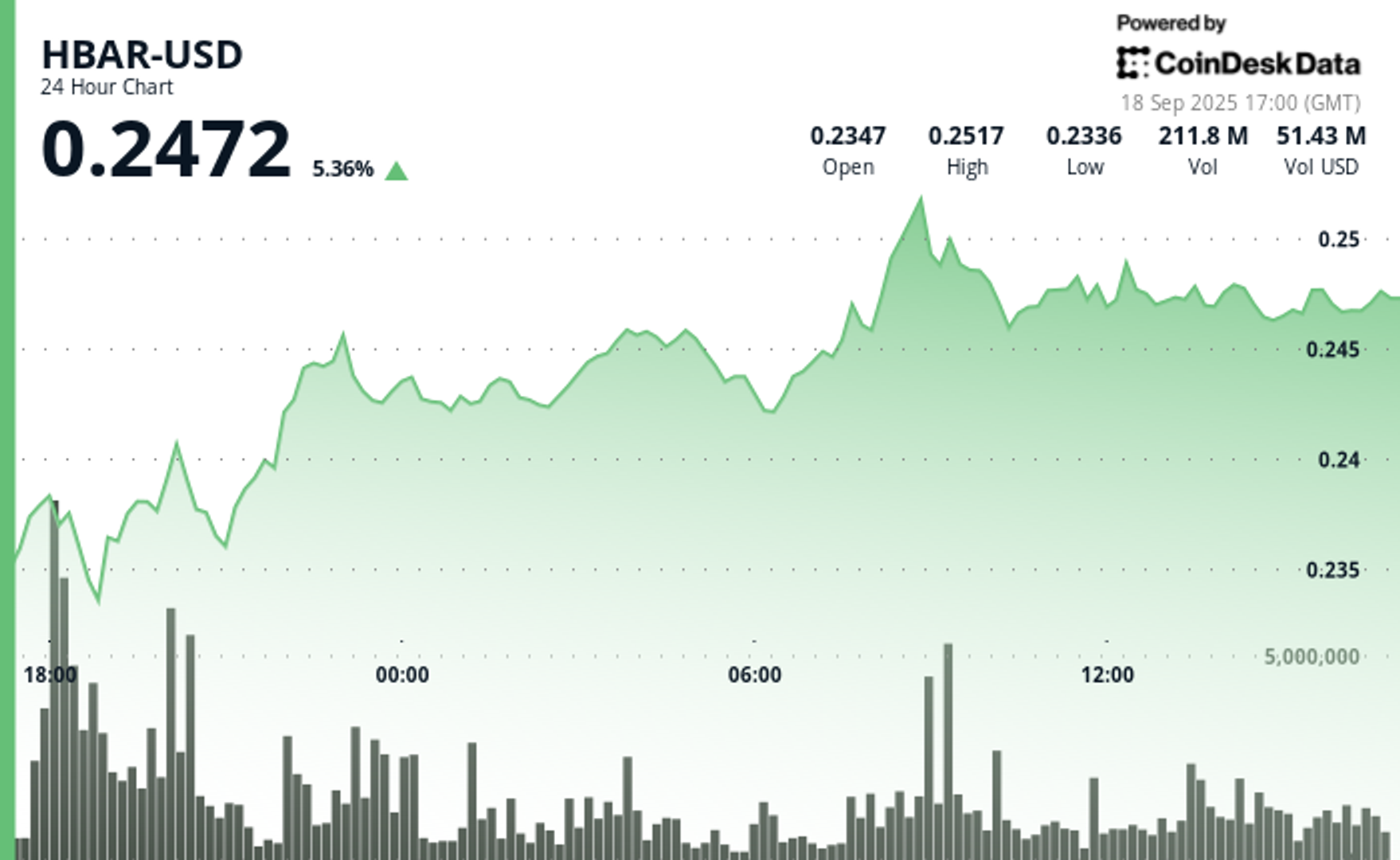

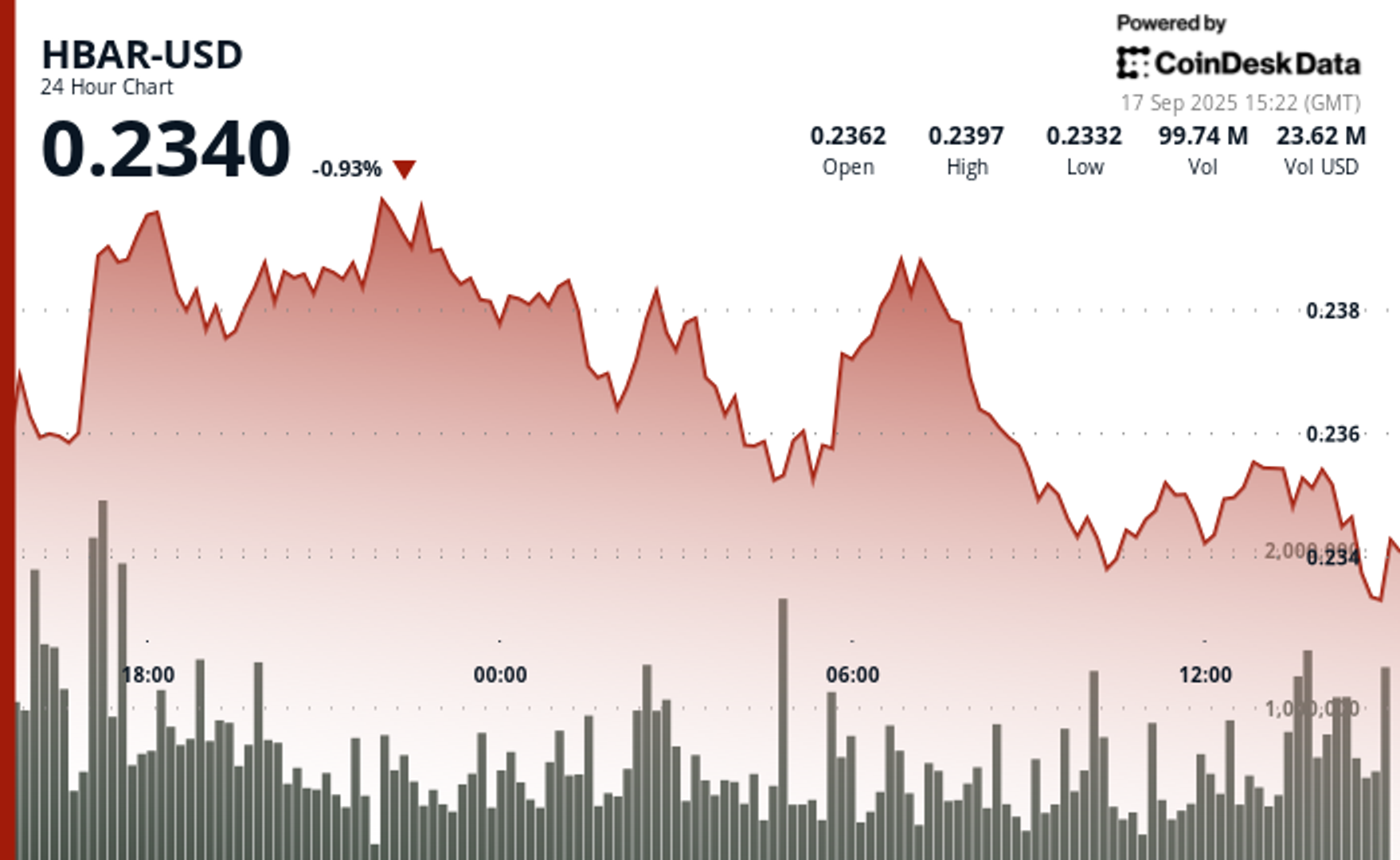

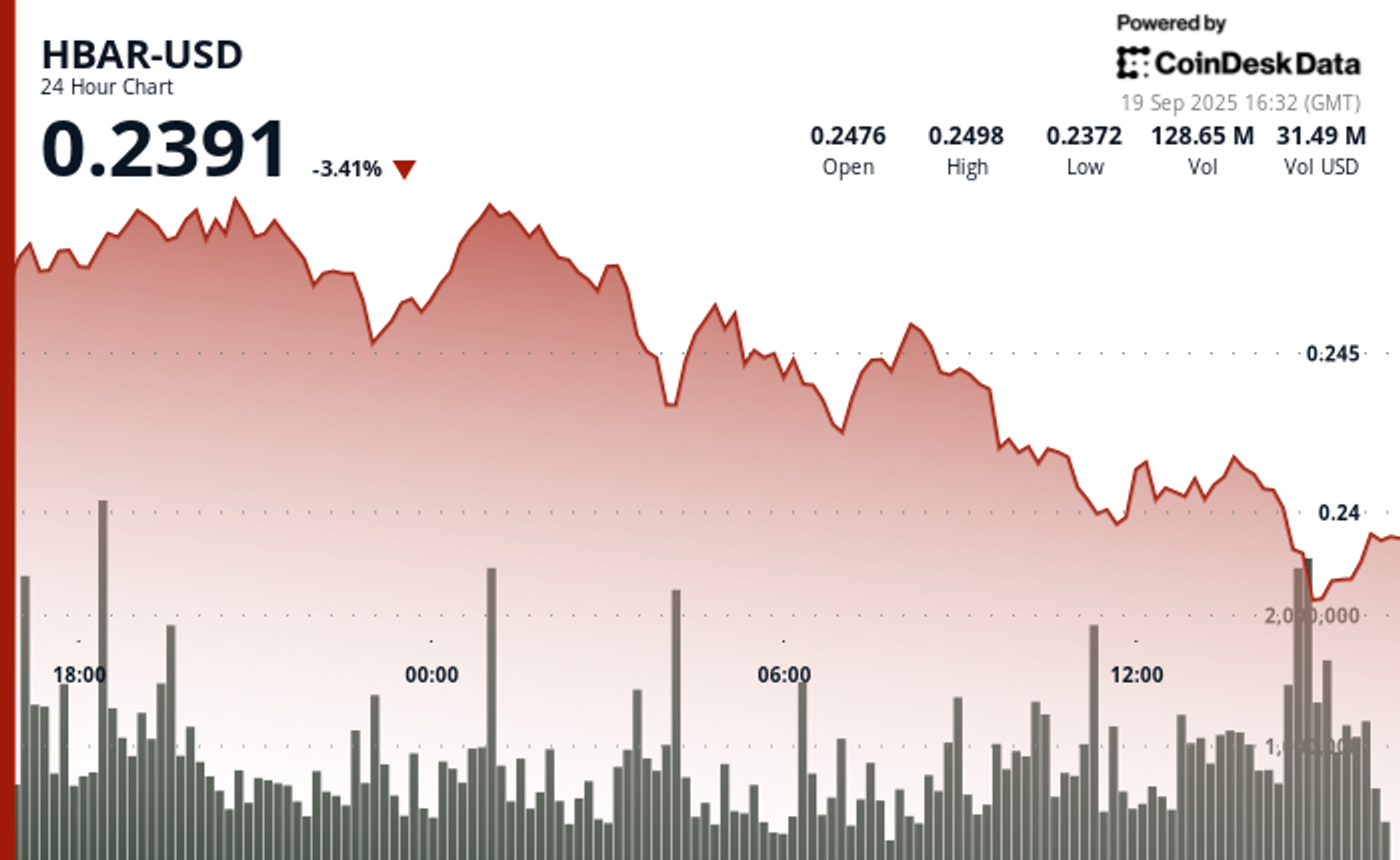

HBAR Slides 3% as Selling Pressure Intensifies, Finds Support at $0.24

NegativeCryptocurrency

Hedera's token, HBAR, has faced a significant decline, dropping 3% as selling pressure mounts. It breached crucial support levels but has found some stability around $0.24. This situation is important as it reflects the ongoing volatility in the cryptocurrency market, which can impact investor confidence and trading strategies.

— Curated by the World Pulse Now AI Editorial System