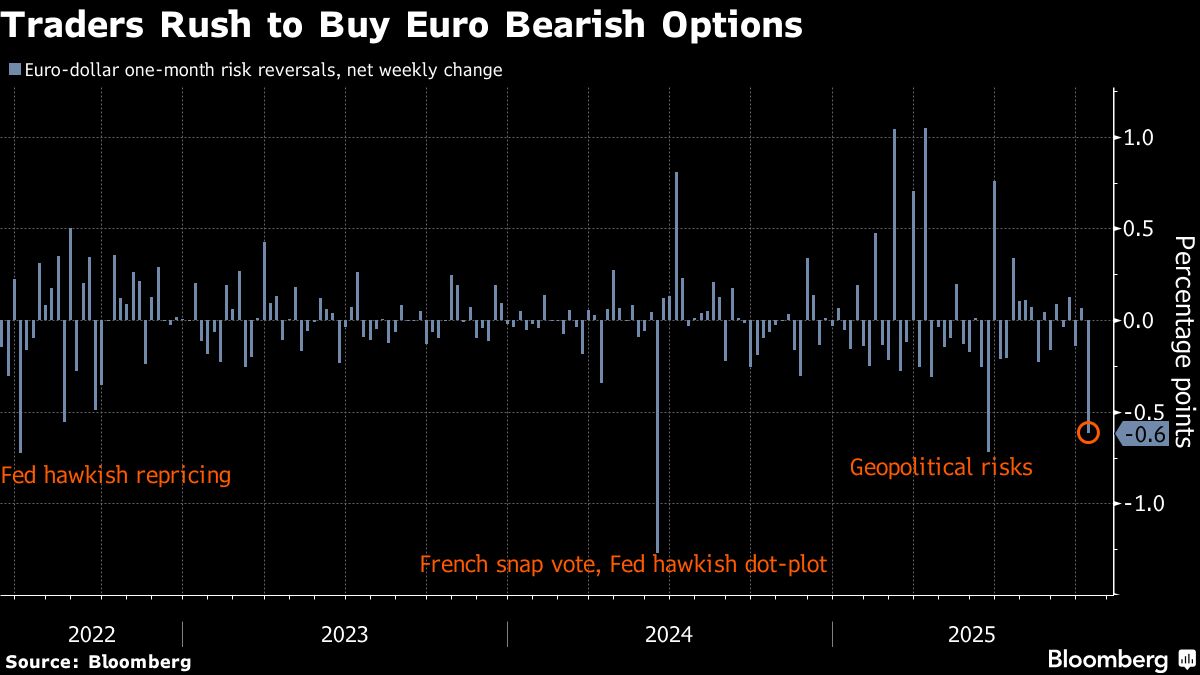

Options Traders are Shifting Against the Euro at a Rare Pace

NegativeFinancial Markets

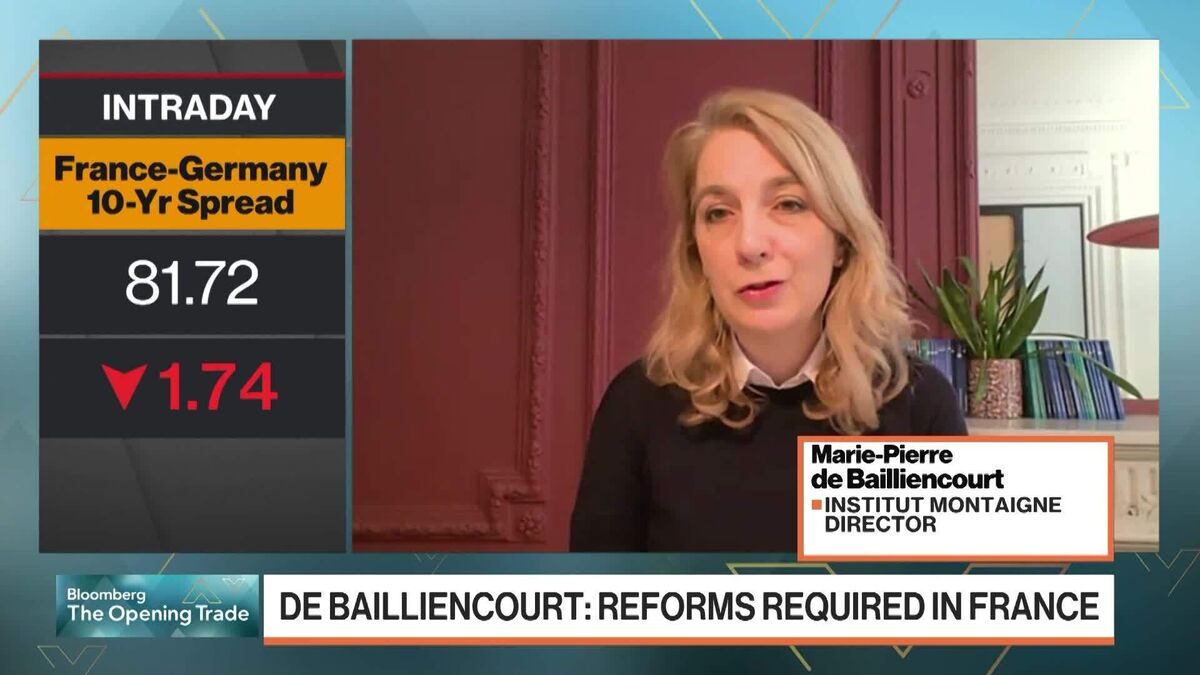

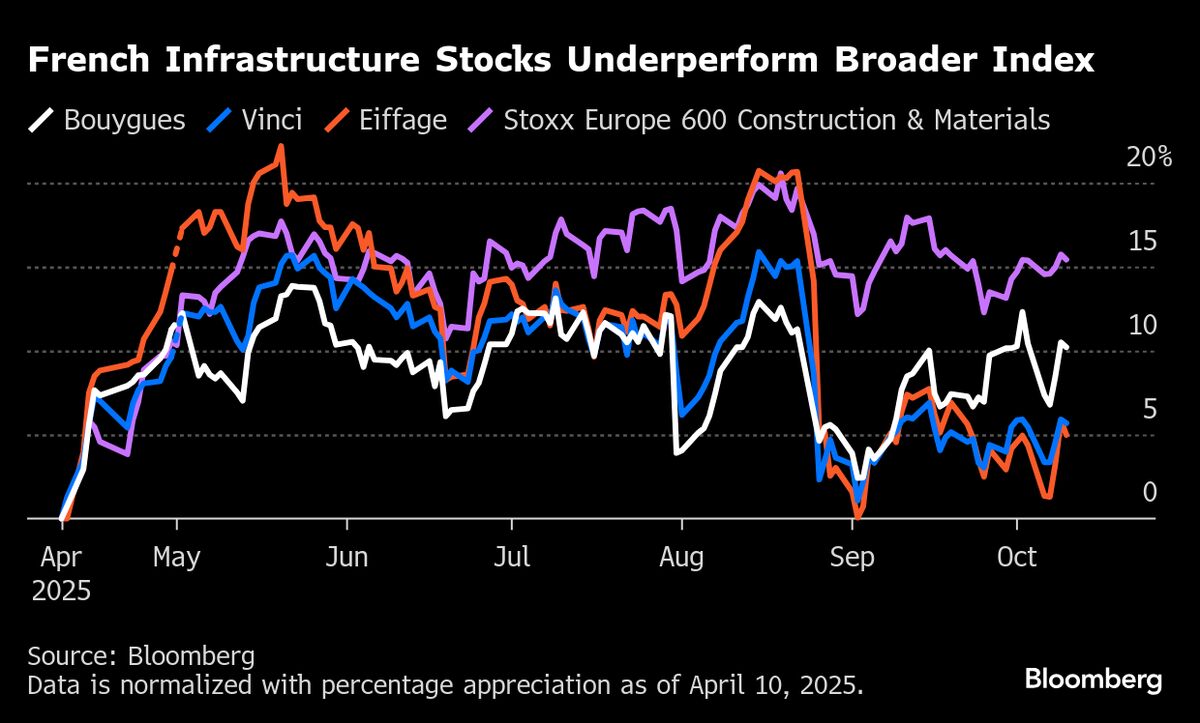

This week, sentiment towards the euro has taken a downturn as turbulent political developments in France have led options traders to adopt a notably bearish stance on the currency. This shift is significant as it reflects growing concerns about the euro's stability, which could impact the broader European economy and investor confidence.

— Curated by the World Pulse Now AI Editorial System