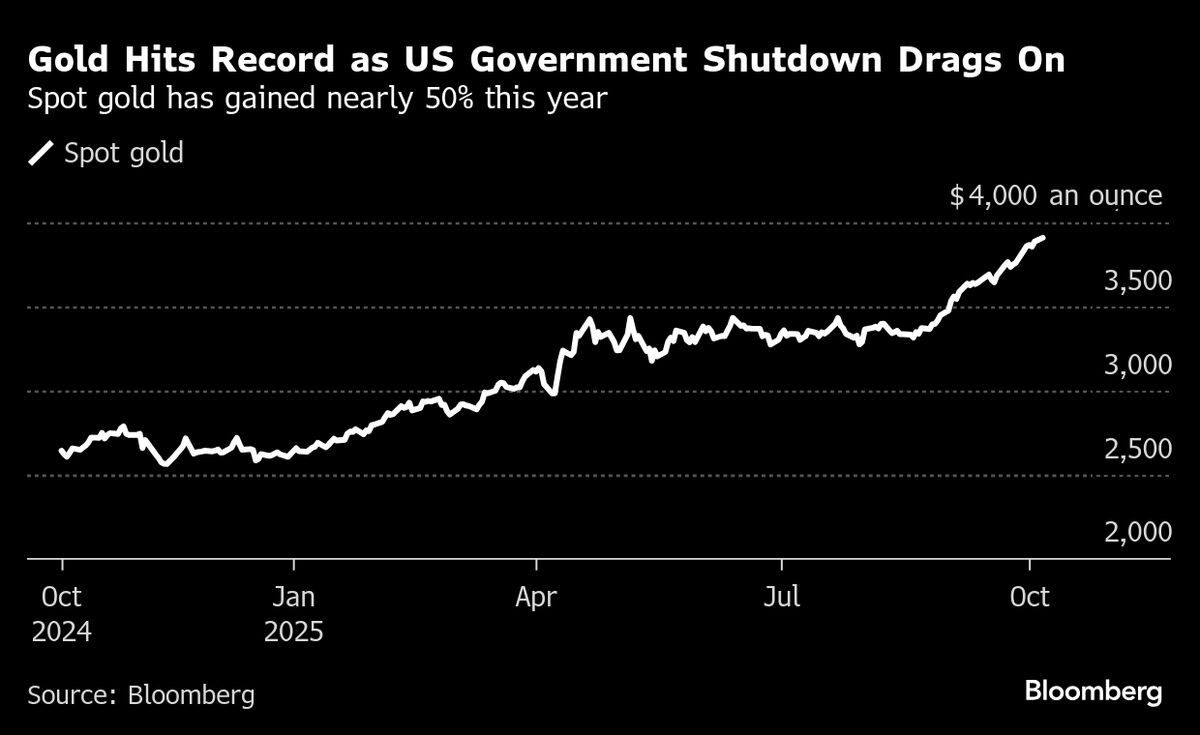

‘Gold-plated Fomo’ powers bullion’s record-breaking rally

PositiveFinancial Markets

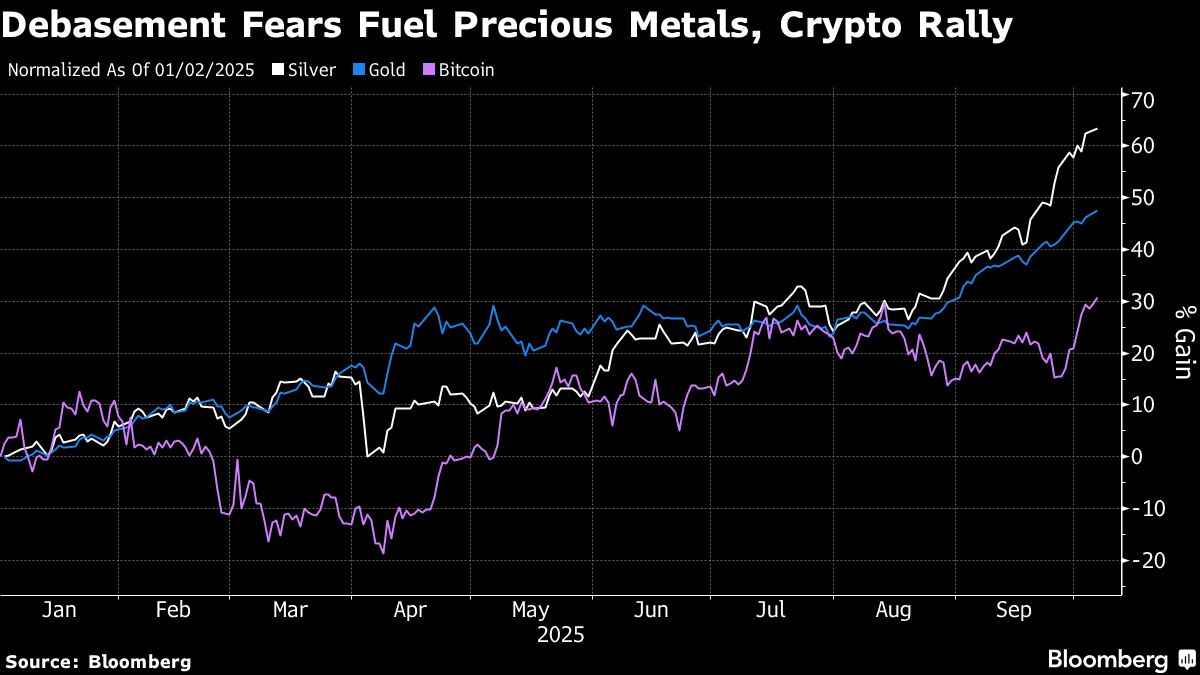

Gold has seen a remarkable surge in price, skyrocketing nearly 50% this year, marking its best performance since 1979. This rally is largely driven by institutional investors who are increasingly turning to bullion as a safe haven amid economic uncertainties. This trend not only highlights the growing confidence in gold as an investment but also reflects broader market dynamics that could influence financial strategies moving forward.

— Curated by the World Pulse Now AI Editorial System