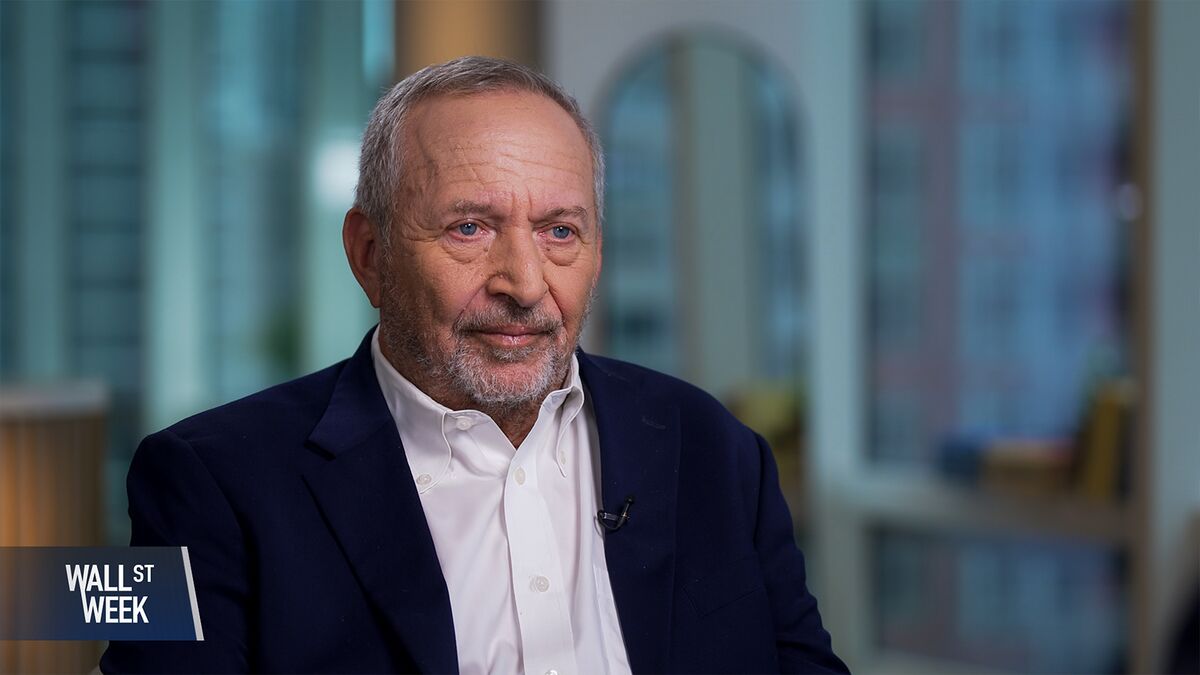

Fed Was Right to Cut Rates by Quarter Point, James Bullard Says

PositiveFinancial Markets

James Bullard, the former president of the Federal Reserve Bank of St. Louis, recently expressed his approval of the Fed's decision to cut interest rates by a quarter point instead of a larger reduction. He emphasized the importance of maintaining the central bank's 2% inflation target, highlighting a cautious approach to monetary policy. This perspective is significant as it reflects a balanced view on economic stability and inflation control, which are crucial for long-term growth.

— Curated by the World Pulse Now AI Editorial System