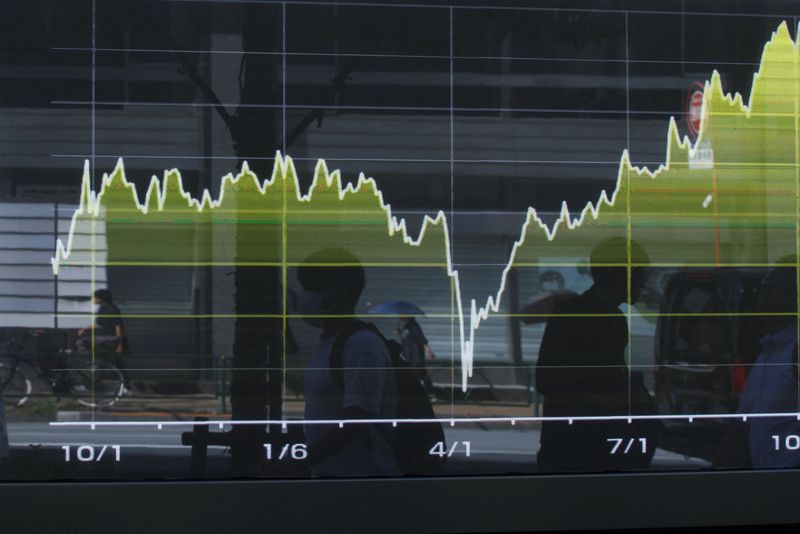

Infosys lifts growth floor amid steady deal wins

PositiveFinancial Markets

Infosys has raised its growth outlook following a series of steady deal wins, signaling strong demand in the technology sector. This is significant as it reflects the company's resilience and ability to adapt to market changes, which can inspire confidence among investors and stakeholders. With a positive trajectory, Infosys is poised to capitalize on emerging opportunities, potentially leading to increased revenue and market share.

— Curated by the World Pulse Now AI Editorial System