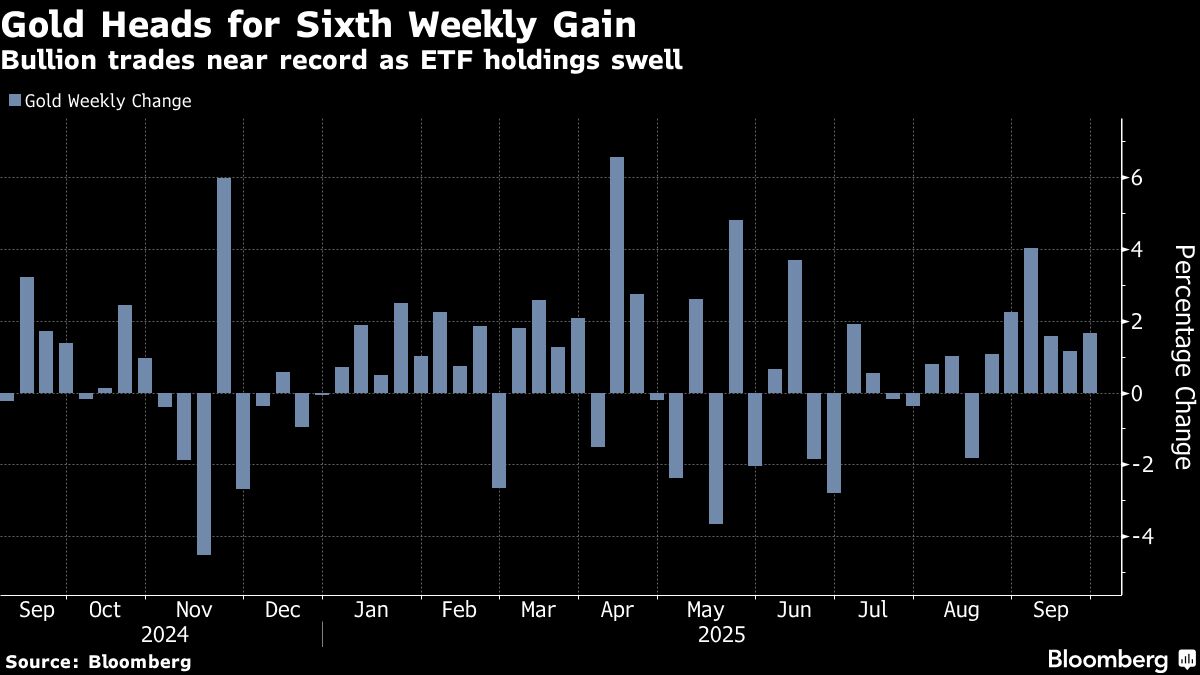

Gold Heads for Sixth Weekly Gain on Risk-Off Tone and ETF Flows

PositiveFinancial Markets

Gold is on track for its sixth consecutive weekly gain, driven by heightened geopolitical tensions and strong inflows into bullion-backed exchange-traded funds. This trend reflects a risk-off sentiment in the broader markets, making gold an attractive safe-haven asset for investors. As uncertainty looms, the continued demand for gold highlights its enduring appeal in turbulent times.

— Curated by the World Pulse Now AI Editorial System