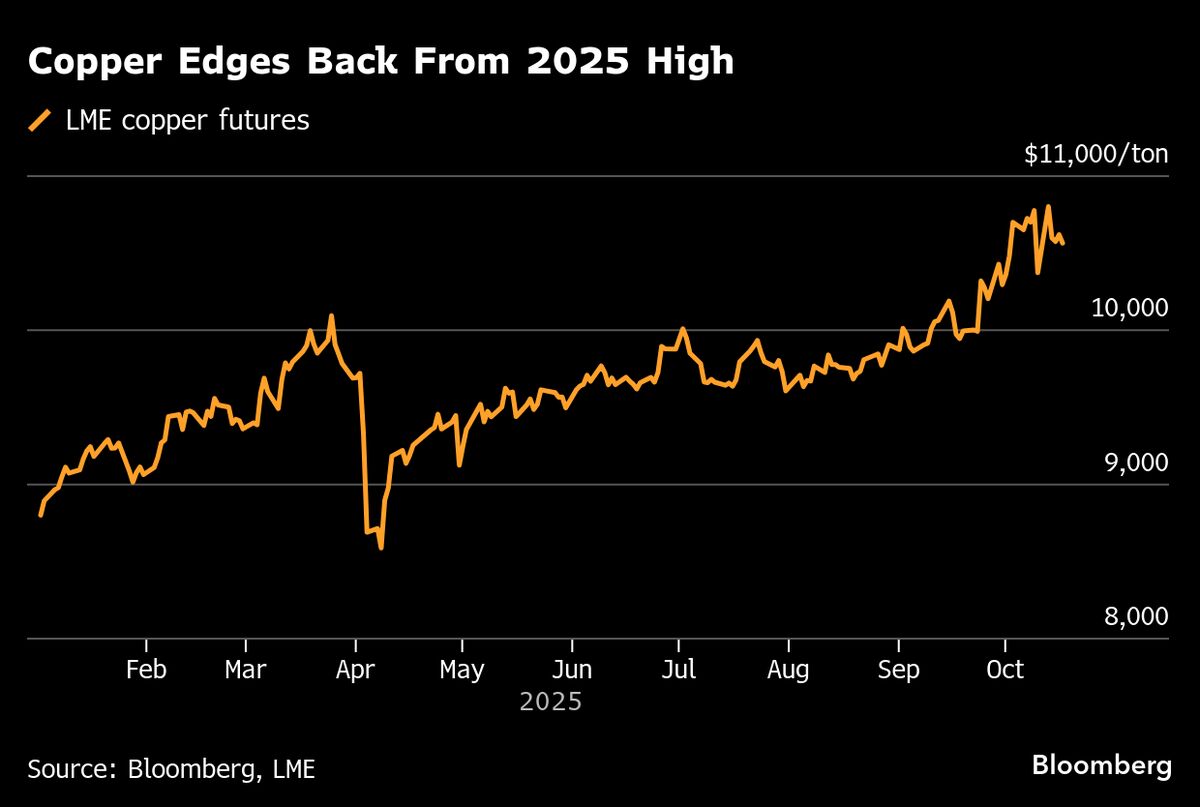

Copper Mining Woes Turn Supply-Demand Forecasts Upside Down

NegativeFinancial Markets

Copper markets are facing an unexpected supply deficit, a significant shift from the forecasts made just a year ago. This change is crucial as it could impact pricing and availability, affecting various industries that rely on copper for production. Traders are now reassessing their strategies in light of this new reality.

— Curated by the World Pulse Now AI Editorial System