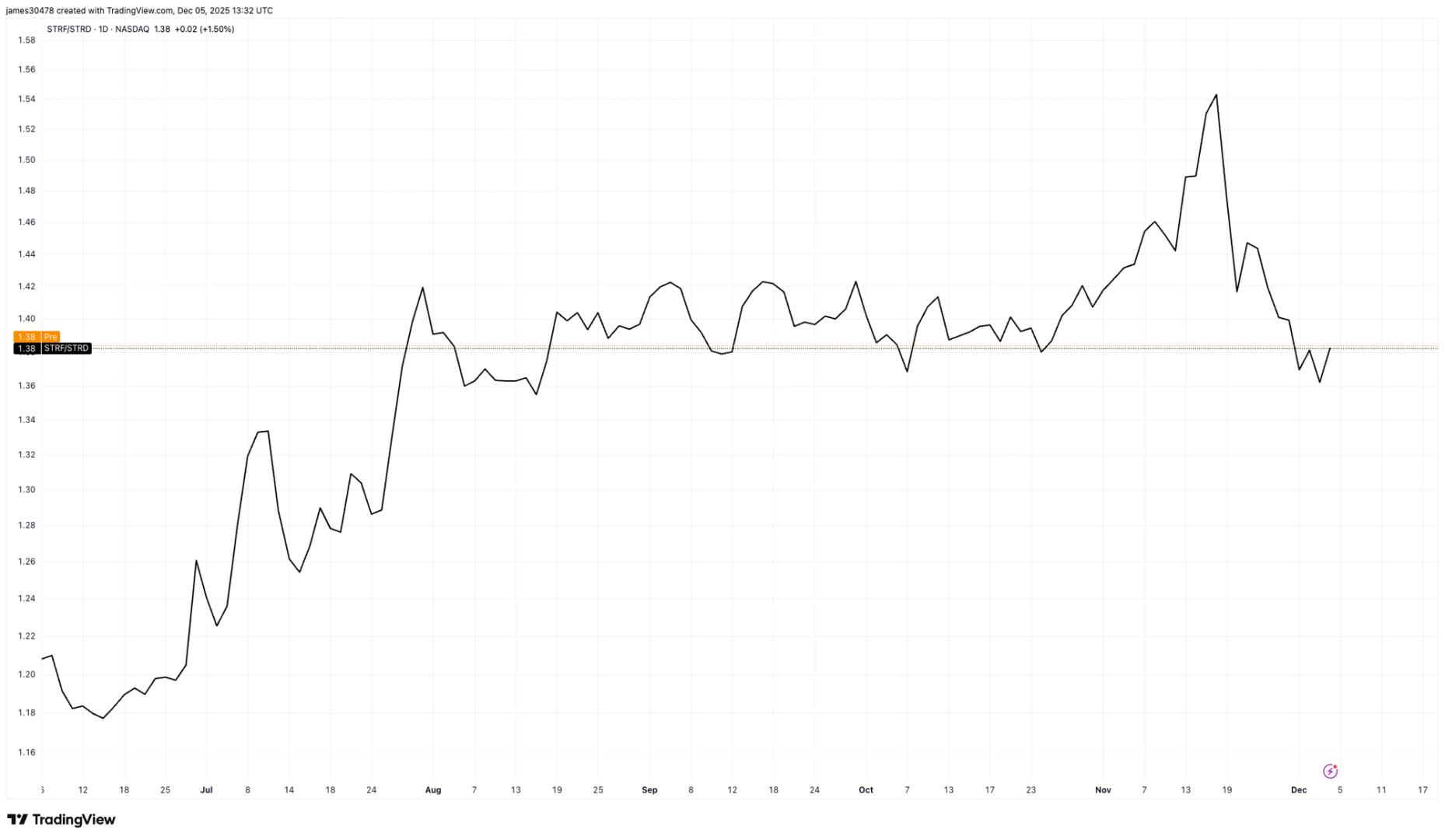

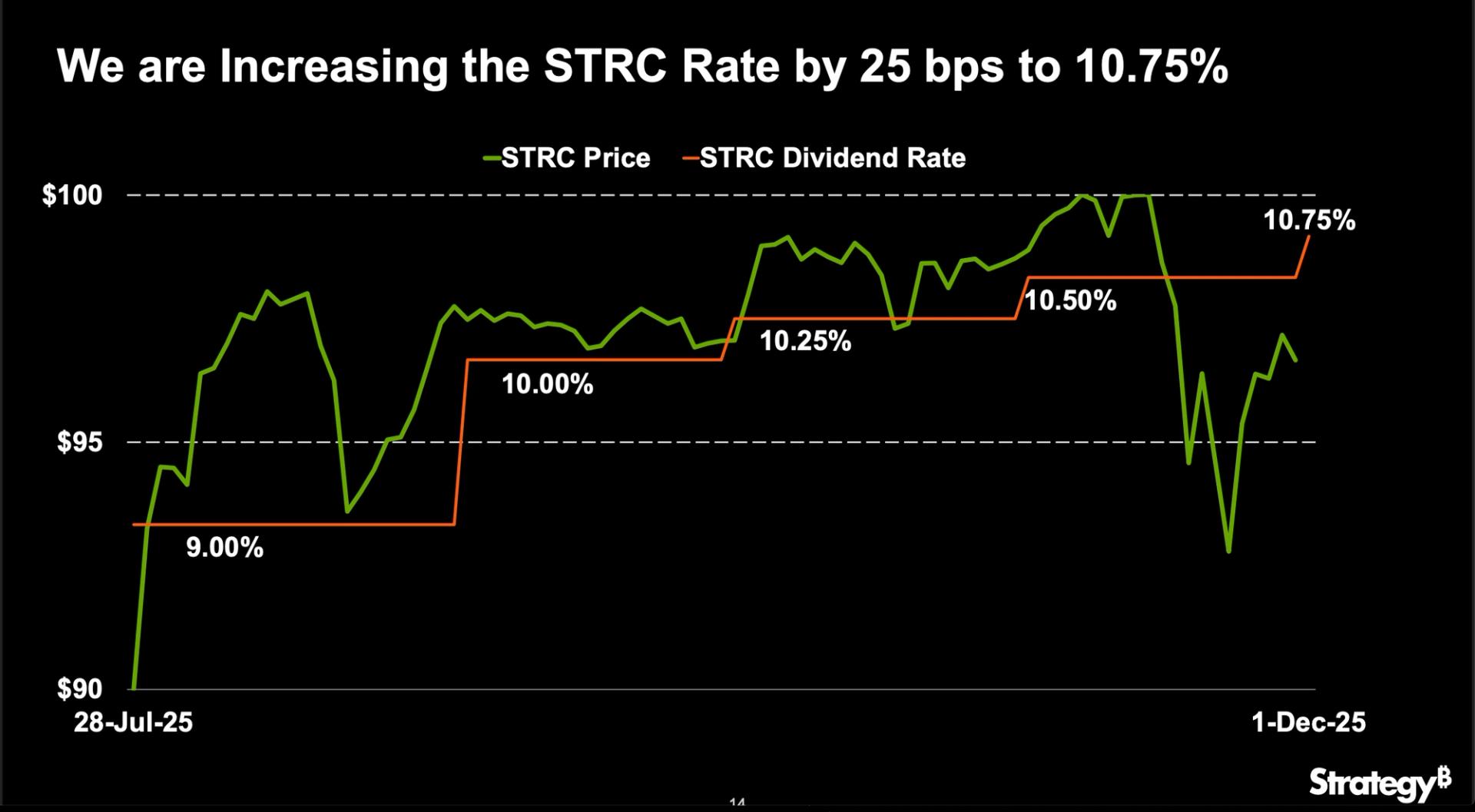

Strategy Battles for Par on STRC, Lifting Dividend to 10.75%

NegativeCryptocurrency

- STRC has increased its dividend payout to 10.75% after its preferred stock fell below the $100 par value, indicating ongoing financial challenges for the company. This decision reflects a strategic response to maintain investor confidence amid market pressures.

- The adjustment in dividend is significant for STRC as it aims to stabilize its stock performance and reassure shareholders during a period of volatility in the cryptocurrency sector. The move may also attract new investors looking for higher yields in a declining market.

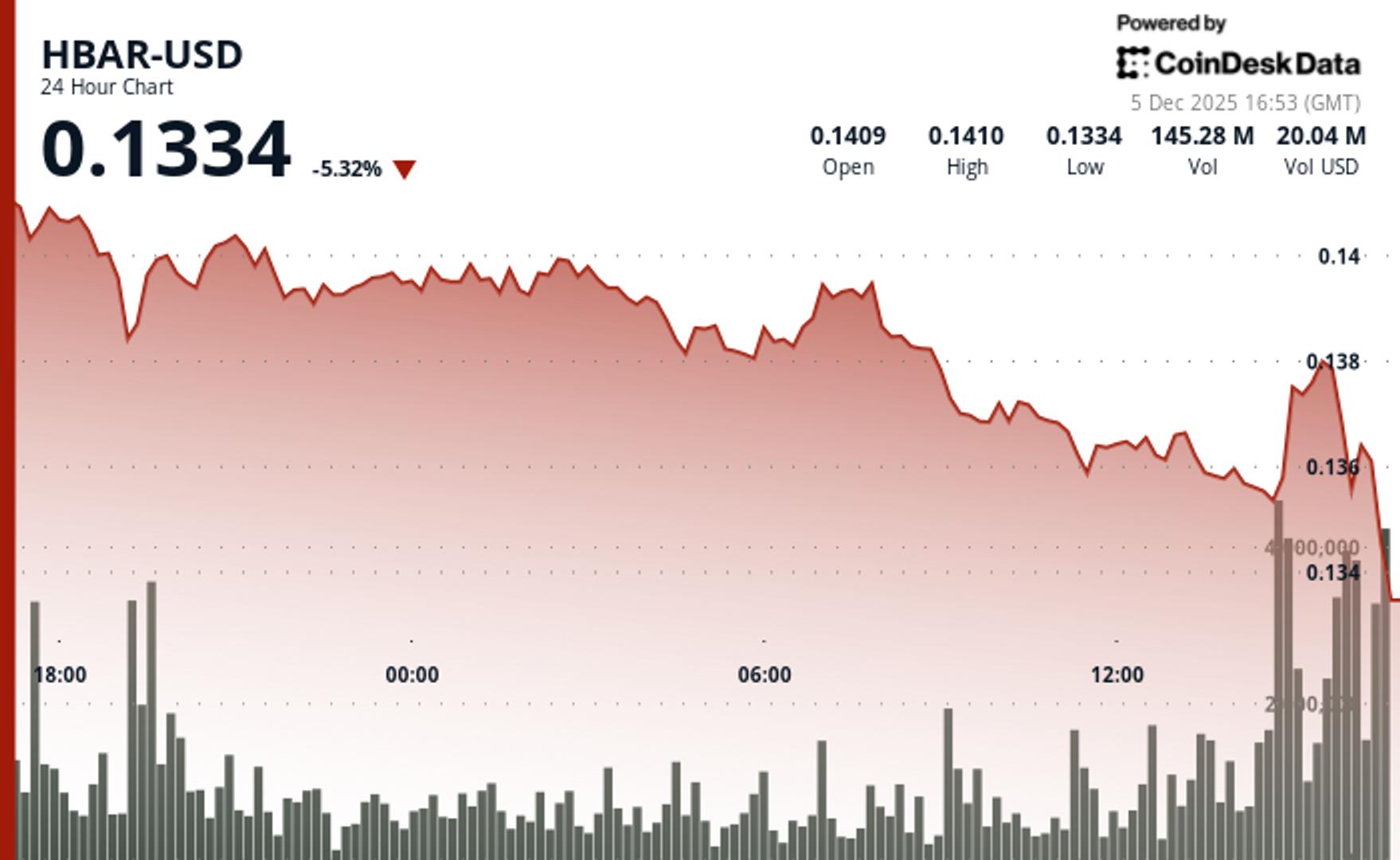

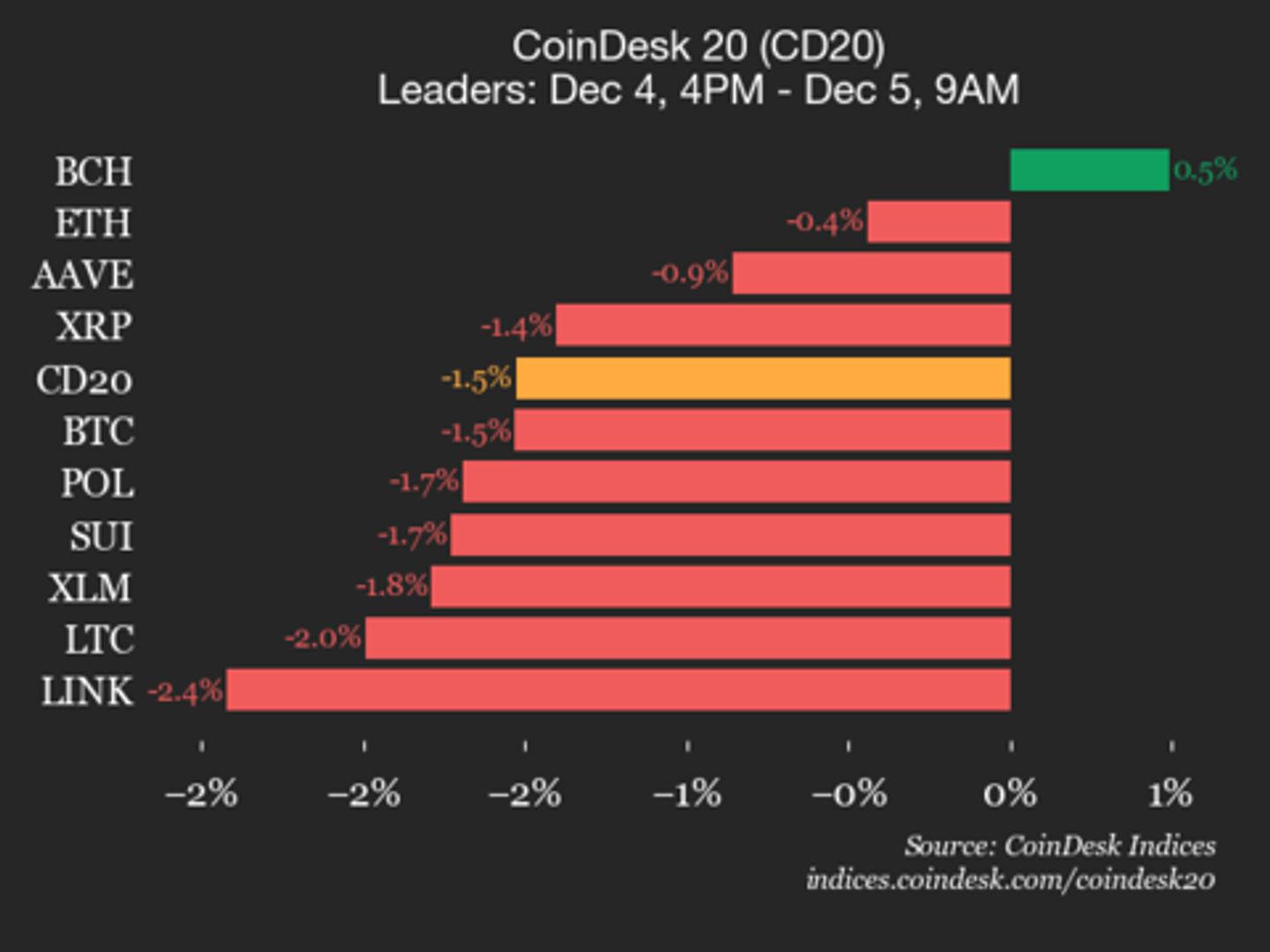

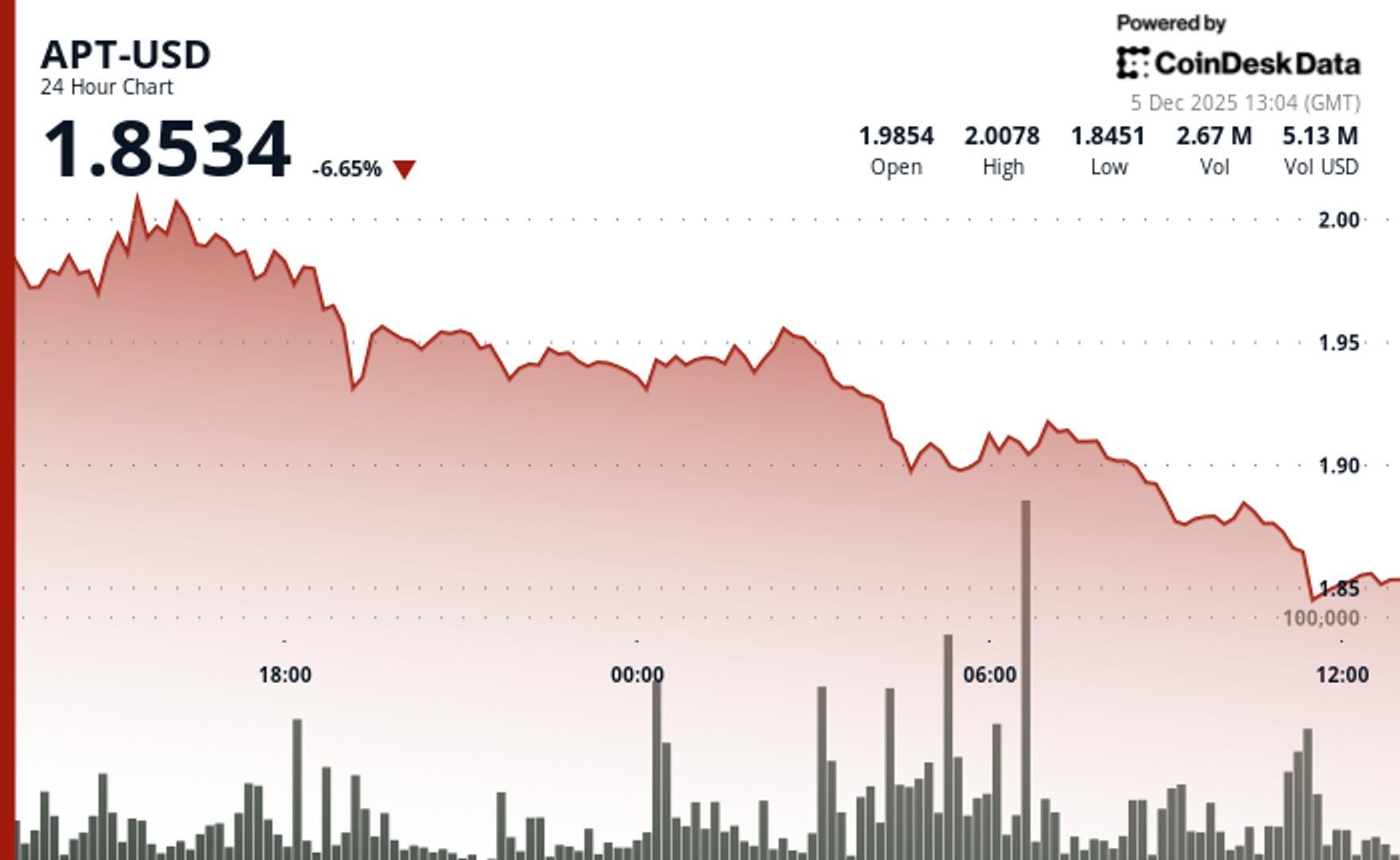

- The broader cryptocurrency landscape is currently marked by a downturn, with major players experiencing significant stock declines. This environment has led to increased trading activity and strategic investments, as firms navigate the challenges posed by market fluctuations and seek to capitalize on potential recovery opportunities.

— via World Pulse Now AI Editorial System