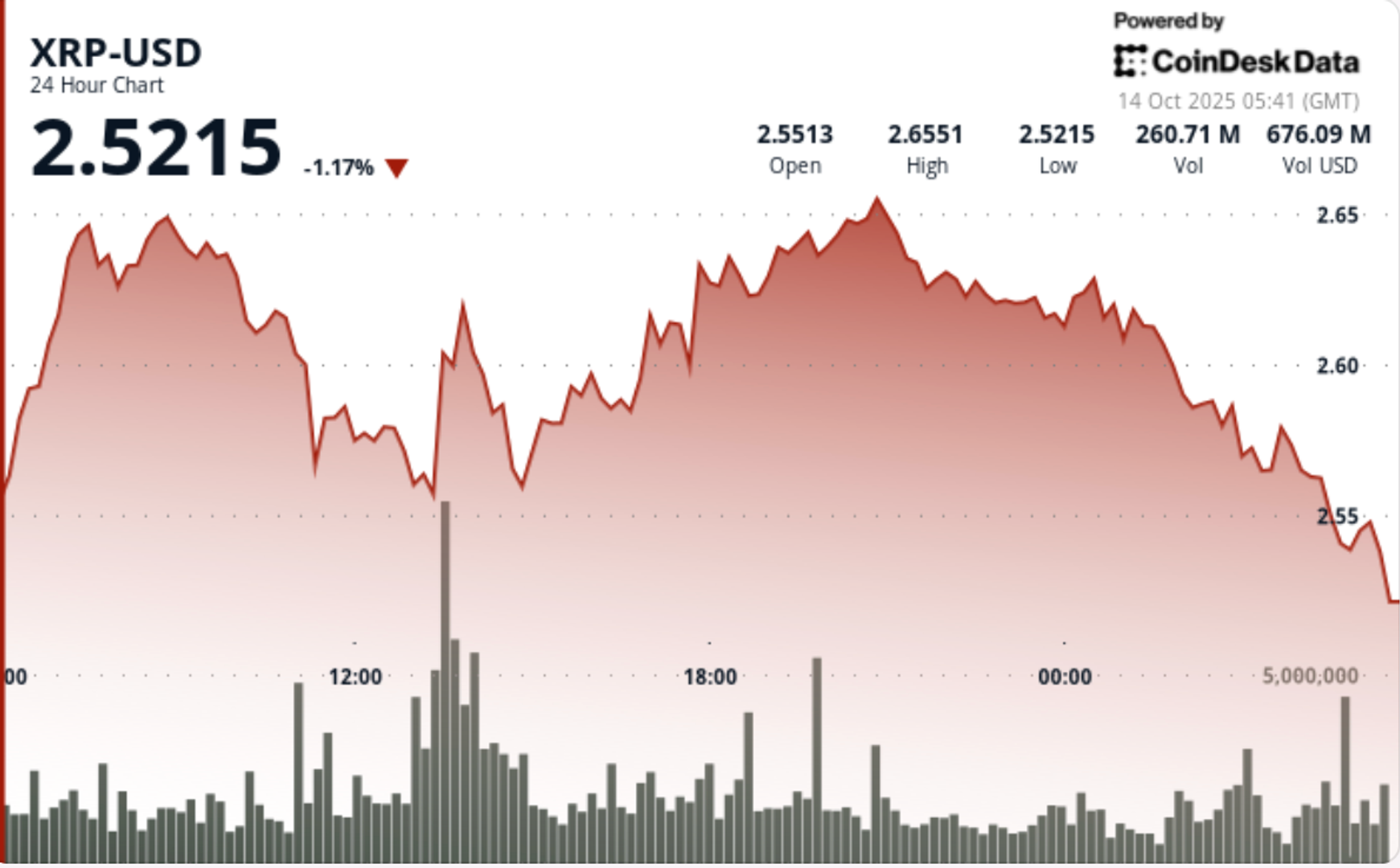

A major Chinese investment bank, China Renaissance Holdings Ltd., is reportedly planning to raise $600 million for a new US-based Digital Asset Treasury company, focusing on investing in BNB as it reaches new highs. This move highlights the growing interest in altcoins and could significantly boost the market, especially as XRP also sees a resurgence with substantial inflows. The potential success of this fundraising could pave the way for more institutional investments in the cryptocurrency space, signaling a positive trend for digital assets.

— Curated by the World Pulse Now AI Editorial System