Venezuela Tension Gives Oil Futures A Lift

PositiveFinancial Markets

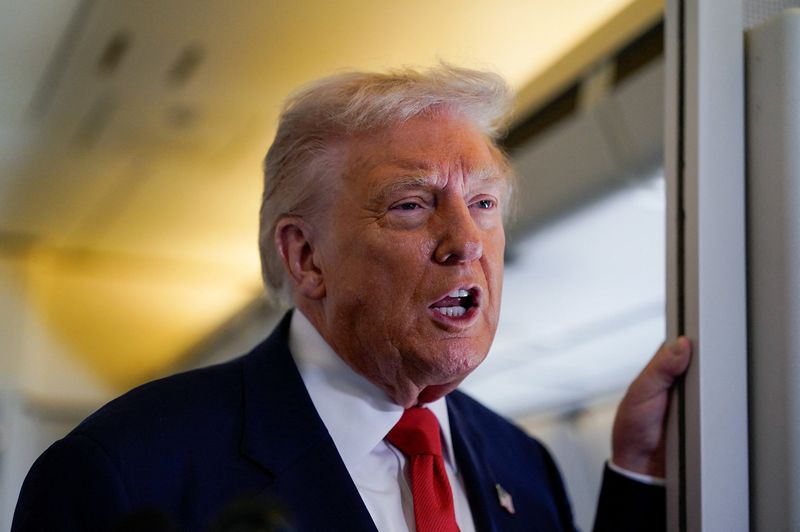

Recent reports indicate that the Trump administration is contemplating military strikes against Venezuela due to drug smuggling concerns, which has led to a rise in oil futures. This development is significant as it highlights the geopolitical tensions in the region and their direct impact on global oil markets, potentially affecting prices and supply.

— Curated by the World Pulse Now AI Editorial System