OPEC+ Balances Oil Risks From Surplus to Sanctions

NeutralFinancial Markets

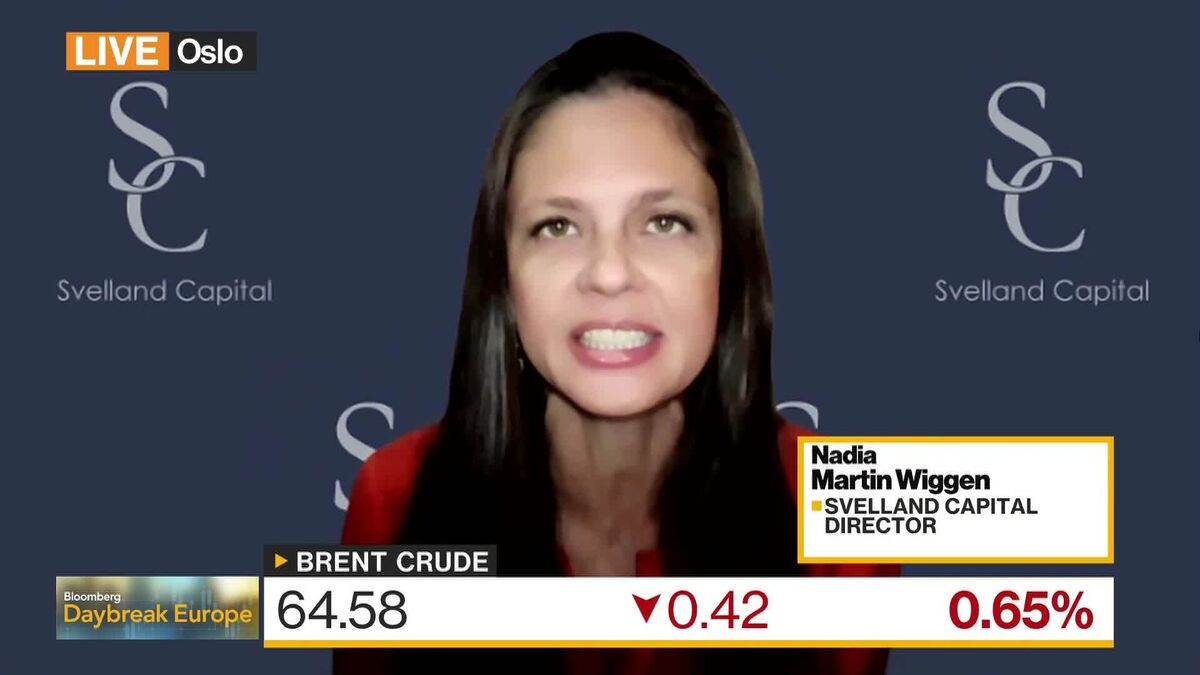

OPEC+ is considering a modest supply increase for December, aiming to balance the risks associated with oil surplus and sanctions. This decision is significant as it reflects the group's ongoing efforts to stabilize the oil market amidst fluctuating global demand and geopolitical tensions.

— Curated by the World Pulse Now AI Editorial System