Oil heads for third monthly decline as dollar, OPEC+ supply weigh

NegativeFinancial Markets

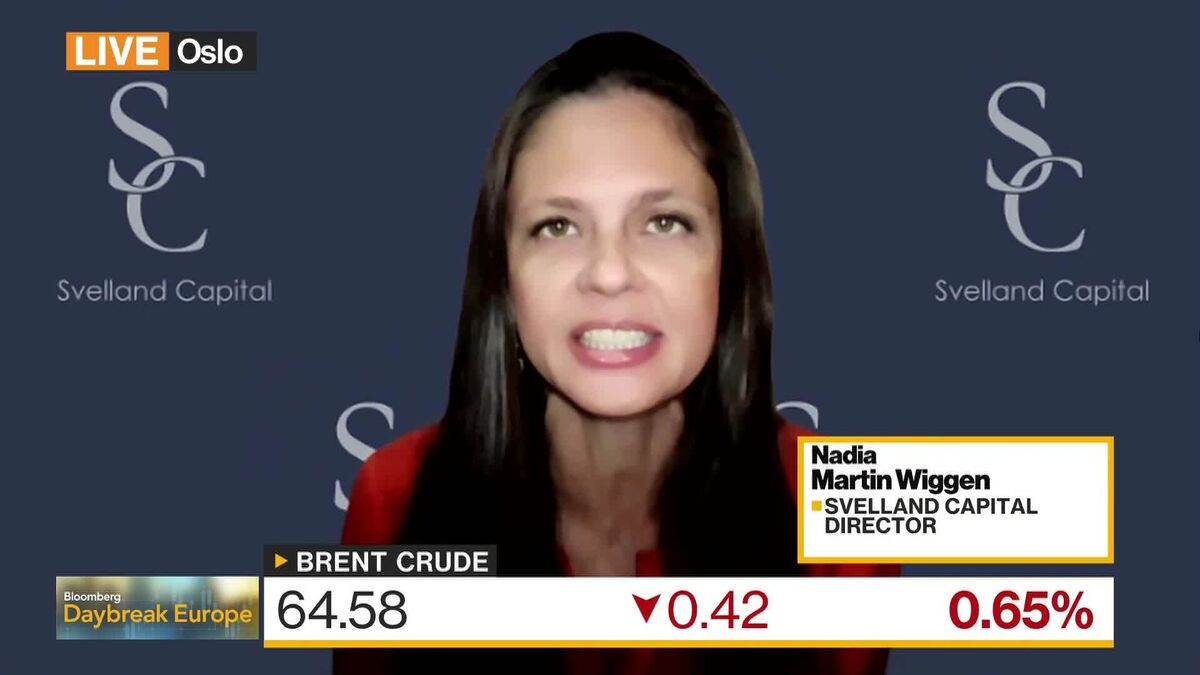

Oil prices are set to decline for the third consecutive month, primarily influenced by a strong dollar and increased supply from OPEC+. This trend is significant as it reflects ongoing challenges in the energy market, impacting both consumers and economies reliant on oil revenues.

— Curated by the World Pulse Now AI Editorial System