Risk aversion boosts gold, hurts bitcoin: Crypto Daybook Americas

NegativeCryptocurrency

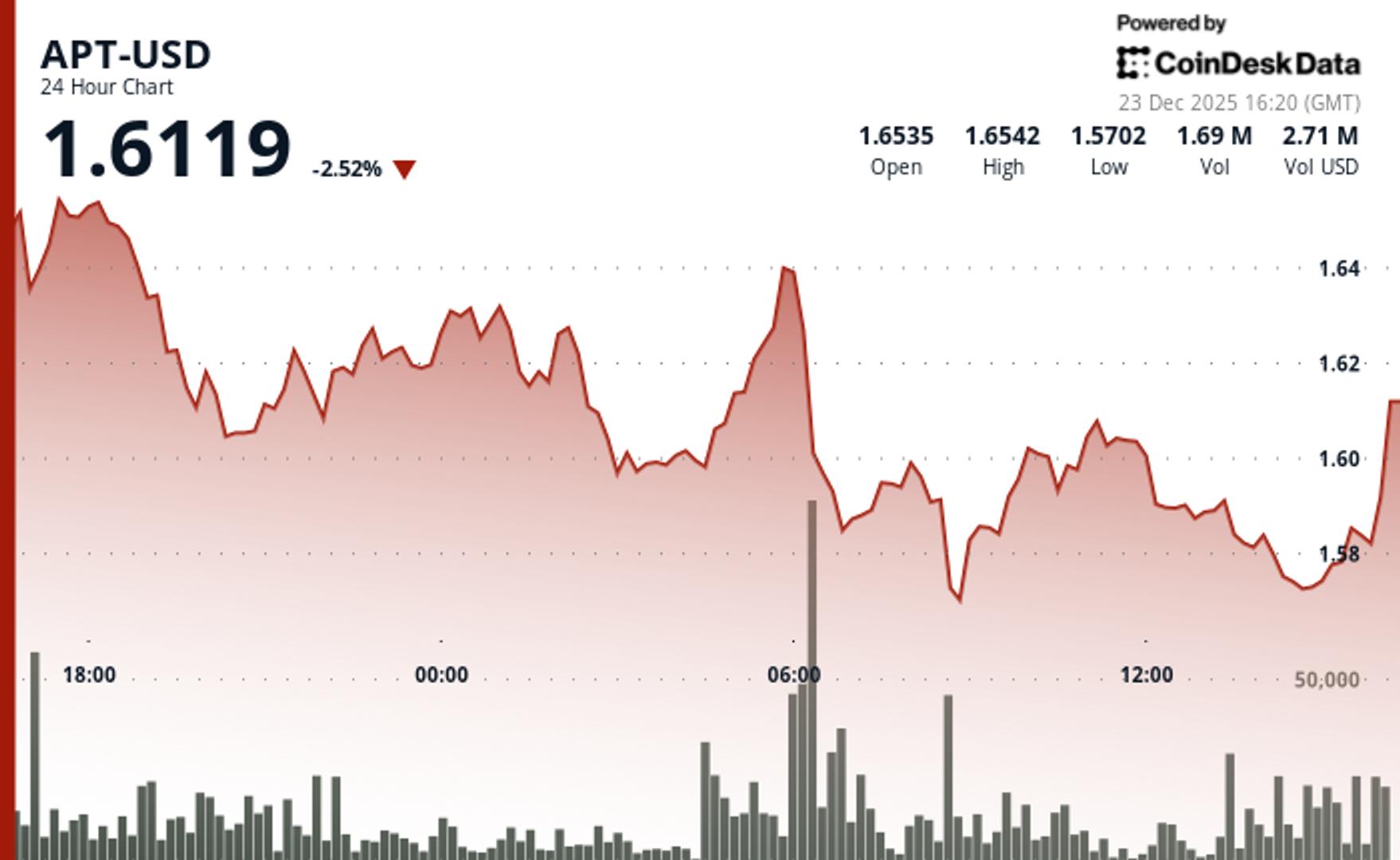

- Risk aversion in the financial markets has led to a significant increase in gold prices while negatively impacting Bitcoin, which has seen a decline in value. As of December 23, 2025, Bitcoin's price is under pressure, reflecting a broader downturn in the cryptocurrency market amid heightened sell pressure.

- The rise in gold prices indicates a shift in investor sentiment towards safer assets, which poses challenges for Bitcoin as it struggles to maintain its value in a volatile market. This dynamic highlights the ongoing competition between traditional safe-haven assets and cryptocurrencies.

- The cryptocurrency market is currently experiencing significant volatility, with Bitcoin's price fluctuating around $90,000 and concerns over potential crashes looming. The recent surge in gold prices, reaching new all-time highs, raises questions about Bitcoin's long-term viability as an alternative investment, especially as market anxieties deepen with warnings from financial giants about potential downturns in 2026.

— via World Pulse Now AI Editorial System