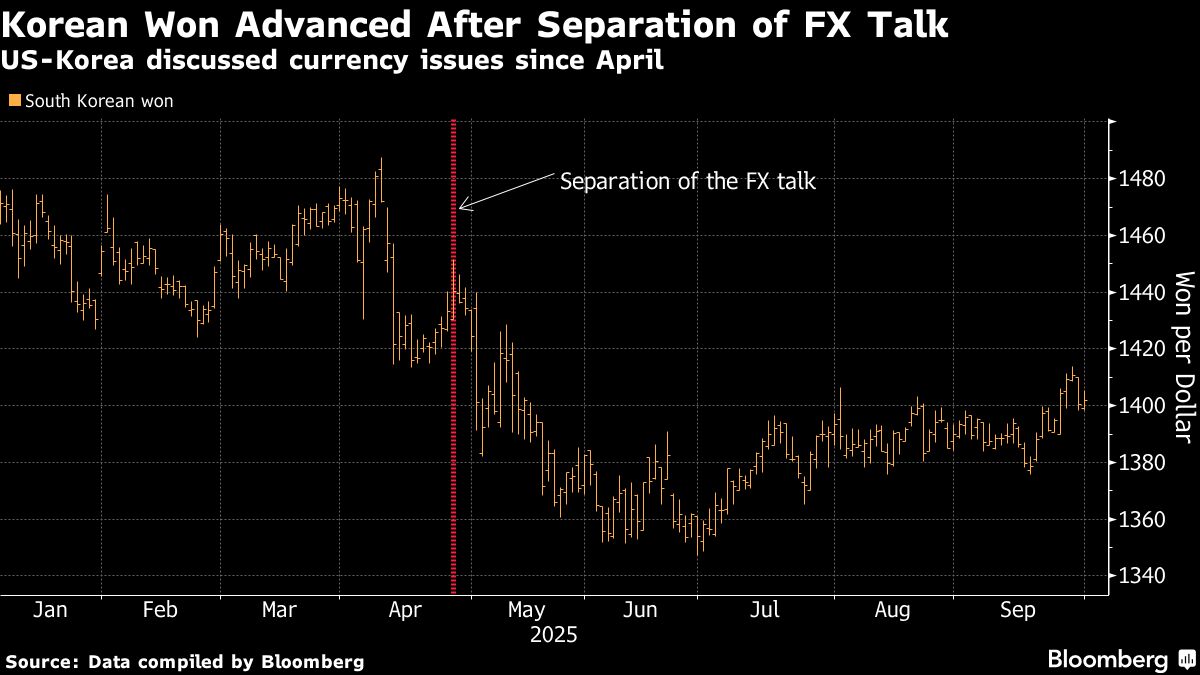

South Korea Moves Toward Forcing Firms to Cancel Treasury Shares

PositiveFinancial Markets

South Korea is taking significant steps to reform its equity market by targeting companies that hold large amounts of their own shares. This initiative aims to enhance market efficiency and attract more investors, making the nation’s stock market one of the most appealing globally. By encouraging firms to cancel treasury shares, the government hopes to boost liquidity and foster a more dynamic investment environment, which is crucial for economic growth.

— Curated by the World Pulse Now AI Editorial System