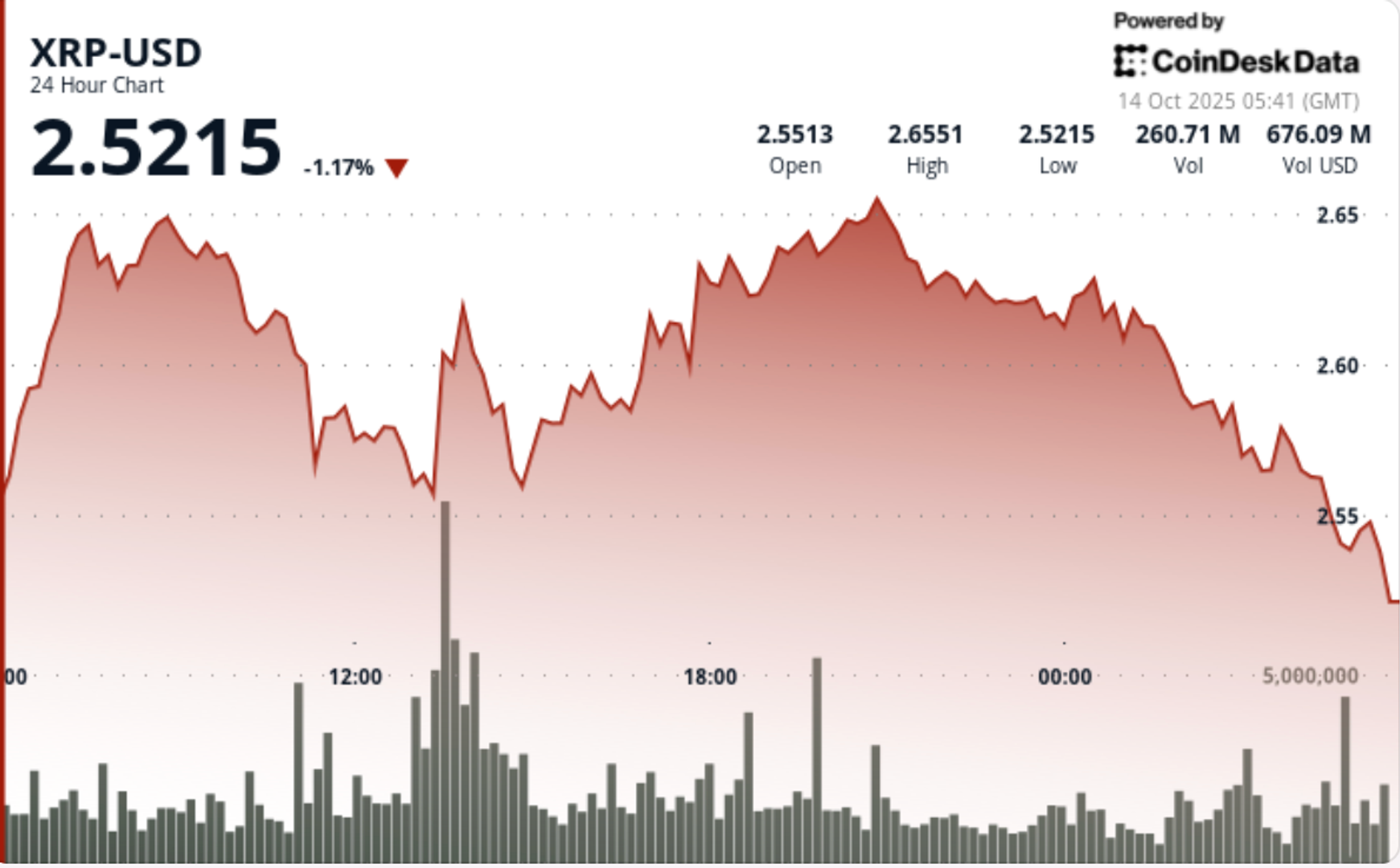

XRP Fades Below $2.60 as $63M Whale Sales Hit Binance

NegativeCryptocurrency

XRP has dropped below the $2.60 mark as significant whale sales totaling $63 million have impacted its value on Binance. This decline is noteworthy as it reflects the volatility in the cryptocurrency market, raising concerns among investors about potential further losses and market stability.

— Curated by the World Pulse Now AI Editorial System