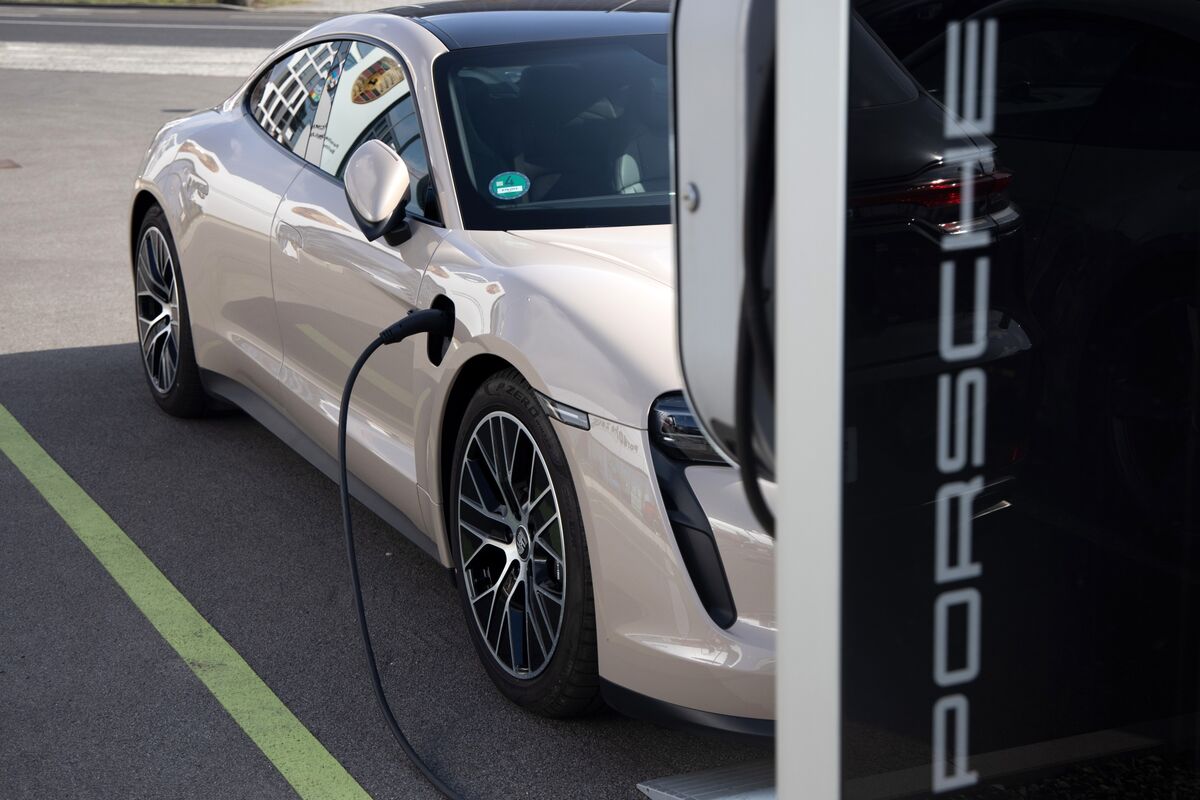

Porsche shares plunge after announcing EV rollout delay

NegativeFinancial Markets

Porsche's shares have taken a hit following the announcement of a delay in their electric vehicle rollout, highlighting the intense competition European carmakers face from Chinese rivals and the current weak demand for luxury cars. This situation is significant as it reflects broader challenges in the automotive industry, where companies must adapt quickly to changing market dynamics to remain competitive.

— Curated by the World Pulse Now AI Editorial System