Silver Traders Rush Bars to London as Historic Squeeze Rocks Market

PositiveFinancial Markets

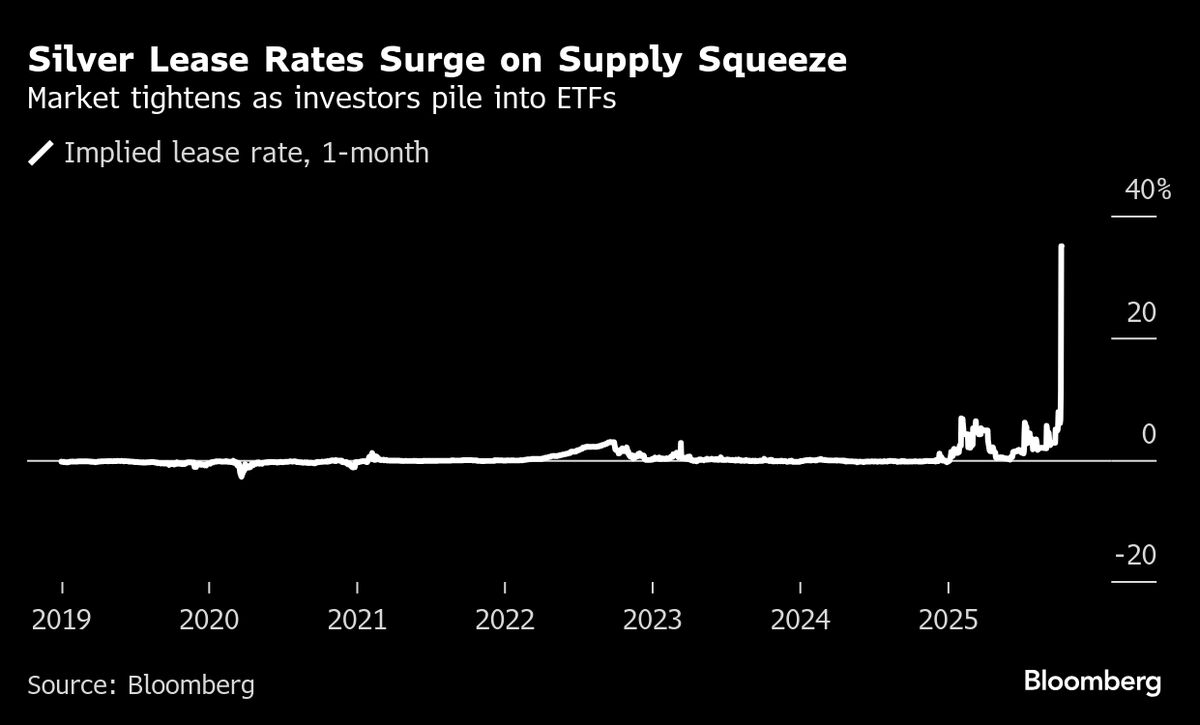

The London silver market is experiencing a historic surge as traders rush to buy bars amid a massive short squeeze, pushing prices above $50 an ounce for only the second time ever. This event not only highlights the volatility of the silver market but also evokes memories of the infamous Hunt brothers' attempt to corner the market in 1980. Such price movements can significantly impact investors and the broader economy, making it a crucial moment for those involved in precious metals.

— Curated by the World Pulse Now AI Editorial System