Gold’s Safe-Haven Demand Grows on Worries About U.S. Credit Sector

PositiveFinancial Markets

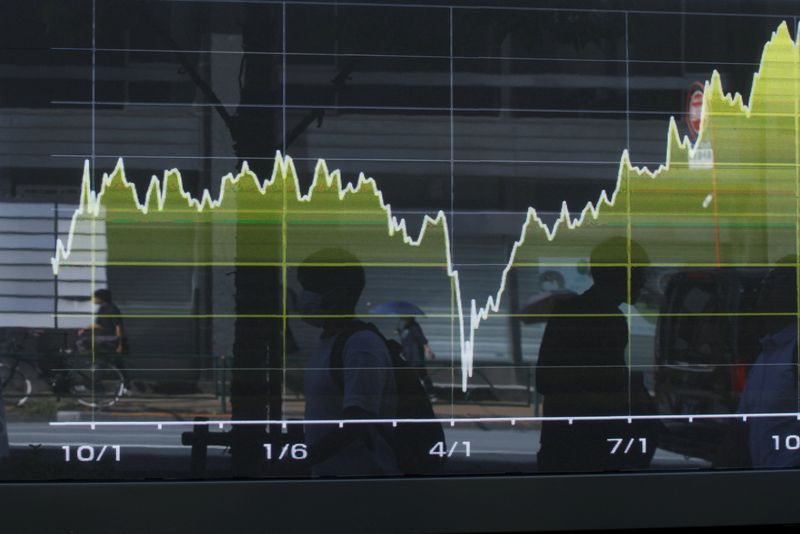

Gold futures are experiencing a significant rise as concerns about the U.S. credit sector grow. This increase in demand highlights gold's role as a safe haven for investors during uncertain economic times, making it a crucial asset to watch.

— Curated by the World Pulse Now AI Editorial System