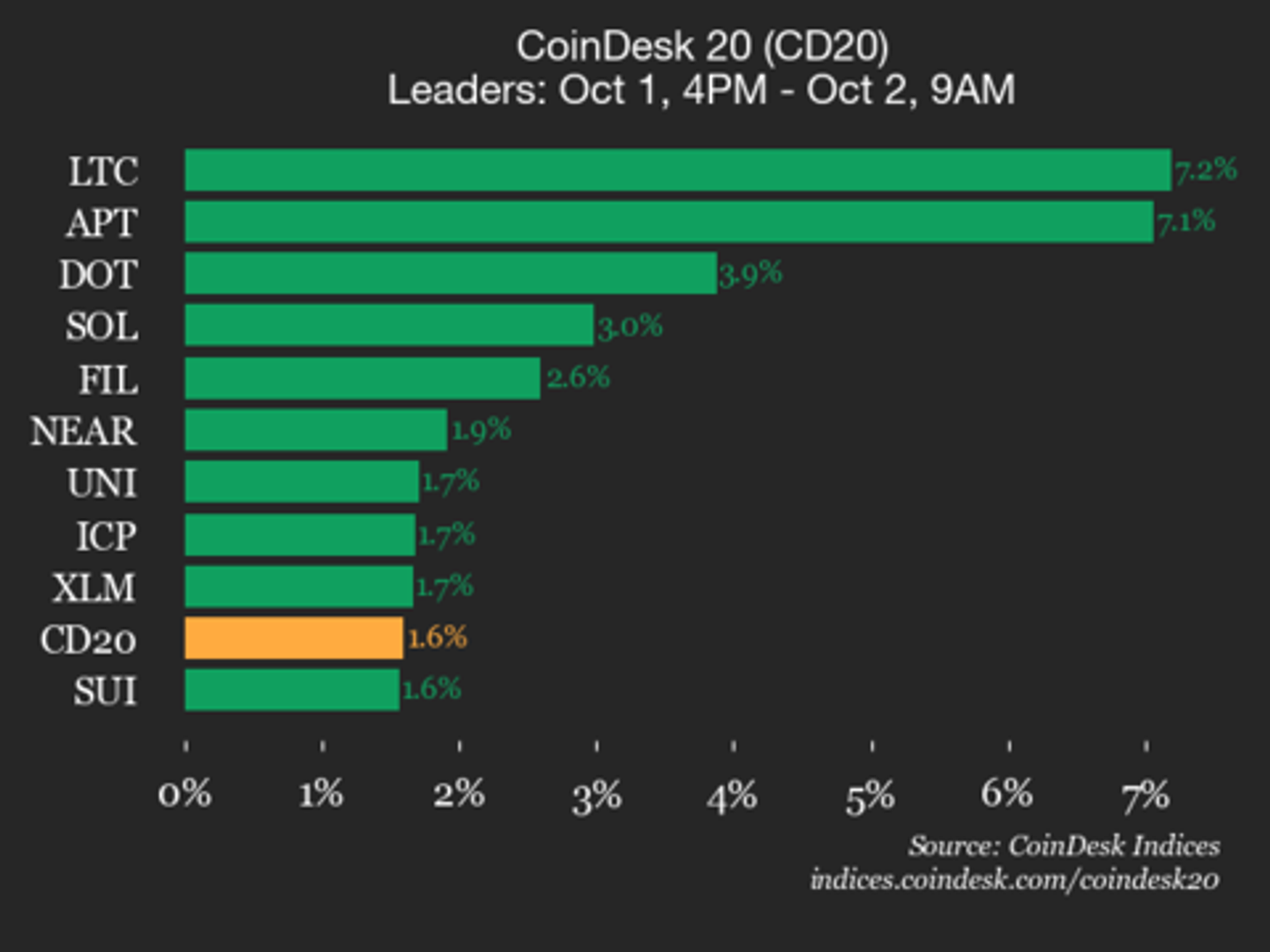

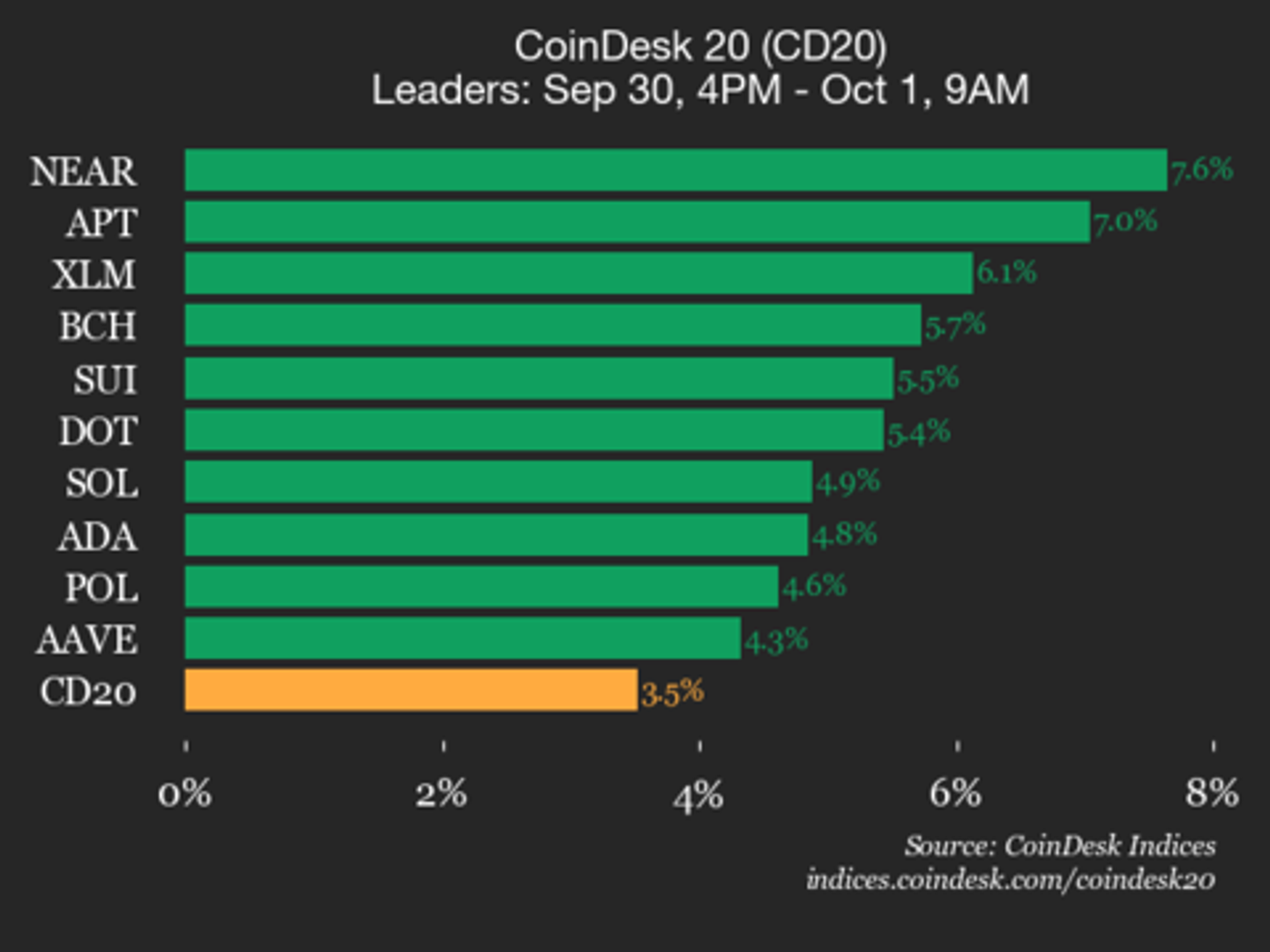

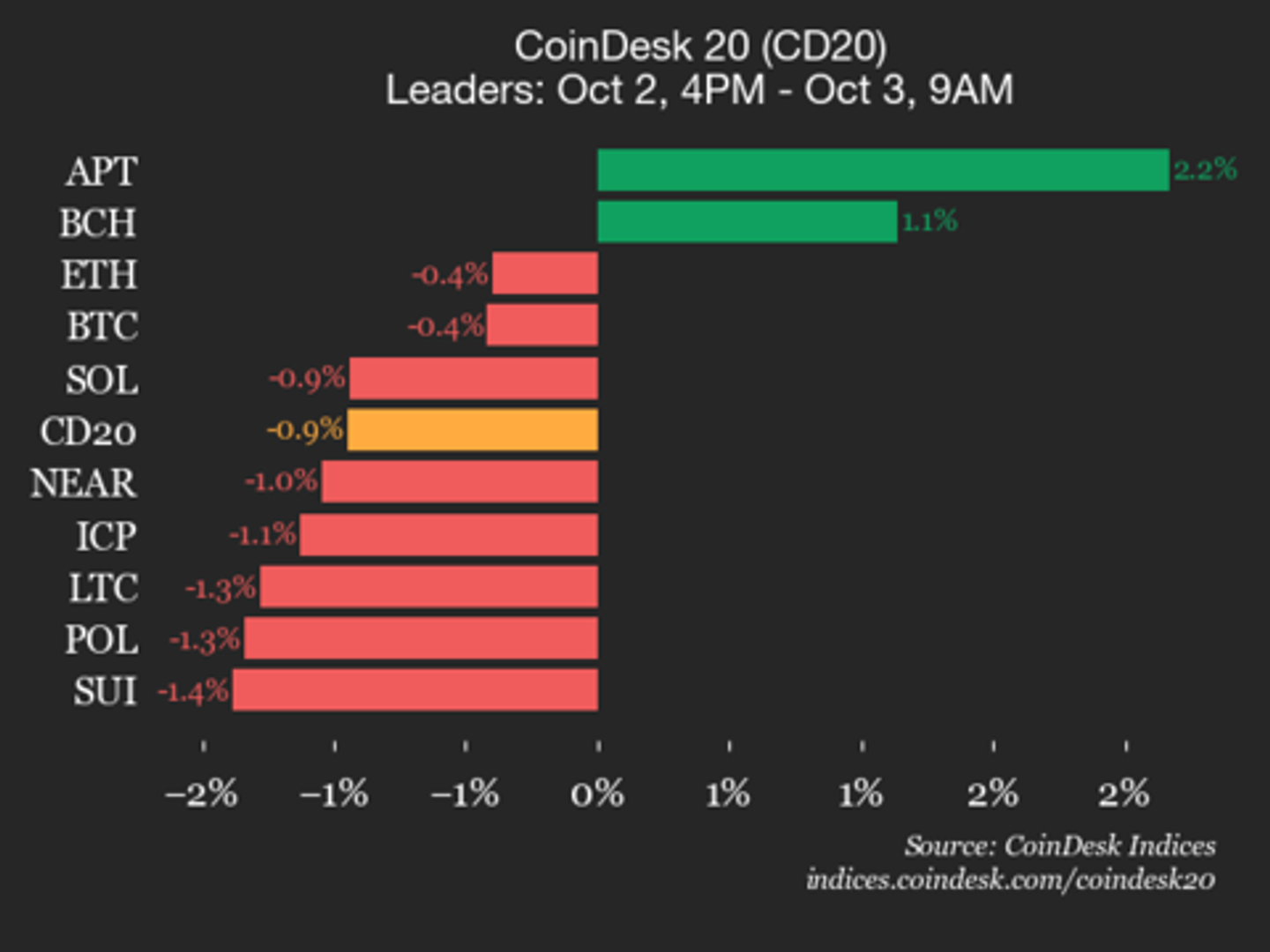

CoinDesk 20 Performance Update: Chainlink (LINK) Drops 3.2%, Leading Index Lower

NegativeCryptocurrency

In the latest CoinDesk 20 performance update, Chainlink (LINK) has seen a decline of 3.2%, contributing to a downward trend in the overall index. This drop is significant as it reflects the current volatility in the cryptocurrency market, which can impact investor confidence and market dynamics. Understanding these fluctuations is crucial for anyone involved in crypto investments.

— Curated by the World Pulse Now AI Editorial System