US Treasuries Gain as Fed’s Williams Fuels Rate-Cut Bets

PositiveFinancial Markets

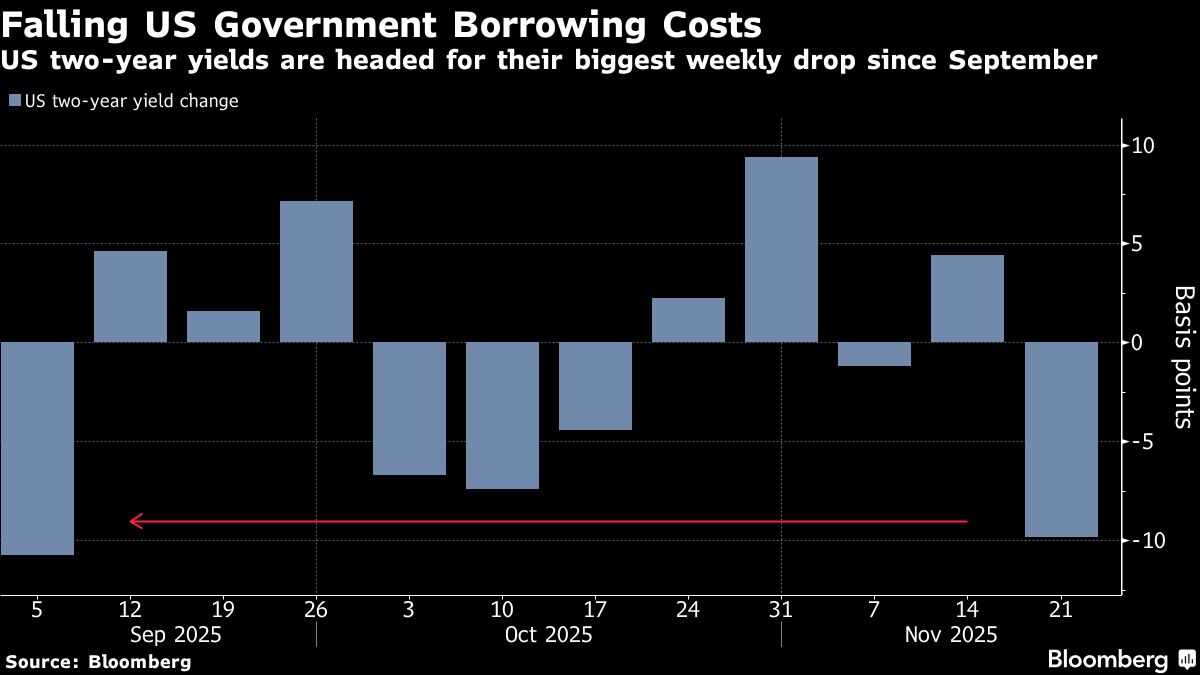

- US Treasuries gained as traders reacted positively to Federal Reserve President John Williams' indication of potential interest-rate cuts, reviving expectations for a December reduction. This development reflects a shift in market sentiment towards lower borrowing costs.

- The remarks from Williams are significant as they suggest a willingness from the Federal Reserve to adjust monetary policy in response to economic conditions, which could influence investor confidence and market stability.

- This situation highlights ongoing debates within the Federal Reserve regarding interest rates, as internal divisions persist amid economic challenges, including inflation and labor market dynamics, complicating the decision-making process.

— via World Pulse Now AI Editorial System