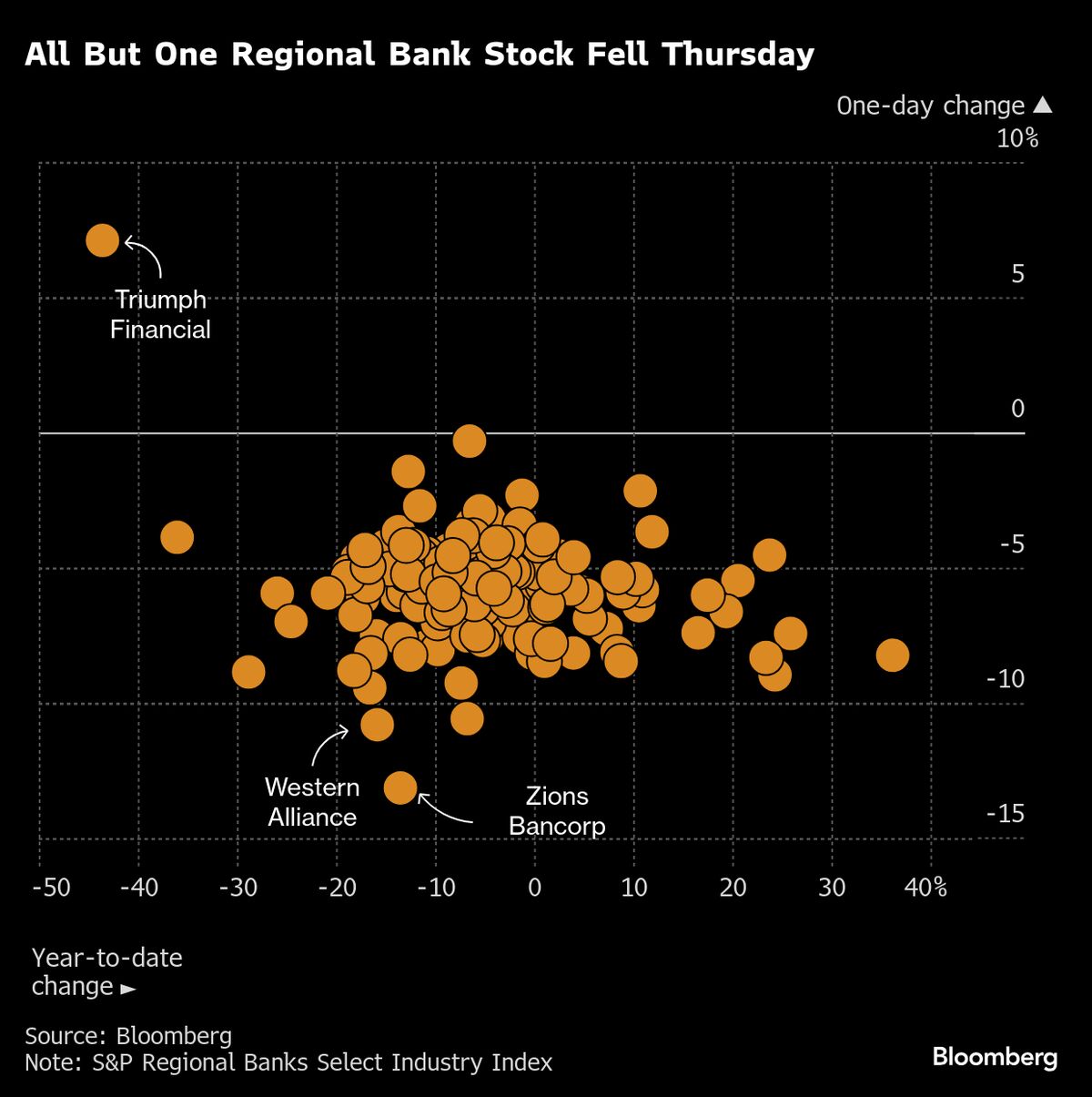

U.S. stocks fall as midsized bank earnings worry traders about underlying state of the economy

NegativeFinancial Markets

U.S. stocks have taken a hit as concerns grow over the earnings of midsized banks, raising alarms about the overall health of the economy. This follows the recent Chapter 11 filing of First Brands Group, which has led to increased scrutiny on the quality of loans issued by banks and lenders. The situation is significant as it reflects broader economic challenges and could impact investor confidence moving forward.

— Curated by the World Pulse Now AI Editorial System