Who’s who in the Fed’s latest dot plot

NeutralFinancial Markets

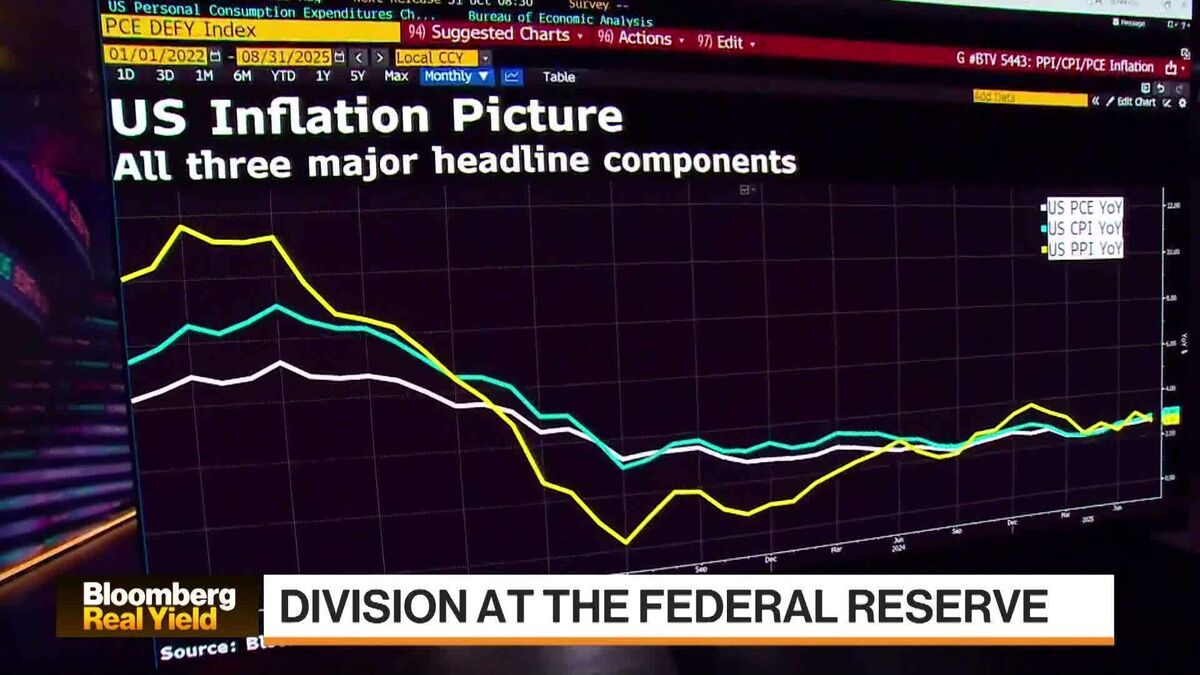

The Federal Reserve has released its latest dot plot, providing insights into the future trajectory of interest rates and economic policy. This update is crucial as it reflects the Fed's outlook on inflation and growth, helping investors and policymakers gauge the central bank's direction. Understanding these projections can influence market behavior and economic planning.

— Curated by the World Pulse Now AI Editorial System