US stocks rebound after top Fed official signals openness to rate cut

PositiveFinancial Markets

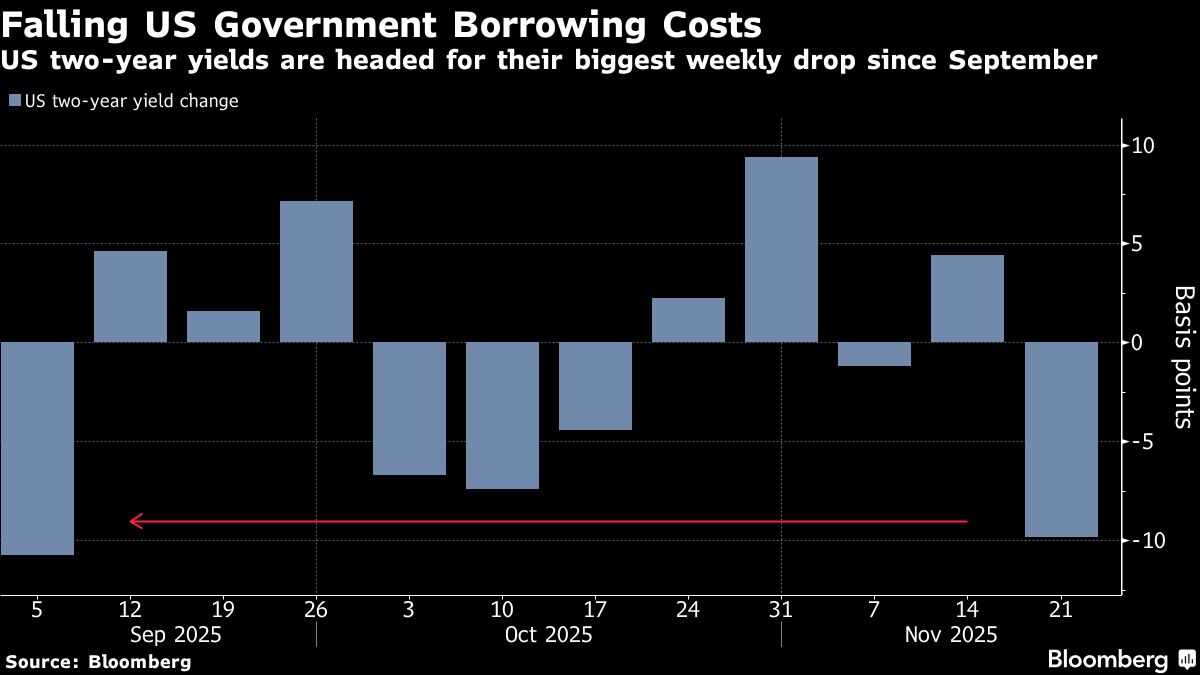

- US stocks have rebounded after John Williams signaled a potential openness to rate cuts, suggesting a shift in monetary policy could be on the horizon.

- This development is significant as it reflects the Federal Reserve's ongoing assessment of economic conditions and its willingness to adjust interest rates to support growth.

- The situation highlights the complexities within the Federal Reserve, where internal divisions exist regarding the timing and necessity of rate cuts amidst mixed economic signals.

— via World Pulse Now AI Editorial System