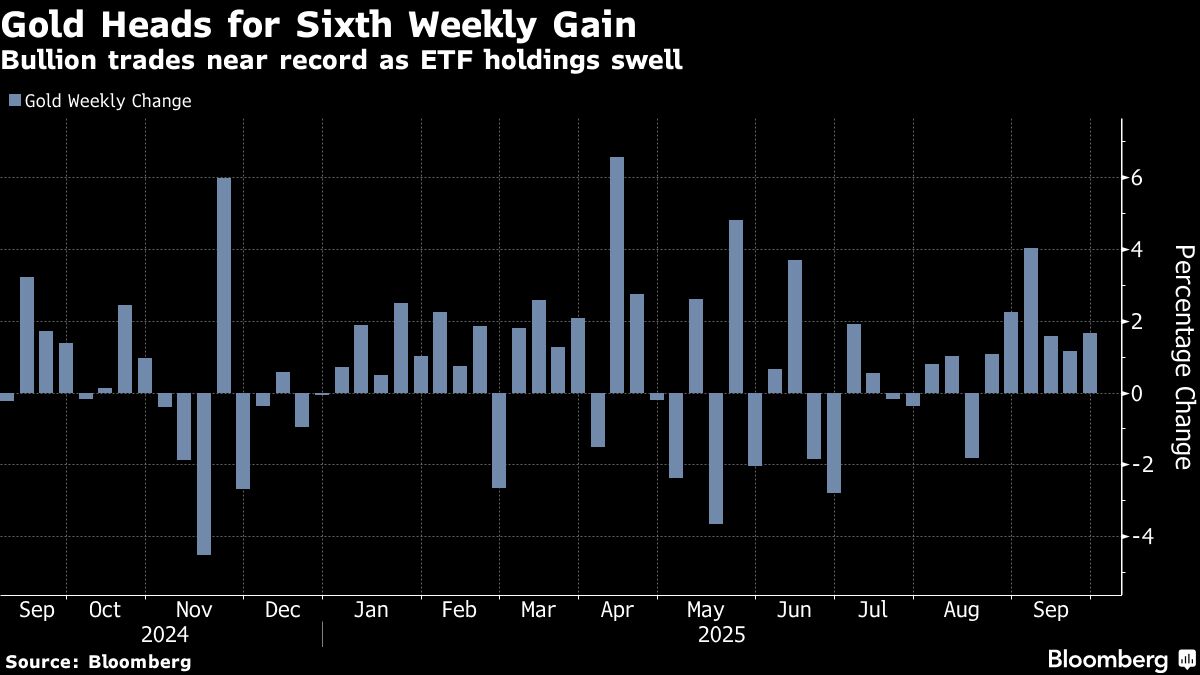

India’s Festive Gold Demand Set to Decline on Record Prices

NegativeFinancial Markets

India's gold jewelry sales are expected to decline this festival season due to soaring bullion prices, which are pushing consumers to consider cheaper alternatives. This trend is significant as India is one of the largest gold markets in the world, and a drop in demand could impact both local jewelers and the broader economy.

— Curated by the World Pulse Now AI Editorial System