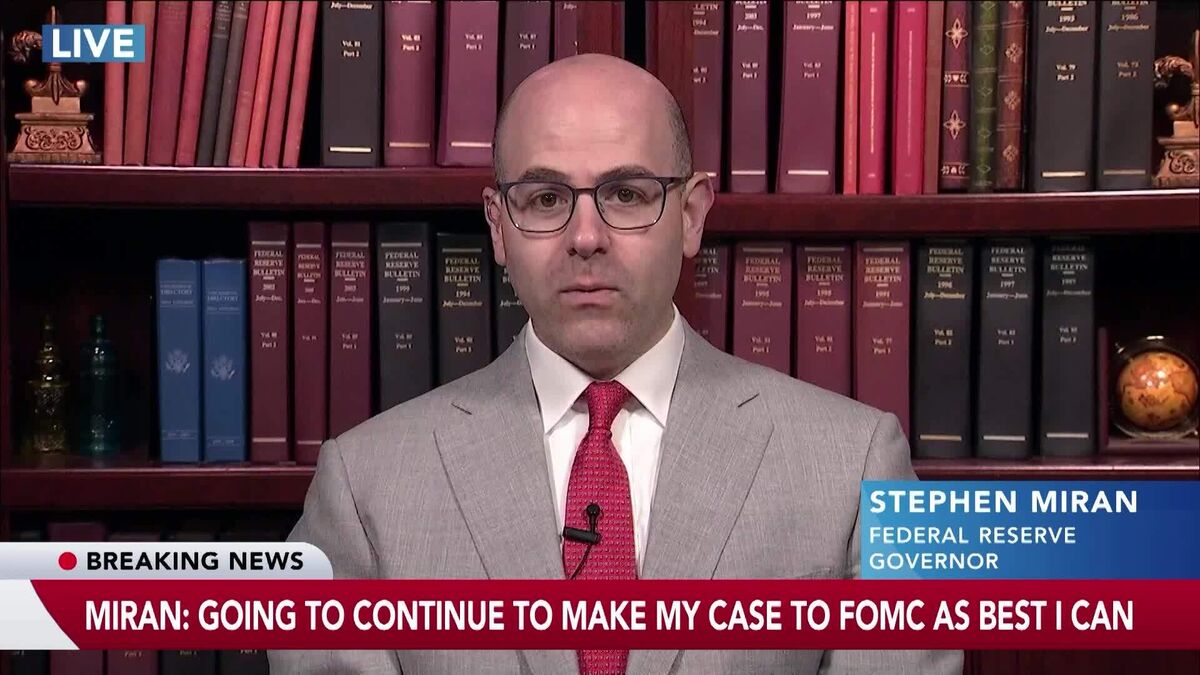

ECB Says Consumers’ Inflation Expectations Rose in August

NeutralFinancial Markets

In August, the European Central Bank reported a rise in inflation expectations among consumers in the euro-zone. This increase supports the argument against further lowering interest rates, indicating that consumers are becoming more cautious about future price increases. Understanding these expectations is crucial as they can influence economic policy and consumer behavior.

— Curated by the World Pulse Now AI Editorial System