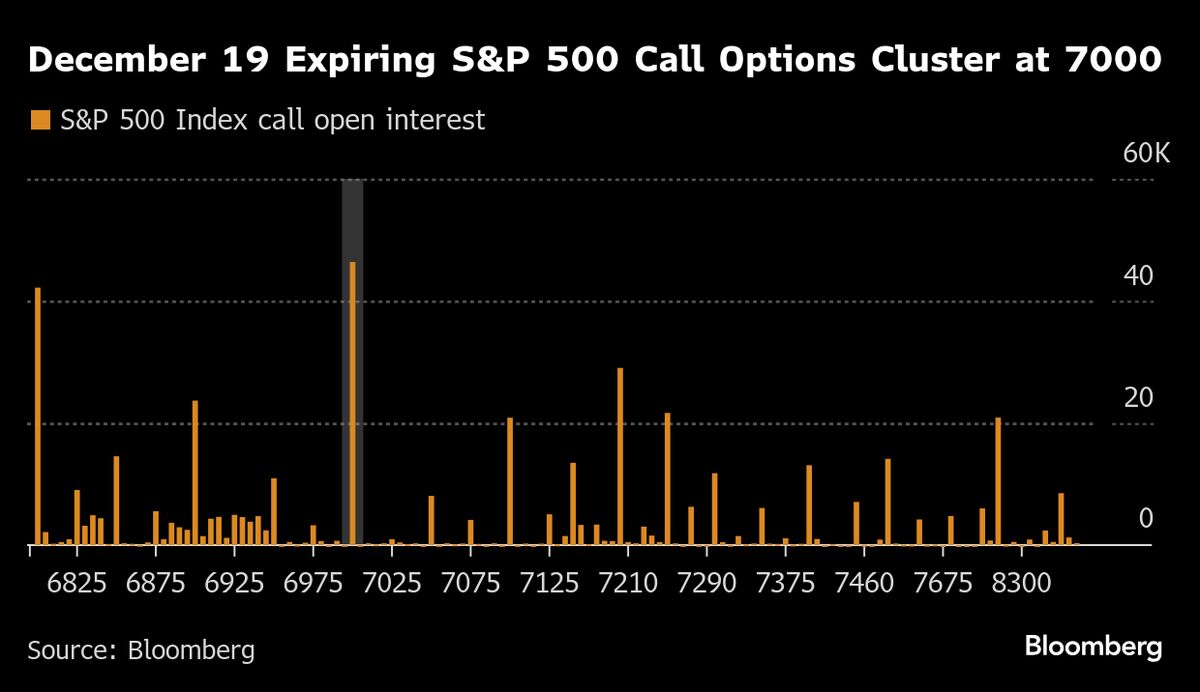

Options Traders See S&P 500 Treading Water in Next Two Months

NeutralFinancial Markets

Options traders are predicting that the S&P 500 may not see significant movement in the next two months, despite a strong performance in US equities this year. This insight from the derivatives market suggests that while the market has been thriving, traders are cautious about future gains, indicating a potential pause in momentum. Understanding these trends is crucial for investors looking to navigate the market effectively.

— Curated by the World Pulse Now AI Editorial System