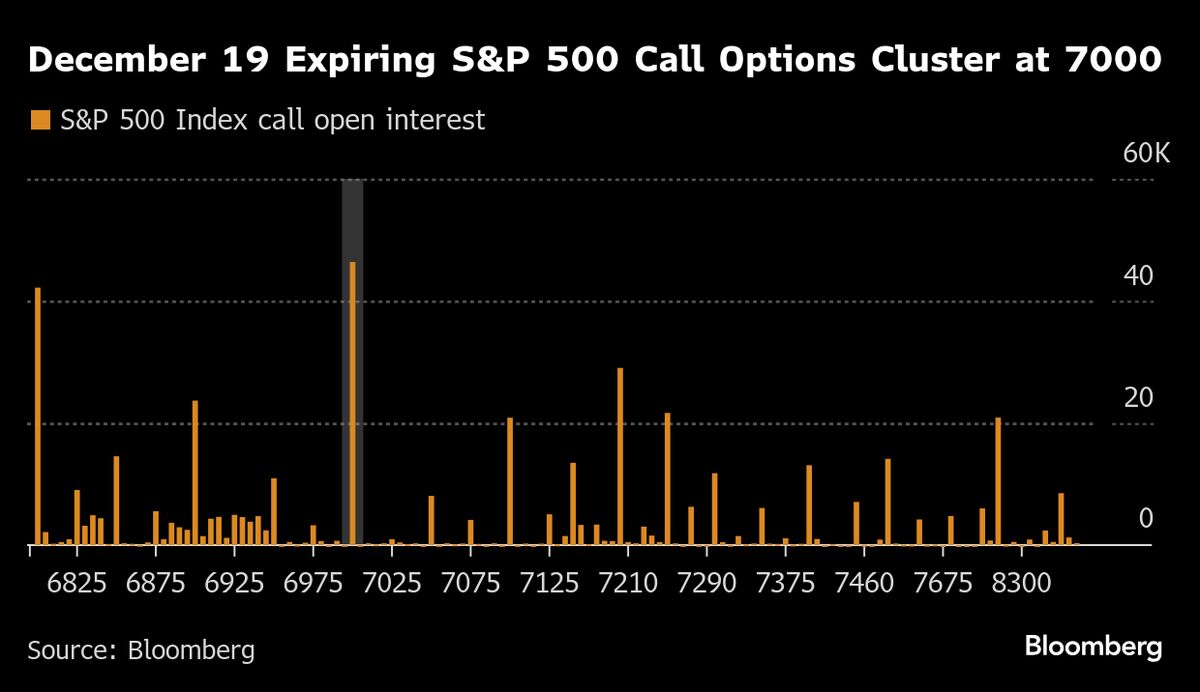

U.S. Futures Rise, Global Markets Mostly Lower; Gold Up, Oil Falls

NeutralFinancial Markets

U.S. futures for the S&P 500 are showing an upward trend, indicating potential optimism in the American market. However, stock markets in Asia and Europe are experiencing declines, reflecting a cautious response to a highly anticipated U.S.-China agreement. This mixed performance highlights the complexities of global market reactions and the ongoing economic interplay between major economies.

— Curated by the World Pulse Now AI Editorial System