France’s wealthy shift funds to Luxembourg and Switzerland

NegativeFinancial Markets

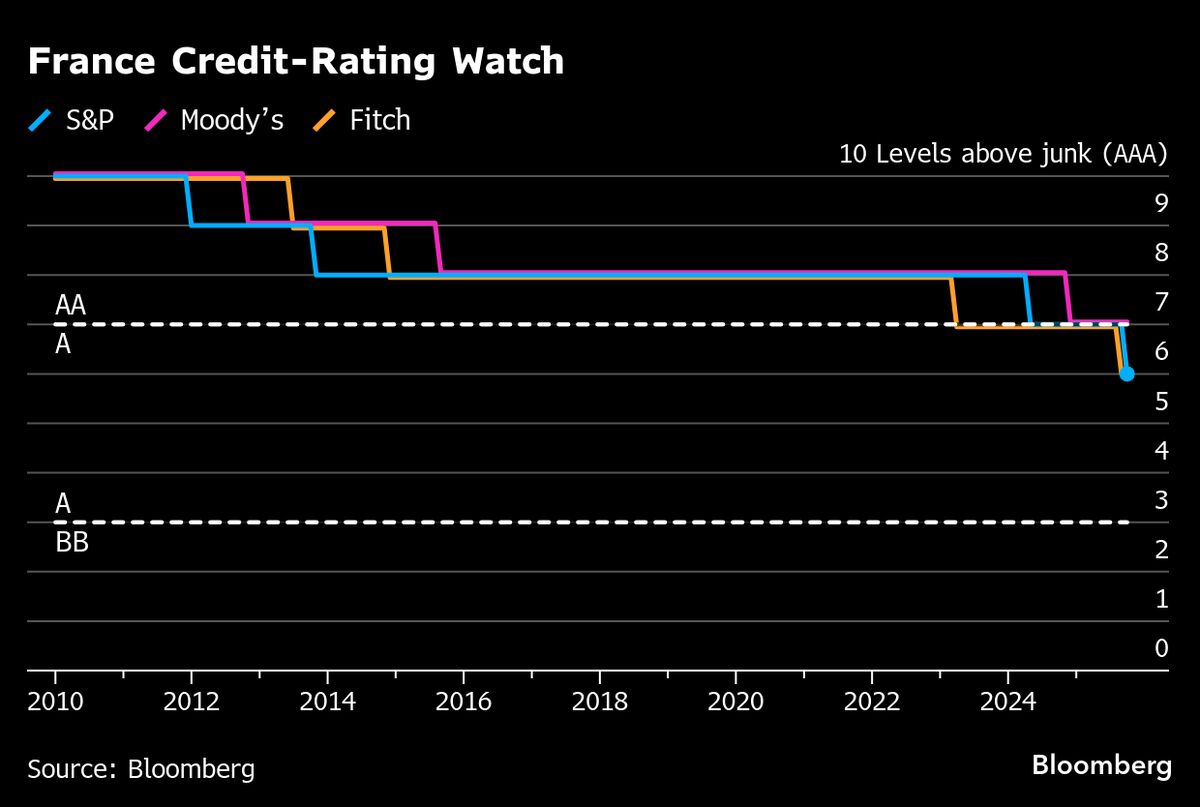

Recent political turmoil and looming tax threats in France have prompted wealthy individuals to shift their investments to safer havens like Luxembourg and Switzerland. This trend highlights the growing concerns among asset managers about the stability of the French economy and the potential impact of government policies on wealth management. As more funds flow out of France, it raises questions about the long-term implications for the country's financial landscape and its attractiveness to investors.

— Curated by the World Pulse Now AI Editorial System