The Fed, Crypto and A.I. Weigh on the Markets

NegativeFinancial Markets

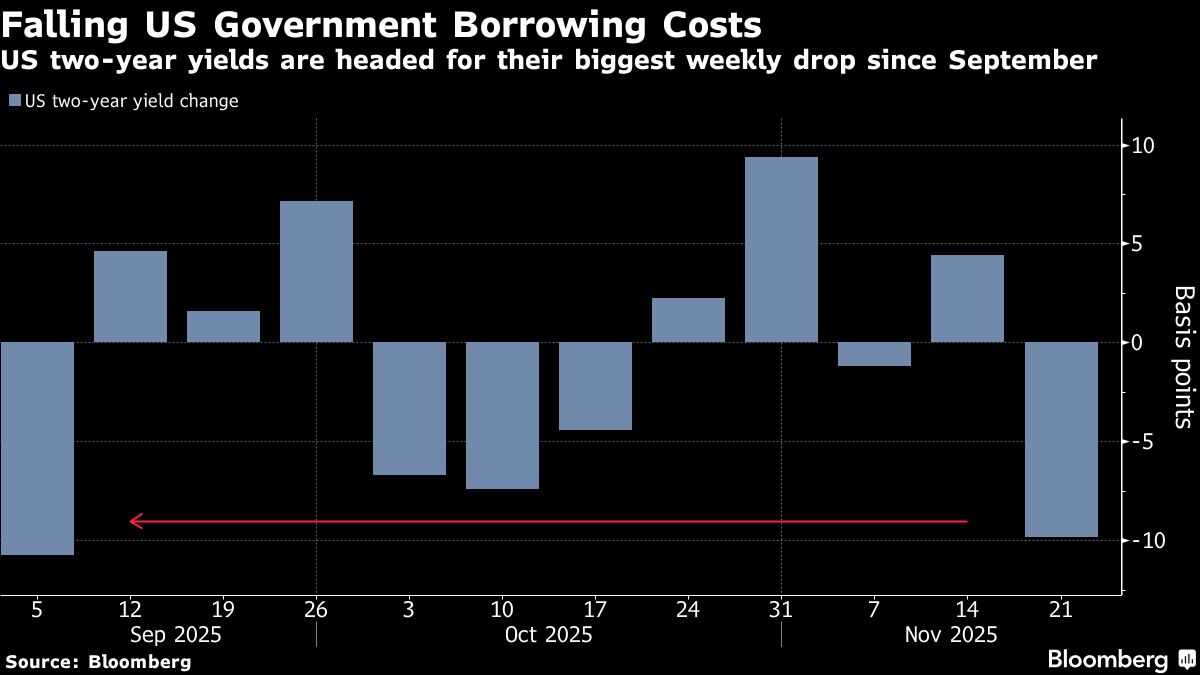

- Recent market fluctuations have been driven by rising concerns over the Federal Reserve's monetary policies, alongside significant sell-offs in cryptocurrency and tech stocks.

- This situation is critical as it reflects investor sentiment and the potential impact on economic stability, particularly in sectors heavily reliant on technology and innovation.

- The broader context reveals a pattern of volatility in global markets, with fears of inflated valuations in tech and AI sectors, prompting a shift in investor focus towards safer assets like bonds.

— via World Pulse Now AI Editorial System