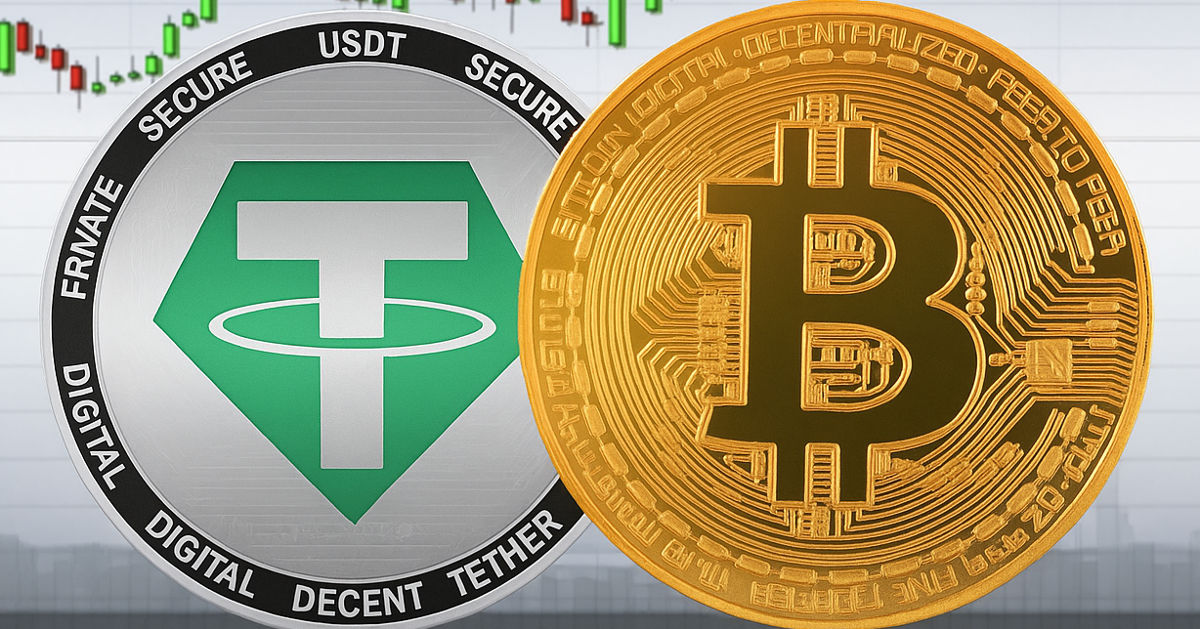

Tether Scoops $1 Billion In Bitcoin, Strengthening $10-B Stockpile

PositiveCryptocurrency

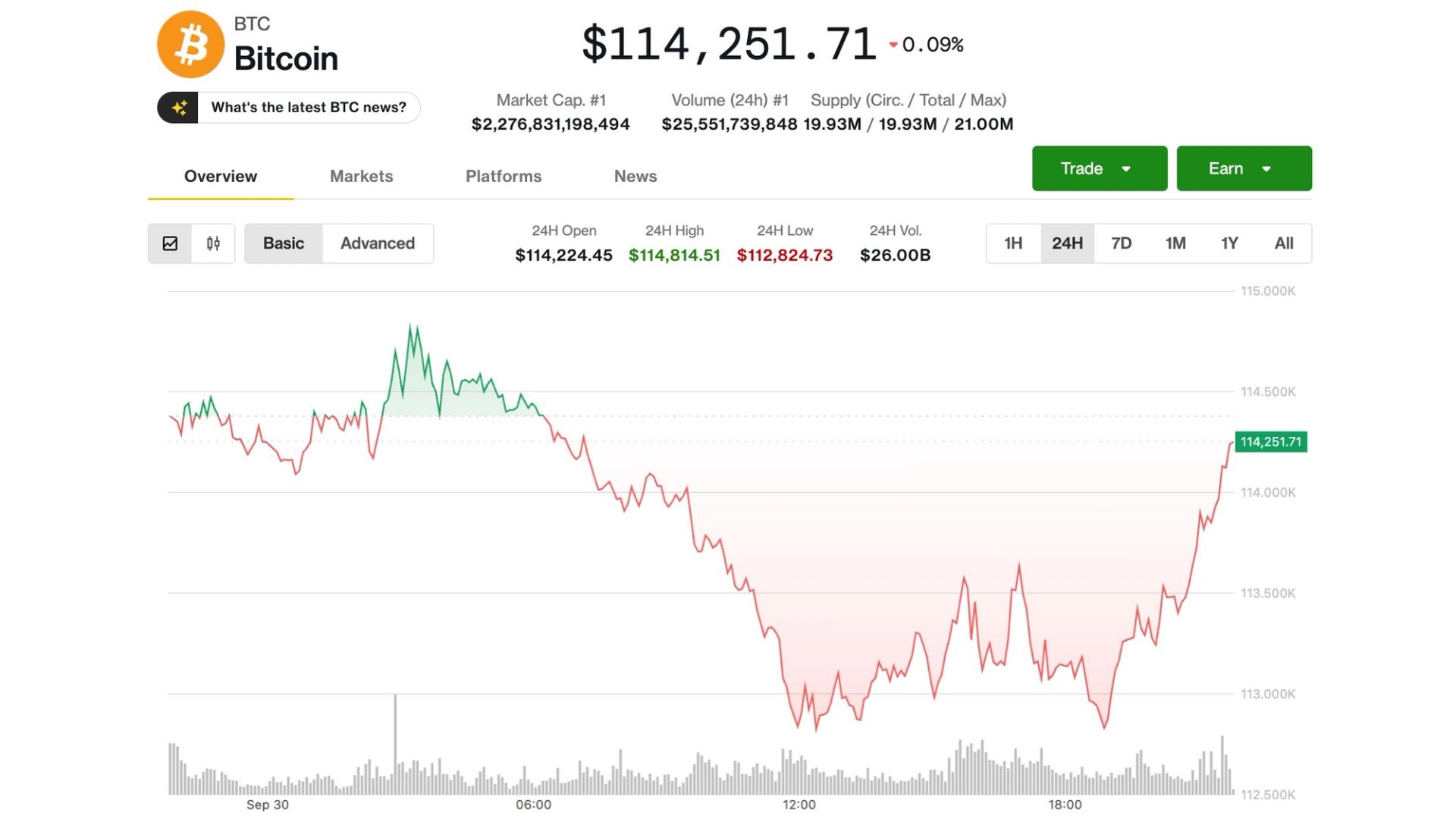

Tether has made a significant move by acquiring 8,889 Bitcoin in a single transfer from Bitfinex, boosting its Bitcoin reserves to approximately $9.8 billion. This $1 billion addition marks one of the largest top-ups to Tether's BTC balance this year, highlighting the company's strong position in the cryptocurrency market. The timing of this purchase suggests a strategic approach, reflecting Tether's confidence in Bitcoin's future and its commitment to maintaining a robust stockpile.

— Curated by the World Pulse Now AI Editorial System