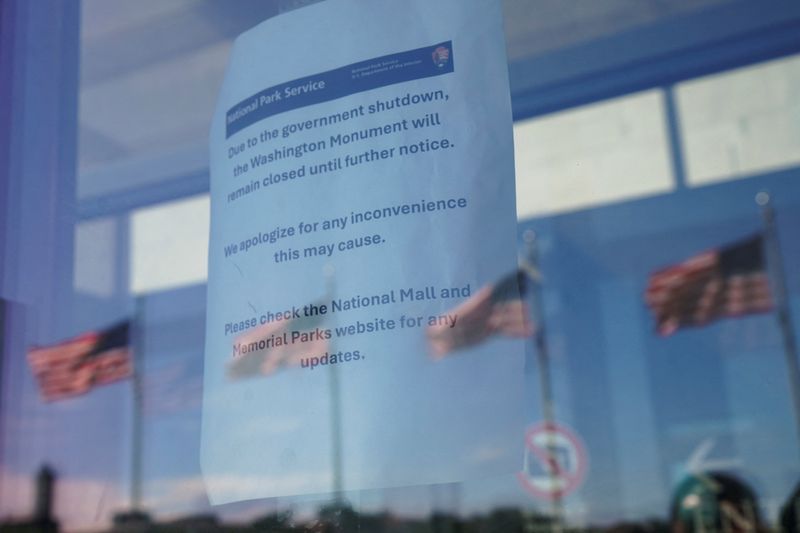

Factbox-US government shutdown: What is open, what is closed

NeutralFinancial Markets

The recent US government shutdown has led to the temporary closure of various federal agencies and services, affecting numerous employees and operations across the country. This situation arises from budgetary disagreements in Congress, highlighting the ongoing challenges in government funding. Understanding what is open and closed during this period is crucial for citizens who rely on these services, as well as for employees facing uncertainty about their jobs.

— Curated by the World Pulse Now AI Editorial System