Congo’s Cobalt Export Shock Spurs Rally and Doubts Over Supply

PositiveFinancial Markets

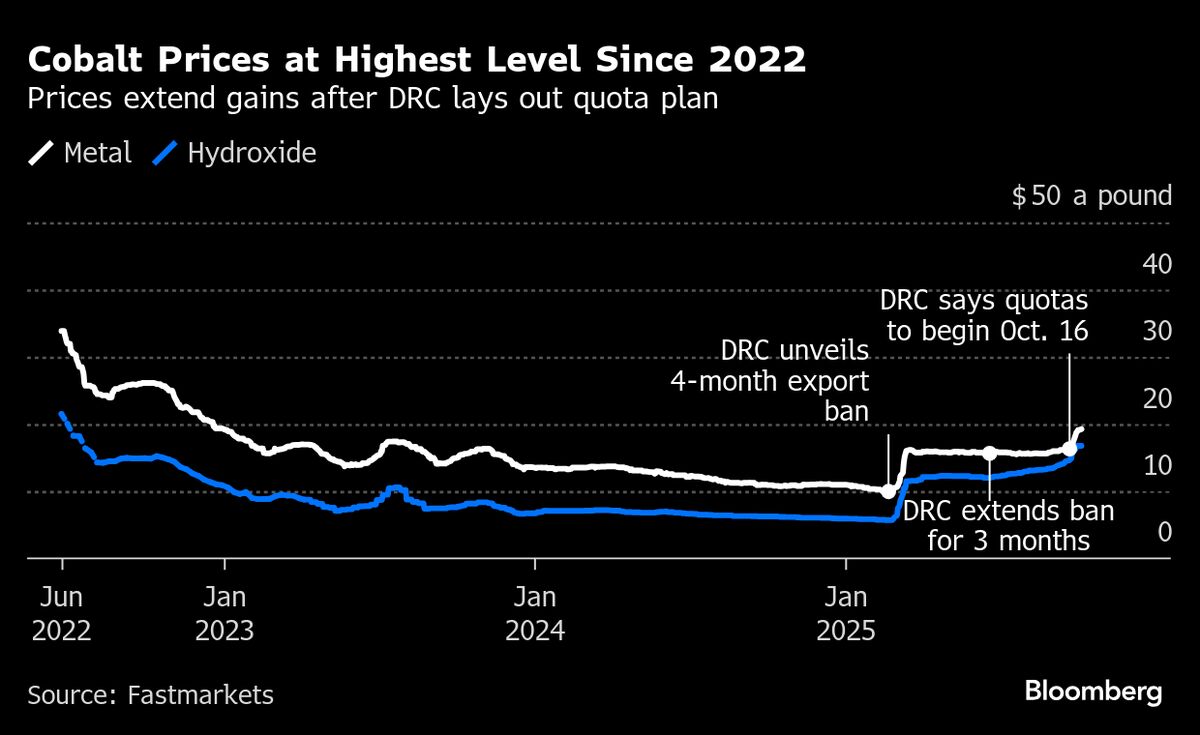

Cobalt prices have surged to a three-year high due to export restrictions from Congo, the world's leading producer. This situation raises concerns about potential shortages of this crucial battery material, which is essential for electric vehicles and renewable energy technologies. As demand for cobalt continues to grow, these export curbs could significantly impact the market and the future of sustainable energy solutions.

— Curated by the World Pulse Now AI Editorial System