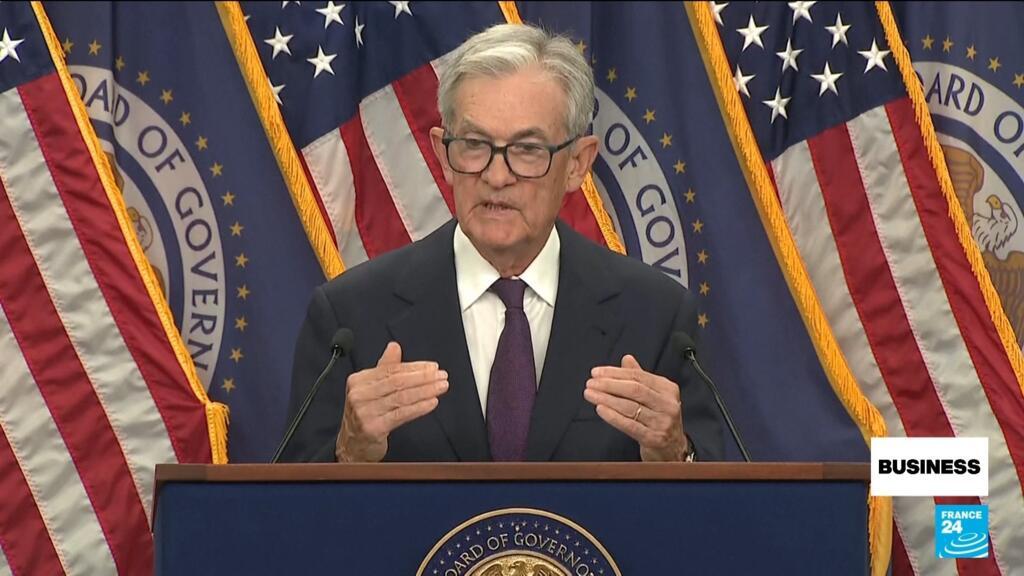

ECB’s de Guindos: Rate cut cycle may not be over yet

NeutralFinancial Markets

ECB Vice President Luis de Guindos has indicated that the cycle of interest rate cuts may not be finished, suggesting that the central bank is still evaluating its monetary policy in response to economic conditions. This is significant as it reflects ongoing concerns about inflation and economic growth in the eurozone, which could impact borrowing costs and investment decisions across the region.

— Curated by the World Pulse Now AI Editorial System