The Eco Data to Watch Without a US Jobs Report

NeutralFinancial Markets

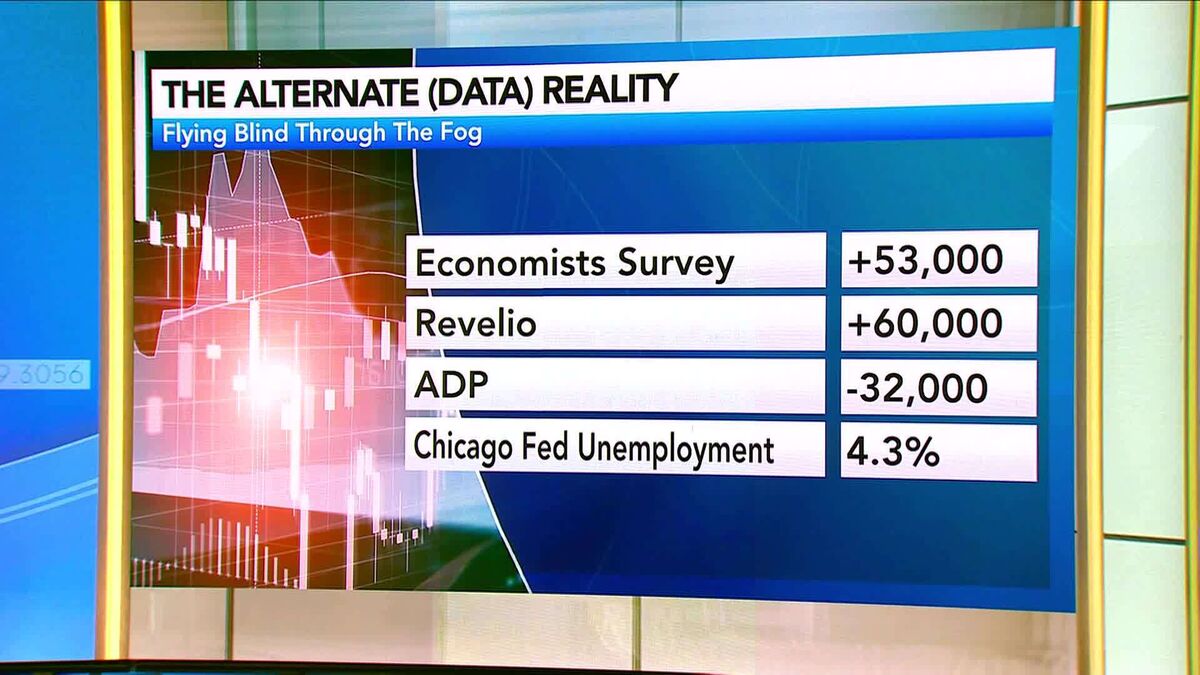

With the US jobs report on hold due to the government shutdown, Wall Street is turning its attention to other economic indicators. Recent data suggests a slowdown in hiring, fewer layoffs, modest wage increases, and a decrease in demand for workers in September. This situation is significant as it reflects the current state of the labor market and could influence economic policies moving forward.

— Curated by the World Pulse Now AI Editorial System