XRP Price Faces Wall – Recovery Hits Resistance As Market Momentum Fades Again

NeutralCryptocurrency

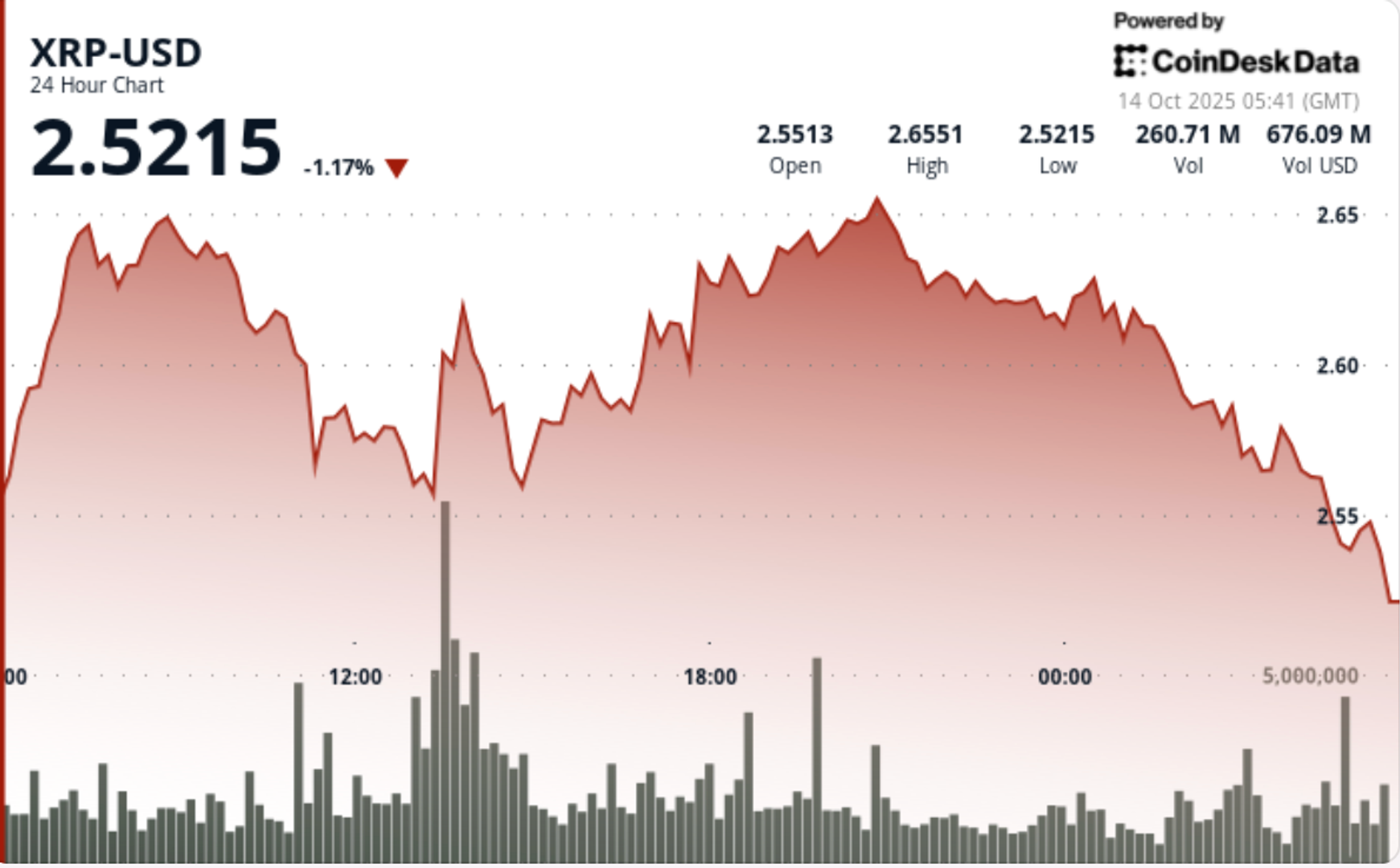

XRP is currently experiencing a price increase, surpassing $2.450, but it faces significant resistance around the $2.620 mark. While there are positive signs with the price trading above $2.520 and the 100-hourly Simple Moving Average, a bearish trend line is forming, indicating potential challenges ahead. If XRP settles below $2.50, it could lead to a fresh decline. This situation is crucial for investors as it highlights the volatility and uncertainty in the cryptocurrency market.

— Curated by the World Pulse Now AI Editorial System