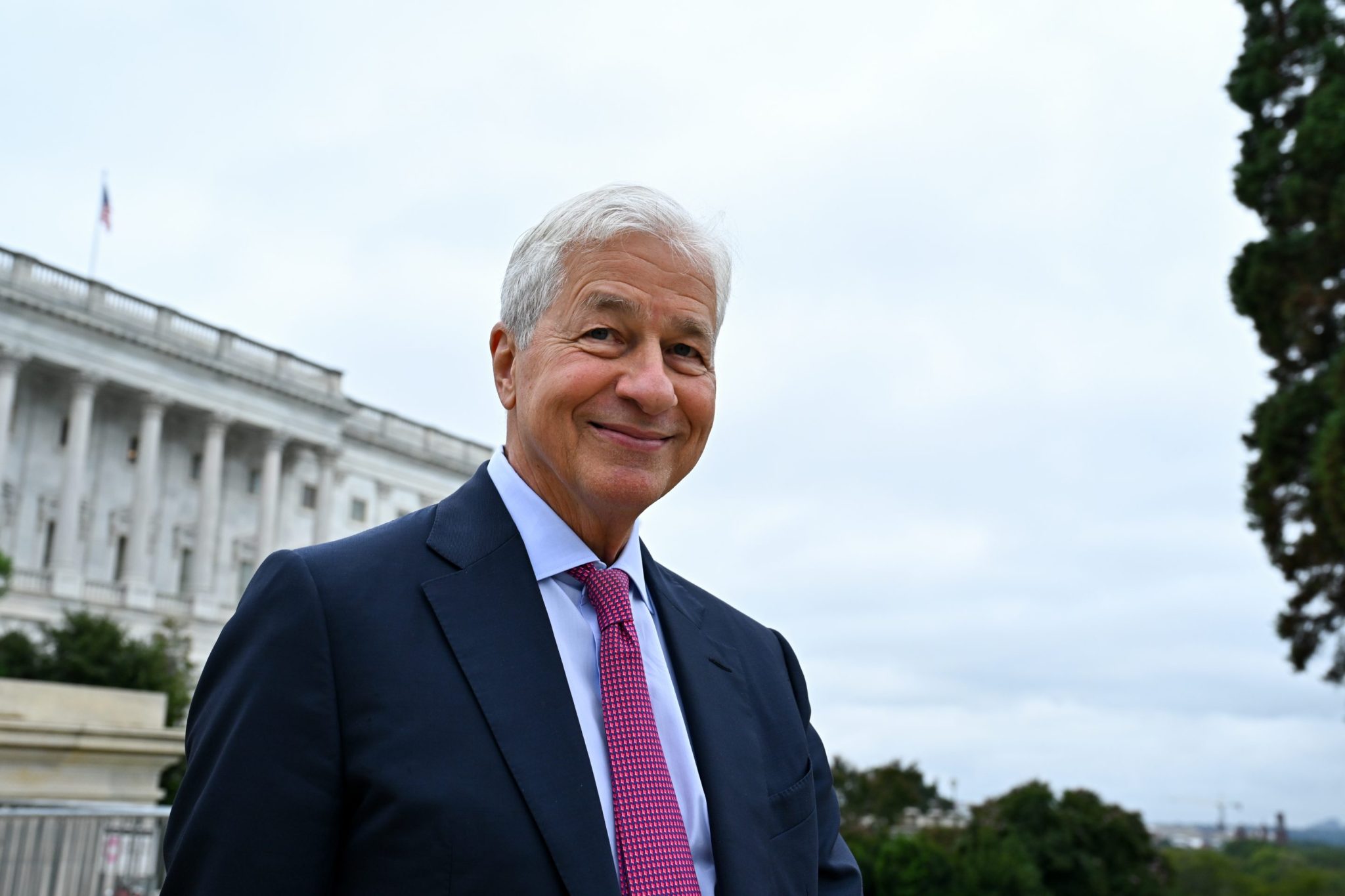

CATL stock remains JPMorgan’s top pick despite market share drop

NeutralFinancial Markets

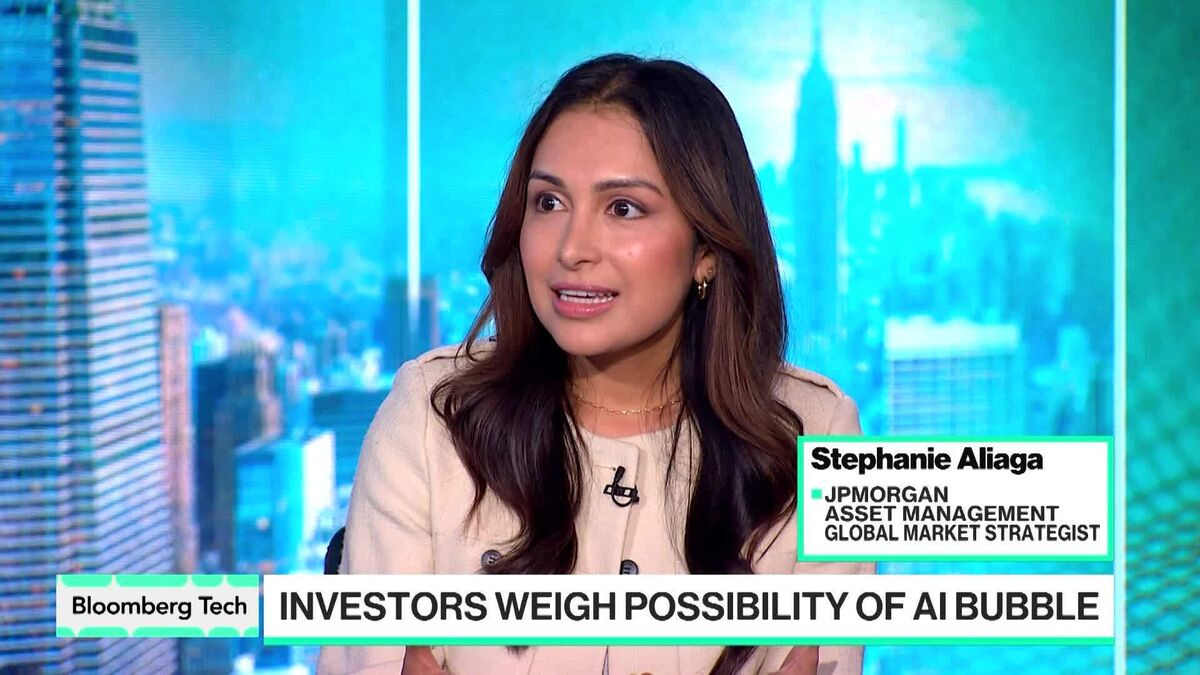

Despite a recent drop in market share, CATL continues to be a favored stock pick for JPMorgan. This highlights the bank's confidence in CATL's long-term potential in the electric vehicle battery market, which is crucial as demand for sustainable energy solutions grows. Investors may want to keep an eye on CATL's performance as it navigates these challenges.

— Curated by the World Pulse Now AI Editorial System